Development of methodology for economic evaluation of land plots for the extraction and processing of solid minerals

Abstract

The Russian economy has a pronounced resource specialization; in many regions, subsoil use is a backbone or one of the main areas of the economy. In these conditions, the improvement of the methodology for the economic evaluation of lands on which mining enterprises are located is of particular relevance. On the basis of the existing experience in assessing industrial land, the authors present a developed methodology for determining the cadastral value of land plots where mining enterprises are located, taking into account their industry characteristics and the specifics of production and commercial activities. At the same time, cadastral valuation is considered as a specific form of economic valuation. Particular emphasis is placed on the importance of taking into account the cost factors that have the greatest impact on the formation of the cost of land for the extraction and processing of solid minerals, and the method of assessment depending on the characteristics of the object. To carry out theoretical research, the methods of analysis and synthesis of legal and scientific and technical literature in the field of cadastral and market valuation of land were used in the work. The practical part is based on the application of expert methods, including the method of analysis of hierarchies, system and logical analysis. The method of M.A.Svitelskaya was chosen as the basis, which presents a combination of modified methods of statistical (regression) modeling and modeling based on specific indicators of cadastral value. The use of this technique in economic practice contributes to increasing the efficiency of cadastral valuation and the objectivity of its results.

Introduction

The sphere of mining in the Russian Federation is one of the most profitable types of economic activity [1, 2]. Income from the extraction of minerals forms the most important tax base for the country and to a large extent participates in the growth of government revenues [3-5]. The tax on land plots, as provided for by the Tax Code of Russia, is calculated on the basis of their cadastral value, which, in turn, should be reasonable and take into account the peculiarities of using the relevant territory. Currently, a methodology for cadastral valuation has been developed and approved, which includes different methods for determining the cadastral value of land plots, depending on the type of permitted use. However, for industrial and other special-purpose lands intended for the extraction, processing, enrichment of solid minerals, there is no legally approved method. In this regard, the development of a methodology for the economic assessment of lands on which mining enterprises are located, containing reserves of solid minerals, plays an important role in improving the efficiency of the subsoil use, including the system of their taxation.

For the implementation of the entire complex of works of a mining enterprise, vast territories are required. Often they have a low cadastral value, despite the fact that their use brings significant profit.

To determine the cadastral value of land plots for the mining industry, the method of a standard (reference) property is used. This method involves the choice of a reference object, for which, by adjusting for cost factors, the cost is calculated.

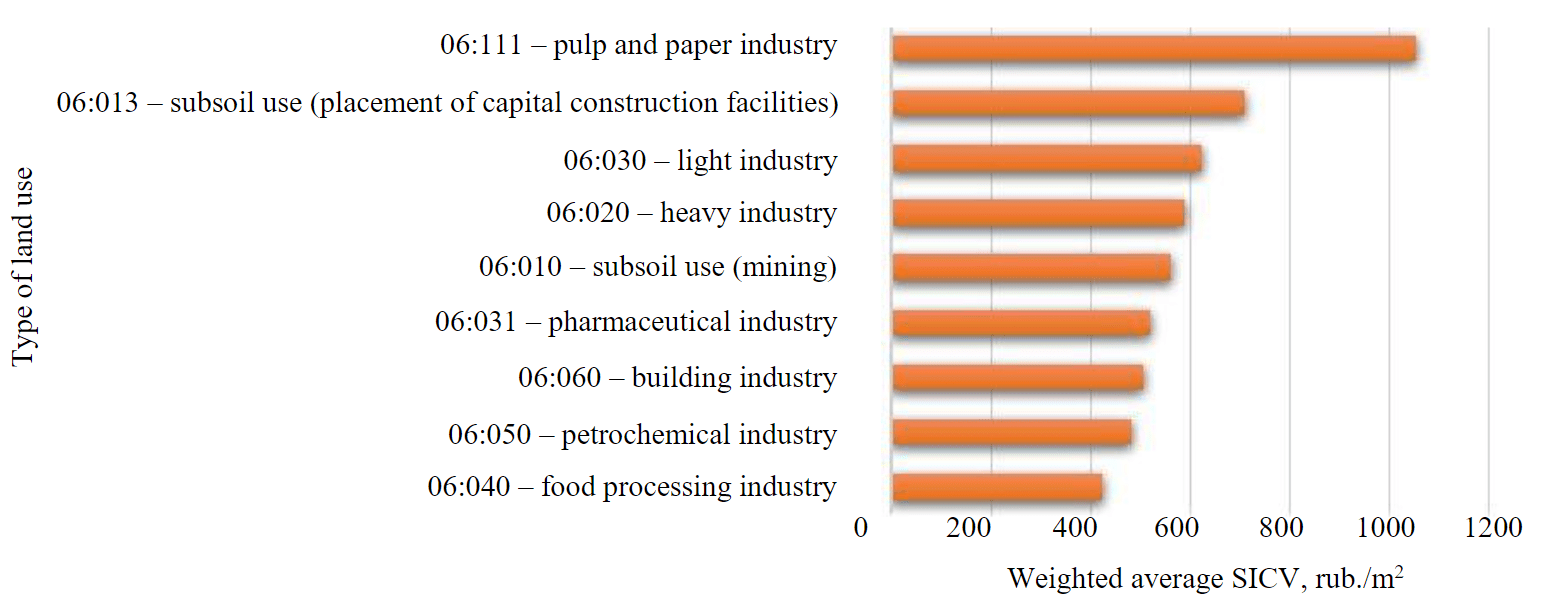

The results of the analysis of the report on the results of the state cadastral valuation of land plots in the Belgorod Region showed that land plots intended for subsoil use or for the production of heavy industry (N 06:010, 06:011, 06:020) are included in the “Production activity” segment along with lands intended for the placement of roadside service facilities, production and storage facilities, agricultural production, administrative, domestic and household buildings and structures and other industries: light, pharmaceutical, food, pulp and paper and etc. For these types of permitted use, when calculating the cadastral value, the same valuation method and the same cost factors were used: the rating of the territory of municipalities, location according to the status of a settlement, distance to the administrative center of a settlement, distance to a major highway, availability of free access to the site, availability of electricity, water supply, gas supply, railway line. Thus, the following were not taken into account: geological knowledge, mineral reserves, climatic conditions, location of water resources, relief. This has led to the fact that the average value of the specific indicator of cadastral value (SICV) for the land plots of mining enterprises lags significantly behind the SICV of the land plots of the pulp and paper industry (Fig.1).

Fig.1. Analysis of the values of the weighted average SICV by type of permitted use in the context of the segment “Production activities”

Quite a lot of publications, both Russian and foreign, have recently been devoted to the issues of the validity of the results of cadastral valuation. So, D.S.Valiev, I.A.Khabarova, D.A.Khabarov provide for the rejection of the principles of mass assessment in relation to industrial and other special purpose lands; allocation of classification of industrial objects according to the degree of their negative impact on the environment; application of individual assessment methods based on this classification [6]. V.V.Bastrykin with co-authors argue that the lands allocated for subsoil use are influenced by the unity of the fate of land plots, the preservation of the ability to generate profitability regardless of changes in physical characteristics and the presence of direct and indirect costs in the value of objects [7]. A number of domestic scientists substantiate the importance of taking into account various cost factors in assessing industrial land: A.V.Gordeev – environmental factors [3], N.N.Onoprienko – engineering-geological parameters [8]. V.M.Chabin, M.M.Demidova developed adjustments to specific indicators of the cadastral value of the considered type of permitted use for linear objects [9]. M.A.Grekhov offers a methodology for taking into account the negative impact of industrial enterprises on the environment when calculating the cadastral value of land under mining facilities [10]. M.A.Svitelskaya developed a methodology for determining the cadastral value of land under the objects of the oil and gas industry [11], based on the calculation of the difference in profi-tability from the activities of enterprises extracting minerals and profitability from other industrial facilities. In addition, the methodology proposes to take into account the differentiation of the individual characteristics of the objects of assessment, which include the composition of reserves by ca-tegory, the dimension of the deposit; geological structure; geological knowledge; availability of a license for subsoil use; the level of development of the oil-producing industry in the area of location; climatic conditions; socio-economic conditions [12]. E.N.Nikitina proposed a method for calculating the cadastral value of subsoil use land plots using individual assessment methods, taking into account the influence of two groups of factors: direct and indirect. Direct factors are understood as the pre-sence of mineral reserves, the location of the land plot, the type (nature) of its use. Indirect methods include the physical characteristics of the site – area, relief, etc., the presence of communications, transport accessibility, types of rights to the land plot, the availability of a license for the development of the deposit, the cost of reclamation of the disturbed land plot, the stage of the life cycle of structures located on the land [13]. The methodology of E.N.Nikitina is based on the idea of the importance of taking into account the life cycle of subsoil use and the assessment of the cost of all land plots necessary to ensure the uninterrupted operation of a mining enterprise.

G.R.Appleyard, A.Agosto, D.Gulevich, R.Fuss, M.Kraevskaya, K.Pavlovsky, R.Uberman, M.Zelinskaya deal with the issues of land assessment under mining complexes in countries with developed and developing economies. Among the variety of evaluation methods for subsoil areas with a sufficient degree of geological study, the method of discounting cash flows and its modifications within the income approach are used [18-20]. The comparative approach, the main requirement for which is the presence of a sample of analogous objects, also finds application in foreign practice (especially in the USA) at all stages of geological exploration [21]. In the context of this approach, the method developed by the tax service of the state of Arizona (USA) for assessing land plots with mineral deposits, based on determining the minimum standard cost of reserves in the subsoil, related to the area, is also highlighted. At the stages of development and exploitation of a land plot with the presence of minerals, the cost approach to assessment is used as the main one, while at the stage of geological study of the subsoil, other methods are also used. Among the most well-known, it is worth highlighting the method of evaluating participation [14, 17], as well as the method of geological ranking, or, as it is called in Russian practice, the method of geological and industrial eva-luation of deposits [22, 23], which includes qualitative and quantitative indicators of valuable components contained in mineral reserves [24, 25]. In addition, scientists A.Bieda, E.Wojczak and P.Pazhich used a SWOT/TOWS analysis, which made it possible to identify cost factors, relationships and the degree of their influence on the cost of land with mineral deposits in Poland on a five-point Tilgner scale [26].

Goals and objectives

The uniqueness and value of land plots with mineral reserves is obvious. The importance of determining the correct cadastral value of the mining enterprises lands is beyond doubt. The assessment of such lands implies the need to take into account cost factors that go beyond the traditional ones. Despite the existing studies of Russian and foreign scientists in the field of assessing the cadastral value of land, the complex problem of taking into account the specifics of the economic activity of mining facilities has not been resolved [6, 27, 28] and is relevant [10, 12, 29].

In this regard, the main goal of the study is to develop a methodology for determining the cadastral value of land on which mining enterprises are located, taking into account their industry characteristics and the specifics of industrial and commercial activities in order to increase the efficiency of the cadastral valuation and the objectivity of its results. The object of the study is the cadastral value of land plots of the industrial land category and other special purpose occupied by facilities for the extraction and processing of solid minerals. To achieve this goal, the study provides for the solution of a number of tasks: justification of the need to take into account the individual characteristics of land plots on which objects for the extraction and processing of solid minerals are located; improving the methodology for assessing the value of land under industrial facilities in terms of a set of cost factors for land under facilities for the extraction and processing of solid minerals; determination of the appreciation coefficient for land plots under facilities for the extraction and processing of solid minerals; calculation of specific indicators of the cost of land plots under the objects of mining and processing plants; comparison of the obtained results with the specific indicators of the cadastral value obtained during the last round of the cadastral valuation. The scientific novelty of the study lies in substantiating the influence of factors such as mineral reserves and the level of their geological exploration, transport accessibility, the location of water resources and terrain, on the cost of land under objects for the extraction and processing of solid minerals, as well as in developing methods for determining rating their score.

The proposed methodology for the valuation of land plots under facilities for the extraction and processing of solid minerals has been implemented on the land plots of the Bystrinskoye Mining and Distribution Company, Tominskiy Processing Plant, Mikheevsky Processing Plant, Novo-Shirokinsky mine.

Research methodology

At present, for the assessment of industrial and other special purposes land, the use of the M.A.Svitelskaya methodology appears to be the most reasonable. It was tested on land plots of the oil and gas industry, which is adjacent to the mining industry considered in this study, which enterprises carry out the extraction and processing of solid minerals [11, 12]. In this regard, this technique was chosen as the base one, based on a combination of the statistical (regression) modeling method [30-32] and the modeling method based on specific indicators of the cadastral value [33]. The results of a detailed analysis of this methodology made it possible to highlight the shortcomings in terms of determining the set of cost factors and the distribution of points within each factor:

- allocation of some groups within the factors is subjective: small/medium/significant removal, high/medium/low level of development;

- the factor “reserves of minerals” can be separated from the factor “geological knowledge”, although the calculation of reserves directly depends on the geological knowledge of the deposit;

- in accordance with the Federal Law of the Russian Federation “On Subsoil”, a license for the use of subsoil certifies the right to carry out work on the geological study of subsoil, the development of mineral deposits; at the same time, persons carrying out the listed actions without a license bear administrative, criminal liability, and, thus, the factor “holding a license for subsoil use” is disputable;

- in the factor “the level of development of the oil industry in the area of location” the level is determined by experts; experts of each subject of the Russian Federation, when determining the cadastral value within the framework of the methodology of M.A.Svitelskaya, can use different approaches to assessing the level of development, thereby obtaining different results from each other, which may ultimately lead to a biased and incorrect value of the cadastral value; in addition, the technology of extraction and processing of oil and gas differs from the technology of extraction and processing of solid minerals.

The authors also share the opinion of E.N.Nikitina, according to which “land plots of subsoil use of companies in the extractive sector represent a single complex of land plots that are used to carry out the entire list of works related to with the extraction, processing and transportation of minerals and the product of their processing, as well as with the storage of mining waste” [13]. At the same time, the method of cadastral valuation of subsoil use land plots proposed by E.N.Nikitina provides for the calculation of the cadastral value of subsoil use land plots using the individual assessment method, which will undoubtedly have a negative impact on the economic costs of conducting the state cadastral land valuation. Moreover, the inappropriateness of applying individual valuation methods in this case is also justified by paragraph 3 of the Guidelines on the state cadastral valuation, which regulate the use of an individual calculation of the cadastral value of real estate objects only if it is impossible to use mass valuation methods.

It should be noted that all subsoil use objects are of a rental nature. Mining rent is understood as “income received at the stage of mining, excluding income from products made from minerals at subsequent stages” [34]. The presence of minerals causes the emergence of absolute mining rent, the best natural conditions for the development of deposits (size of reserves, geological structure) form differential mining rent I, and the use of the most advanced technologies and equipment by a mining enterprise leads to the formation of differential mining rent II. At the same time, differential rent I should belong to the owner of natural resources, rent II – to the owner of the enterprise [35]. In modern conditions, the withdrawal of absolute mining rent occurs through the payment by the mining enterprise of profit tax, tax on the extraction of minerals and customs duties. At the same time, the existing scale of the mineral extraction tax does not take into account the mining-geological, economic-geographical and other conditions for the development of deposits, respectively, the differential mining rent I is not withdrawn, and the completeness of the collection of mining rent into state ownership is not ensured. In this regard, a score indicator based on a cumulative assessment of mineral deposits reserves, features of the geological structure, climate, conditions of transport accessibility, terrain, remoteness to water sources and settlements will allow taking into account most of the factors that form the differential mining rent I.

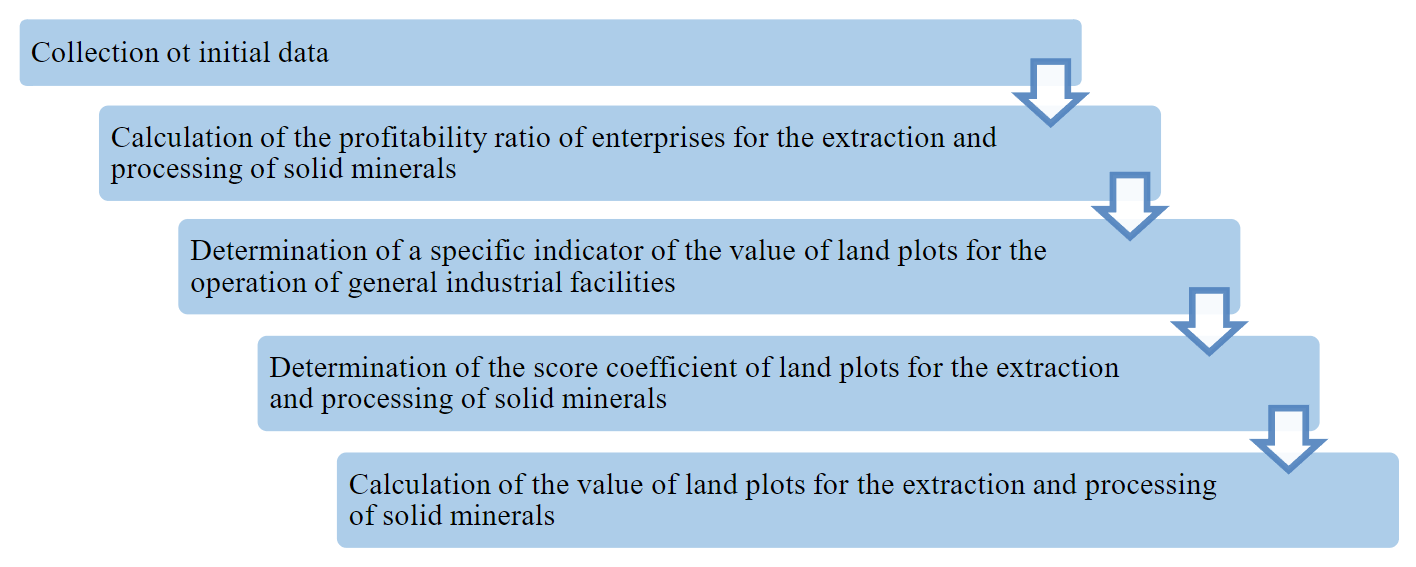

All of the above was the reason for the need to improve the lands assessment methodology of M.A.Svitelskaya in terms of a set of cost factors and the method of their scoring, taking into account the peculiarities of the work and operation of enterprises for the extraction and processing of solid minerals (Fig.2).

Collection of initial data

The initial data are the main characteristics of land plots and deposits obtained from the official databases and thematic maps of Rosreestr[, territorial planning documents, geographic information systems and data funds of the constituent entities of the Russian Federation and municipalities, data from the geological fund of the Russian Federation and Rosnedra, as well as other sources provided in information systems.

Calculation of the profitability ratio of enterprises for the extraction and processing of solid minerals

Obviously, the profitability of deposits directly affects their market value. Calculation of the profitability ratio of mining enterprises and processing of solid minerals makes it possible to assess the level of profitability of the object under study [36]. The authors propose to calculate the profitability ratio Kp, which characterizes the excess of the profitability of a mining enterprise over the profitability of general-purpose industrial enterprises, for example, mechanical engineering, non-ferrous and ferrous metallurgy (by analyzing the net profitability of production and sales according to standard forms of financial statements of companies). The use of this coefficient will make it possible to move from the cost of land plots to the operation of general industrial facilities to the cost of sites intended for the placement of enterprises for the extraction and processing of solid minerals.

Fig.2. The sequence of calculations to determine the cost of land for the extraction and processing of solid minerals [11]

To calculate the profitability ratio of an enterprise for the extraction and processing of solid minerals, two indicators are determined: net profitability of production Рpr and net sales margin (profit) Рm. Net profitability of production, calculated using the cost indicator, takes into account the specific costs of this industry and allows you to evaluate the return on investment, i.e. efficiency of production activities in general. Net return on sales shows the efficiency of the operating activities of a mining enterprise:

The net profitability of production is determined this way:

Next, the considered median average indicators are calculated by years among enterprises engaged in the extraction and processing of solid minerals and general-purpose enterprises. Comparison of median values allows you to calculate excess profitability values. Based on the data obtained, the median value of the excess for two types of profitability is determined.

To determine the average excess of the profitability of enterprises for the extraction and processing of solid minerals over the profitability of enterprises of other types of industrial activity, the following is used:

where Рprmv – net profitability of production (median value), %; Рmmv – net profit margin (median), %.

Due to the instability of the socio-economic and foreign policy situation, as well as possible changes in the activities of companies, this coefficient should be updated according to the financial statements.

Determination of a specific indicator of the value of land plots for the operation of general industrial facilities

In this study, it is proposed to take the results of the state cadastral valuation of industrial land as a basis, since it allows zoning territories by price and thereby takes into account the location factor of the objects of assessment. However, the results of the analysis of information on the values of the specific indicator of the cost of land plots under general purpose industrial facilities made it possible to conclude that the cost of land of a given type of use (which includes land for the development of minerals) is often calculated as a weighted average between the cost of land in settlements, forest fund and agricultural purpose [37]. Thus, both the features of enterprises for the extraction and processing of solid minerals and the high level of income arising from the use of the territory are not taken into account.

Determination of the score coefficient of land plots for the extraction and processing of solid minerals

In order to take into account the individual characteristics of the enterprise, a score indicator is calculated, which is based on the values of the scores for assessing value factors.

Due to the limited amount of available information and the specifics of the industry under consideration, an expert method was used to justify and select factors that reflect the individual characteristics of objects [38]. The use of correlation-regression analysis for these purposes is also impossible due to the lack of data on transaction prices for land plots of the type of use considered in the article. The study of the territories of large enterprises for the extraction and processing of solid mi-nerals, the conditions affecting the construction and operation of facilities in this industry, as well as the ability to determine information on them, contributed to the identification of the main cost factors for assessing the land on which they are located, namely: mineral reserves and the level of their geological exploration, geological structure, climatic conditions, transport accessibility, location of water resources, socio-economic conditions, terrain [32]. The dimension of the point scale for assessing cost factors was determined in accordance with the scale substantiated by M.A.Svitelskaya in the dissertation “Development of a methodology for assessing land plots under industrial facilities”.

Brief description, rationale for the choice of cost factors and methods for assigning assessment points to them, depending on the characteristics of the object of assessment:

1. Mineral reserves and the level of their geological exploration. The more detailed the mineral reserves are studied, the more efficient is the production and commercial activity of the mining enterprise. To reduce risks and eliminate incorrect results of assessing the reserves of a mineral deposit, as well as obtaining initial data for compiling a technological scheme for mineral processing with the necessary quality parameters for the finished product, the degree of geological exploration of the deposit is important [39].

Mineral deposits are divided by the size of reserves into small, medium and large, and according to the degree of geological exploration – into four categories – A, B, C1, C2. Thus, the following categories were identified for this factor and assessment points were determined by expert means: large field – 7 points (maximum value), medium – 4 points, small – 1 point (minimum value) [32]. The experts proceeded from the judgment that the larger the deposit, the higher the assessment score.

2. Geological structure. In accordance with the order of the Ministry of Natural Resources of the Russian Federation dated 07.03.1997 N 40 “On approval of the classification of mineral reserves”, the following groups of deposits (areas) were distinguished according to the complexity of the geological structure.

The first group: a simple geological structure with very large, large and less often medium-sized bodies, in which the occurrence is disturbed or slightly disturbed. These bodies are characterized by stable power, internal structure, sustained quality of the mineral, uniform distribution of the main valuable components. Features of the geological structure of these deposits (areas) in the process of geological exploration make it possible to identify reserves of categories A, B, C1 and C2.

The second group: deposits (areas) with a complex geological structure with bodies of large and medium sizes, in which the occurrence is disturbed. They are characterized by unstable power and internal structure or unsustainable quality of the mineral and uneven distribution of the main valuable components. They also include coal deposits, deposits of salts and other minerals, which have complex or very complex mining and geological conditions of development. Features of the geological structure of deposits (areas) of this group in the process of geological exploration create the possibility of establishing reserves of categories B, C1 and C2.

The third group: deposits (areas) with a very complex geological structure, in which the bodies of minerals are medium and small in size. They are characterized by intensely disturbed occurrence, very variable thickness and internal structure, or a significantly unsustainable quality of the mineral and a very uneven distribution of the main valuable components. The reserves of this group are explored mainly in categories C1 and C2.

The fourth group: deposits (areas) with bodies of small and medium sizes, which are characterized by extremely disturbed occurrence, sharp variability in thickness and internal structure, extremely uneven quality of the mineral and discontinuous nesting distribution of the main valuable components. The reserves of this group are explored mainly in category C2.

The criteria for attributing deposits (their sites) to the corresponding group are the following indicators: the size and morphological features (features) of ore-bearing formations, as well as indicators of the variability of exploration parameters within a certain type of mineral. The complexity of the geological structure determines the methodology of exploration work, their scope and, accor-dingly, the economic costs of exploration and development of the deposit.

The geological structure has a significant impact on the productivity and overall economic efficiency of the mining enterprise: the more complex the geological structure, the higher the operating costs and the risks of unstable operation. Accordingly, with an increase in the complexity of the geological structure, the assessment score should decrease. Using the current classification of deposits, depending on the complexity of the geological structure, the expert method determined the assessment points for four groups of deposits: simple geological structure (7 points); complex geological structure (5 points); very complex geological structure (1 point); deposits with small, less often medium-sized bodies of minerals with extremely disturbed occurrence (1 point) [38].

3. Climatic conditions are fundamental not only in assessing the labor intensity and capital intensity in the process of building a mining enterprise, but also in calculating operating costs. Obviously, the more favorable the climatic conditions, the higher the score. Due to the fact that on the territory of the Russian Federation, according to the Koeppen classification, four types of climate, taking into account the influence of climatic zones on mining production, the assessment points were determined by an expert method as follows: dry climate – 7 points, temperate climate – 5 points, cold (continental) climate – 3 points, polar climate – 1 point.

4. ТрTransport accessibility. The availability of transport and logistics infrastructure has a strong impact on the construction and operation of an enterprise for the extraction and processing of solid minerals. Transport accessibility increases the efficiency of the entire logistics system of the enterprise, which allows for the timely delivery of materials and equipment during the construction period, and the delivery of standardized materials for an uninterrupted production process and marketing of finished products during the operation period.

Transport accessibility is proposed to be assessed based on the rating, which is determined by the following criteria: the distance to the railway station or seaport (the place of shipment of finished products), the distance to suppliers of consumables, the possibility of year-round use of roads, as well as the Engel coefficient characterizing the degree of transport provision of the territory [40]. The Engel coefficient is determined by the formula:

where L – length of transport routes, km; S – territory area, km2; H – population, thousand people.

The reduced rating score of the “Transport accessibility” factor is determined by the formula:

where Pst is a score assigned depending on the distance to the railway station, seaport (up to 15 km – 4 points, from 15 to 50 km – 3 points, from 50 to 100 km – 2 points, over 100 km – 1 point); Pmat – the value of the point, showing the dependence on the distance to the suppliers of materials (up to 1500 km – 4 points, from 1500 to 3000 km – 3 points, from 3000 to 4500 km – 2 points, over 4500 km – 1 point); Pe – a score assigned depending on the Engel coefficient: less than 0.5 – 1 point, from 0.5 to 7 – 2 points, from 7 to 13.5 – 3 points, from 13.5 to 20.5 – 4 points; Pr – a score assigned depending on the possibility of year-round use of roads: yes – 4 points, no – 1 point.

Thus, the maximum sum of points according to the transport accessibility criteria, indicated in the denominator when calculating the PT value, is 16.

Based on the results of the analysis of the transport accessibility of the leading enterprises for the extraction and processing of solid minerals, the reduced points PT were calculated and, depending on their values, four categories of transport accessibility were identified (Table 1). As part of the scoring, it is permissible to assume that the influence of this factor is uniform.

Table 1

Transport accessibility

|

Categories of transport accessibility |

The intervals of the values of the given points PT for the category |

Assessment points |

|

1 |

0,75 < PT ≤ 1 |

7 |

|

2 |

0,50 < PT≤ 0,75 |

5 |

|

3 |

0,25 < PT ≤ 0,50 |

3 |

|

4 |

0 < PT ≤ 0,25 |

1 |

5. Location of water resources. The structure of the enterprise for the extraction and processing of solid minerals includes a processing plant, for the effective operation of which about 15 % of fresh water is required, which is necessary to restore the water balance in case of natural losses [41] associated with the production of finished products and the storage of tailings over a large area in a tailing dump. [42]. If the factory is located far from water sources (lakes, rivers), the enterprise has to build massive water intake systems, create main water pipes, which affects the amount of operating and capital costs, and, accordingly, the profit and profitability of the enterprise. This determines the following principle for assigning assessment points: with increasing distance to a water source, the assessment score should decrease.

The results of the analysis of the location of enterprises for the extraction and processing of solid minerals made it possible to identify the categories of water resources availability and determine using the expert method, assessment points: the presence of water sources that provide the required level of consumption, at a distance of up to 5 km – 7 points; up to 10 km – 4 points; more than 10 km – 1 point [38].

6. Socio-economic conditions. In this study, socio-economic conditions mean the proximity of settlements capable of providing a mining enterprise with a labor force, and workers with the necessary working and rest conditions [43]. Remoteness from settlements increases the costs of the enterprise. This is especially true for the regions of Russia, in many of which there are very long distances with a poor development of transport and social infrastructure. On the other hand, it is necessary to bear in mind the fact that the growth of production and processing of minerals always, to a greater or lesser extent, depending on the industry, negatively affects the environmental and social development of the territory. This fact should be taken into account when determining the cost of land plots located in the territories surrounding the mining enterprise.

The following categories of provision with socio-economic conditions were identified and assessment points were determined by expert means. At the same time, the score was assigned on the basis of the judgment that the farther the settlement is located, the lower the score, and vice versa: a significant distance from large settlements (more than 30 km) – 1 point; average distance from large settlements (20-30 km) – 3 points; small distance from large settlements (10-20 km) – 5 points; the possibility of organizing the accommodation of workers in a large settlement, in the immediate vicinity (5-10 km) – 7 points [38].

7. Terrain. Difficult terrain leads to a significant increase in the cost of the stages of design, construction and operation of an enterprise for the extraction and processing of solid minerals: significant distances between the main and auxiliary facilities of the enterprise, large volumes of earthworks when planning sites, the need for retaining and reinforced soil walls, measures to increase sustainability slopes, strengthening the normative load of the structure of buildings and structures, etc. [44-46]. The more difficult the terrain, the lower the score. Based on the results of this analysis, the following classification of the terrain was developed according to the nature of the relief and assessment points were determined by expert means: flat, characterized by a uniform, more or less even surface with the absence of pronounced irregularities – 7 points; hilly, with a wavy surface – 4 points; mountainous, characterized by a significant elevation of the surface above sea level (above 500 m) – 1 point [38].

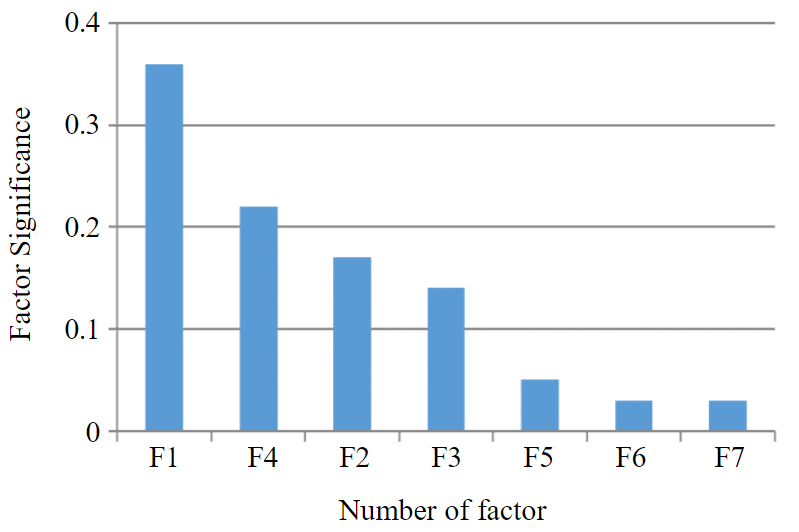

It should be noted that the degree of influence of cost factors on the cost of land plots of enterprises for the extraction and processing of solid minerals is different, respectively, it is necessary to determine the weights of the factors. To do this, it is proposed to use the method of analysis of hierarchies by T.Saaty [47], since it allows you to set the priorities of factors in conditions of uncertainty and multi-criteria, as well as to objectively evaluate the results obtained.

In order to adjust the score of the enterprise on the degree of influence of cost factors, the sum of the scores of the factors is determined taking into account their significance (rank) by multiplying the weight of the factor by the score obtained in the course of analyzing the individual characteristics of the enterprise:

where n – number of cost factors; Si – scoring value in accordance with the proposed methodology; Ri – rank (importance) of cost factors.

The object evaluation score is the ratio to the sum of the weighted evaluation scores to the maximum possible sum of weighted points:

where Sr – the sum of points of factors, taking into account their significance (rank); Sr(max) = 7.

The score indicator ESо.e is used to adjust the average (reference) object to the object of assessment. The score for the average object of assessment will be 0.57, since the sum of the assessment points for such an object will be equal to the average score – 4.

In order to move from the reference object to the object of assessment, it is necessary to calculate the coefficient of the score using

where ESa.о – score of the average object, ESa.о = 0.57.

Calculation of the value of land plots for the extraction and processing of solid minerals

The cost of land plots intended for the extraction and processing of solid minerals is determined by the formula:

where SIVSM – specific indicator of the cost of a land plot intended for the extraction and processing of solid minerals, rub./м2; S – land area, м2.

The specific indicator of the land value of the type of use considered in this study is calculated by the formula

where SIVind – specific indicator of the cost of land plots for the placement of industrial facilities for a wide range of purposes, rub./м2; KSM – appreciation coefficient for land plots intended for the extraction and processing of solid minerals [38].

The coefficient of appreciation for land plots under enterprises for the extraction and processing of solid minerals is determined by the formula

where Kр – coefficient characterizing the excess of the profitability of enterprises for the extraction and processing of solid minerals over the profitability of other industrial facilities.

Another aspect of the problem under study should also be noted. Almost all mining enterprises deal with waste from their production. The growth rates of mining and industrial waste vary significantly depending on the mining and geological conditions and the type of mineral. At present, solving the recycling problem at the level of subsoil users is one of the primary tasks in the field of subsoil use [48]. Official statistics show that over ten years the growth (accumulation) of waste fluctuates within 13-15 %, while the growth rate of production volumes is 1-1.5 % [49].

In the environmental system of Russia, the policy of managing mining and industrial waste is in dire need of radical improvement. State regulation in the field of waste management from mining and processing in most countries is ensured by: the right of private ownership of waste, which determines the degree of responsibility for their formation and use; an active policy of resource saving and energy efficiency; the presence of independent regulatory legal acts regulating the handling of mining and processing waste; close interconnection of central and regional authorities, transfer of powers to regulate waste management to the territorial level; access to information about waste from manufacturers and the public; methods of economic incentives and serious administrative penalties for violating the law. For countries where production volumes are inferior to the volumes of processing of raw materials and secondary mineral resources, the most careful designation of mechanisms that allow this activity to be carried out with less environmental damage is typical [49].

The area occupied by territories under waste from mining activities is included in the total area of the land plot S under the enterprise for the extraction and processing of solid minerals. This makes it unnecessary to include this parameter in the list of cost factors.

Results

To implement the developed methodology for assessing land plots for the extraction and processing of solid minerals, information was collected and an analysis of the territories was carried out for such enterprises as Bystrinskoye Mining and Distribution Company, Tominskiy Processing Plant, Mikheevsky Processing Plant, Novo-Shirokinsky mine. To conduct a profitability ana-lysis, the authors selected large enterprises engaged in general industrial activities, mining and processing of solid minerals. At the same time, the indicators of 2017-2019 were considered as the most relevant annual indicators (as of the date of completion of the study, the financial statements for 2020 were not publicly available).

Based on financial reporting data, the excess of the profitability values of the objects under consideration over the profitability values of economic entities of other industries was calculated. Comparison of median values for a given period (2017-2019) is presented in Table 2.

Table 2

Exceeding the profitability of enterprises for the extraction and processing of solid minerals and other industrial facilities

|

Indicators for assessing the profitability of production |

Indicator values in the period |

Median value of exceeding profitability indicators |

||

|

2017 |

2018 |

2019 |

||

|

Net profit margin Рpr, % |

9,49 |

7,97 |

8,62 |

8,62 |

|

Net profitability of production РM, % |

17,24 |

15,58 |

18,54 |

17,24 |

The average excess of the profitability of enterprises for the extraction and processing of solid minerals over the profitability of enterprises of other types of industrial activity amounted to 12.93 %.

In order to determine the degree of influence of factors on the cost of land plots, an expert analysis was carried out using the method of analyzing hierarchies by T.Saaty and the weights of the factors were obtained (Fig.3). Leading specialists of the Mekhanobr Engineering design institute, who are engaged in the design of processing plants for the largest mining companies in Russia, acted as experts. Experts are leading specialists, participate in the design of enrichment complexes, including in difficult climatic conditions, and deal with different factors (areas) within the specialization under study. According to article [50], when using the hierarchy analysis method, the optimal and sufficient number of the expert group in comparing seven factors is seven people.

The next step was the calculation of the main indicators in accordance with the developed methodology for assessing the cost of land (Table 3).

Table 3

Key indicators of the evaluation

|

Name of the enterprise |

ESоe |

KES |

KSM |

SIVSM, rub./m2 |

|

Tominskiy Processing Plant |

0,811 |

0,420 |

0,184 |

245,19 |

|

Bystrinskoye Mining and Distribution Company |

0,770 |

0,349 |

0,174 |

221,89 |

|

Mikheevsky Processing Plant |

0,820 |

0,436 |

0,186 |

120,32 |

|

Novo-Shirokinsky mine |

0,553 |

–0,032 |

0,125 |

212,63 |

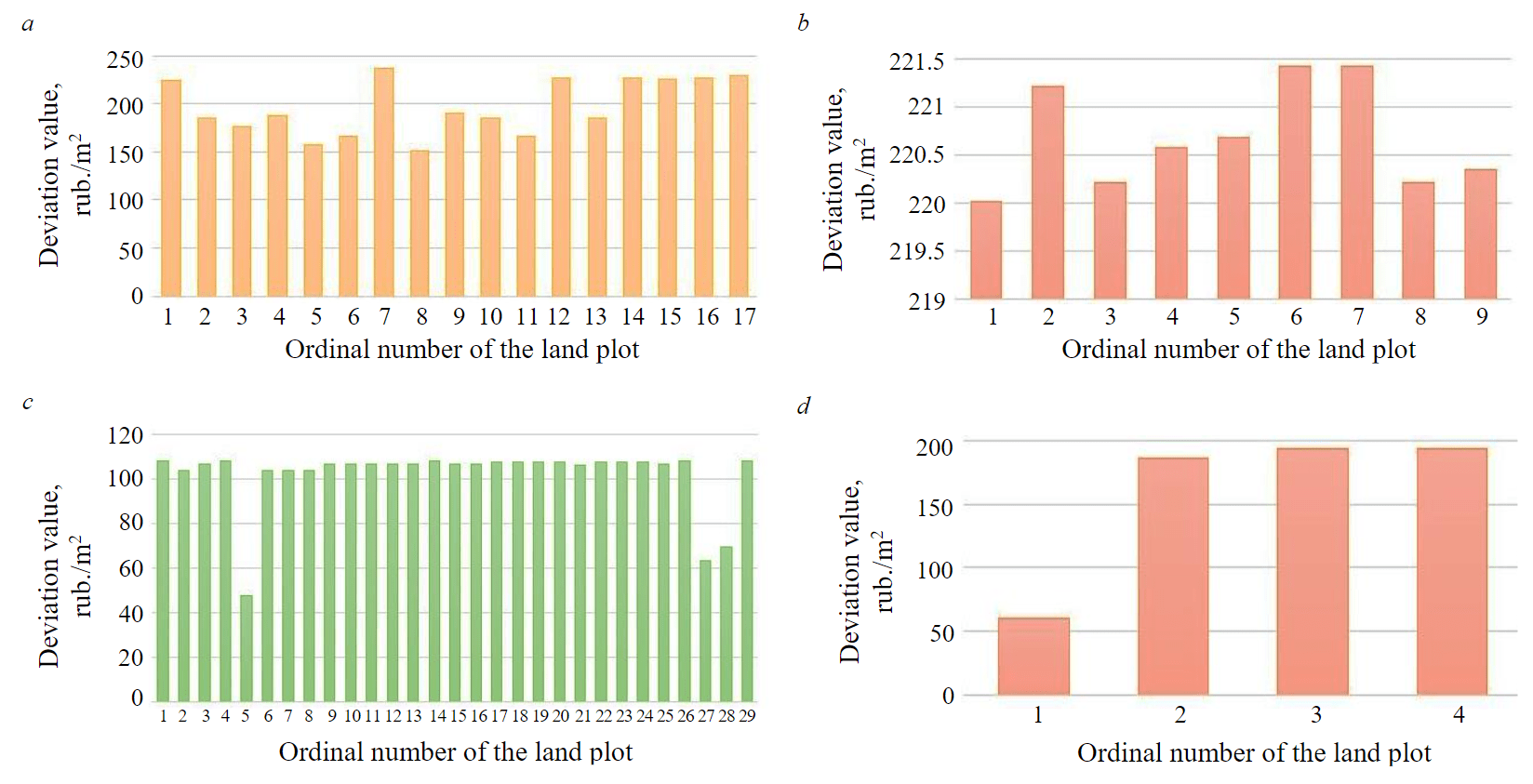

Figure 4 shows the results of comparing the results of the study with the values of specific indicators of the cadastral value of land plots, which, according to Rosreestr, are part of the enterprises under consideration

Fig.3. The results of calculating the weights of factors F1 – mineral reserves and their geological exploration; F4 – transport accessibility; F2 – geological structure; F3 – climatic conditions; F5 – location of water resources; F6 – socio-economic conditions; F7 – terrain

Fig.4. The distribution of deviations of the obtained results from the values of specific indicators of the cadastral value of land plots of Tominskiy Processing Plant (a), Bystrinskoye Mining and Distribution Company (b), Mikheevsky Processing Plant (c), Novo-Shirokinsky mine (d)

The effectiveness of this methodology can be illustrated by analyzing the results of the cost of land plots of enterprises for the extraction and processing of solid minerals located within the same municipality: the Novo-Shirokinsky mine and the Bystrinskoye Mining and Distribution Company – Gazimuro-Zavodskoy district, Zabaikalsky Krai. The value of the specific indicator of the cost of land plots of the Bystrinskoye Mining and Distribution Company, obtained as a result of calculations, is reasonably higher than that of the Novo-Shirokinsky mine, since the Bystrinskoye Mining and Distribution Company is located closer to the sales market (Chita) and has the most developed transport and logistics infrastructure [51]. At the same time, the obtained values of the specific indicator of the cost of land plots of the analyzed enterprises do not differ much, since they are located on the territory with similar climatic characteristics and terrain.

Conclusion

Nowadays, the current methodology for determining the cadastral value of land plots gives nonobjective results in relation to land plots under the facilities of enterprises for the extraction and processing of solid minerals, which leads to a significant reduction in the tax base.

The developed methodology for assessing the value of land plots for the extraction and processing of solid minerals makes it possible to obtain objective values of their cadastral value, while increasing the efficiency of the tax system. The inclusion in the methodology of a number of cost factors that take into account the characteristics of enterprises for the extraction and processing of solid minerals, as well as the rationale for the scale and method for determining the assessment score for them, made it possible to get rid of these shortcomings of existing methods. In addition, the advantage of the developed methodology is also its versatility and the possibility of modification for various objects of the mining industry.

The proposed methodology was applied to calculate the specific indicators of the cost of land plots of four enterprises for the extraction and processing of solid minerals, which made it possible to bring the SIV of land plots within the territory of each enterprise to a single value. Comparison of the obtained results with the results of the current cadastral valuation showed mainly an underestimation of the cadastral value of land plots as part of mining and processing plants. This allows us to conclude that it is necessary to apply new methods for assessing the value of land plots under mining facilities, taking into account specific factors that affect the results of economic activity

References

- Trushko V.L., Trushko O.V. Integrated development of iron ore deposits based on competitive underground geotechnologies. Journal of Mining Institute. 2021. Vol. 250, p. 569-577. DOI: 10.31897/PMI.2021.4.10

- Tatarenko V.I., Gordeev A.V. Remainder approach method in market cost estimation of land parcel objects of industry and transport, included in dangerous industrial object for contestation of cadastral cost results. Geodesy and Cartography. 2016. N 2 (34), p. 111-118 (in Russian).

- Gordeev A.V. Development of a cadastral assessment of lands of the industry and transport taking into account ecological factors. Interexpo GEO-Siberia. 2016. Vol. 3, p. 216-218 (in Russian).

- Boyko N.A., Chvileva T.A., Romasheva N.V. The impact of coal companies on the socio-economic development of coal mining regions and its assessment. Ugol. 2019. Vol. 11, p. 48-53 (in Russian). DOI: 10.18796/0041-5790-2019-11-48-53

- Brigadnov I.A. Multi Multi-criteria Estimation of Load-Bearing Capacity of Solids. Journal of Elasticity. 2020. Vol. 140, p. 121-133. DOI: 10.1007/s10659-019-09762-8

- Valiev D.S., Khabarova I.A., Khabarov D.A. State cadastral valuation of industrial lands and other special purposes with considering the ecological component. Vector of Geosciences. 2018. N 1 (2), p. 61-64 (in Russian).

- Bastrykin V.V., Bolotskikh V.V., Biryukova L.L. The theory and practice of determining the value of land for subsoil use. Imushchestvennye otnosheniya v Rossiiskoi Federatsii. 2020. N 3 (222), p. 20-31 (in Russian).

- Onopriyenko N.N. Аccount engineering-geological factors in the formation of the cadastral value of land. Vector of Geosciences. 2018. N 1 (3), p. 73-79 (in Russian).

- Chabin V.M., Demidova M.M. The methods of efficiency improvement for cadastral evaluation of industrial lands. Zemleustroystvo, kadastr i monitoring zemel. N 6 (114), p. 45-50 (in Russian).

- Grekhov M.A. Internalization of environmental externalities of industrial enterprises in the process of cadastral evaluation. Theory and Practice of Social Development. 2014. N 6, p. 159-161 (in Russian).

- Svitelskaya M. Technique of evaluation of industrial land plots intended for the extraction of minerals. Izvestiya vysshikh uchebnykh zavedeniy. Geodeziya i aerofotosyemka. 2017. N 5, p. 66-68 (in Russian).

- Svitelskaya M. Technique for recording the specific price factors of land plots, which are intended for extraction of mineral resources. Izvestiya vysshikh uchebnykh zavedeniy. Geodeziya i aerofotosyemka. 2017. N 6, p. 48-51 (in Russian).

- Nikitina Е.N. Development of methods for cadastral valuation of land plots for subsoil use: Avtoreferat dis. … kand. ekon. nauk. Moscow: Finansovyi universitet pri Pravitelstve RF, 2015, p. 16 (in Russian).

- Appleyard G.R. Joint Venture as a Basis for Valuation. Proceedings of VALMIN'94, 27-28 October 1994, Sydney, Australia. Australasian Institute of Mining and Metallurgy, 1995, p. 167-174.

- Evseenko V.V. Increasing the economic efficiency of geological exploration based on the concept of company value management: Avtoref. dis. … kand. tekhn. nauk. St. Petrsburg: Sankt Peterburgskii gornyi universitet, 2018, p. 26 (in Russian).

- Füss R., Koller J.A., Weigand A. Determining Land Values from Residential Rents. Land. 2021. Vol. 10 (4), p. 1-29. DOI: 10.3390/land10040336

- Krajewska M., Pawłowski K. Coherent land policy and land value. Geomatics and Environmental Engineering. 2019. Vol. 13. N 4, p. 33-48.

- Uberman R. Valuation of Mineral Resources in Selected Financial and Accounting Systems. Natural Resources. 2014. Vol. 5. N 9, p. 496-506. DOI: 10.4236/nr.2014.59045

- Agosto A. Determinants of Land Values in Cebu City, Philippines. International Conference on Business and Economy, 17-18 February 2017, Cebu, Philippines. 2020, p. 1-20.

- Zielińska M. The issue of valuation of real estate located on mineral deposits. Geographic Information Systems Conference and Exhibition “GIS ODYSSEY 2017”, 4-8 September 2017, Trento – Vattaro, Italy, p. 436-440.

- Ślusarz G., Cierpial-Wolan M. Development of entrepreneurship in valuable natural rural areas. Economia Agro-Alimentare. 2019. Vol. 21. Iss. 3, p. 753-770. DOI: 10.3280/ECAG2019-003010

- Yarullin R.R., Kagirova Z.F. Cost appraisal of subsurface areas with reserves and resources of mineral products (on the materials of oil producing branch of Republic of Bashkortostan). Vestnik Orenburgskogo gosudarstvennogo universiteta. 2007. N 8, p. 205-211 (in Russian).

- Rupprecht S., Njowa G. The valuation of an exploration project having Inferred Resources. SAMREC SAMVAL Code Companion Volume Conference, 17-18 May 2016, Emperors Palace, Johannesburg. 2016. Iss. 5, p. 87-94.

- Sukhomlinov V.S., Mustafaev A.S., Popova A.N., Koubaji H. Accounting for the effects of third elements in the emission spectral analysis and construction of global analytical techniques. Journal of Physics: Conference Series. 2019. Vol. 1384 (1). N 012054. DOI: 10.1088/1742-6596/1384/1/012054

- Egorova A.Y., Lomakina E.S., Popova A.N. Determination of the composition of chalcogenid glasses ASxSE1-x by the method of X-ray fluorescent analysis. Journal of Physics: Conference Series. 2019. Vol. 1384 (1). N 012009. DOI: 10.1088/1742-6596/1384/1/012009

- Bieda A., Wójciak E., Parzych P. Assessment of valuation methodology for land properties with mineral deposits used in Poland. Acta Montanistica Slovaca. 2018. Vol. 23. Iss. 2, p. 184-193.

- Belmach N.V., Kuzmich N.P. Organizational and methodological support of the state cadastral valuation of industrial and other land. RISK: Resursy, Informatsiya, Snabzheniye, Konkurentsiya. 2021. N 2, p. 101-103 (in Russian).

- Bondarenko N.A., Lyubimova T.V., Selivanova A.V. Engineering-geological conditions and their evaluation at the cadastral value of land. Regionalnye geograficheskie issledovaniya: Sbornik nauchnykh trudov. Krasnodar: Kubanskii gosudarstvennyi universitet, 2019. Iss. 2 (12), p. 3-9 (in Russian).

- Agibalov I.A., Kolomytseva A.S., Cheremisina E.V., Ershova N.V. Cadastral valuation and features of the industrial land market in the Belgorod region. Aktualnye problemy zemleustroistva, kadastra i prirodoobustroistva: Materialy II mezhdunarodnoi nauchno-prakticheskoi konferentsii fakulteta zemleustroistva i kadastrov VGAU, 30 aprelya 2020 g., Voronezh. Voronezh: Voronezhskii gosudar-stvennyi agrarnyi universitet im. Imperatora Petra Pervogo, 2020, p. 94-104 (in Russian).

- Lepikhina O.Yu., Pravdina E.A. Variable accounting of pricing factors at land parcels cadastral valuation (on the example of Saint Petersburg). Bulletin of the Tomsk Polytechnic University. Geo Assets Engineering. 2019. Vol. 330. N 2, p. 65-74 (in Russian). DOI: 10.18799/24131830/2019/2/94

- Kovyazin V.F., Kitsenko A.A., Seyed Omid Reza Shobairi. Cadastral valuation of forest lands, taking into account the degree of development of their infrastructure. Journal of Mining Institute. 2021. Vol. 249, p. 449-462. DOI: 10.31897/PMI.2021.3.14

- Pavlova V.A., Sulin M.A., Lepikhina O.Yu. The mathematical modelling of the land resources mass evaluation in agriculture. Journal of Physics: Conference Series. 2019. Vol. 1333. Iss. 3. N 032049. DOI: 10.1088/1742-6596/1333/3/032049

- Bykowa E., Skachkova M., Raguzin I. et al. Automation of Negative Infrastructural Externalities Assessment Methods to Determine the Cost of Land Resources Based on the Development of a “Thin Client”. Sustainability. 2022. N 14 (15). N 9383. DOI: 10.3390/su14159383

- Yumayev M.M. Mining rent: the distribution of tax burden between the production companies and processing companies. Financial Journal. 2011. N 2, p. 65-76 (in Russian).

- Maiorova N.E. Mining rent in the modern taxation system. Journal of Mining Institute. 2003. N 155, p. 208-211 (in Russian).

- Cherepovitsyn A., Rutenko E., Solovyova V. Sustainable Development of Oil and Gas Resources: A System of Environmental, Socio-Economic, and Innovation Indicators. Journal of Marine Science and Engineering. 2021. Vol. 9. Iss. 11. DOI: 10.3390/jmse9111307

- Bykova E.N., Banikevich T.D., Raguzin I.I. Modern features of the cadastral valuation of agricultural land. Engineering Journal of Don. 2022. N 6, p. 1-14 (in Russian).

- Bykova E.N., Beloborodova M.D., Romashina T.A. Consideration of individual characteristics of land plots of mining enterprises in determining their cadastral value. Innovatsii. Nauka. Obrazovanie. 2021. N 35, p. 1629-1642 (in Russian).

- Pashkevich N.V., Tarabarinova T.A., Golovina E.I. Problems of Reflecting Information on Subsoil Assets in International Financial Reporting Standards. Academy of Strategic Management Journal. 2018. Vol. 17. Iss. 3, p. 1-9.

- Dabiev D.F., Dabieva U.M. Assesment of the infrastrukture of transport of Russia. Mezhdunarodnyy zhurnal prikladnykh i fundamentalnykh issledovaniy. 2015. N 11. Part 2, p. 283-284 (in Russian).

- Arshidinov M.M., Ospanova G.Sh. Ozonization purification of industrial plants waste water. AUPET Bulletin. 2020. N 3 (50), p. 90-95 (in Russian). DOI: 10.51775/1999-9801_2020_50_3_90

- Kalashnik N.A. 4D modeling of concentrating mill tailings dam protecting dike soil consolidation. Izvestiya vysshikh uchebnykh zavedenii. Gornyi zhurnal. 2020. N 7, p. 56-62. DOI: 10.21440/0536-1028-2020-7-56-62

- Melnikov R.M., Furmanov K.K. Evaluating of Impact of Provision of Infrastructure on the Economic Development of Russian Regions. Regional Research of Russia. 2020. Vol. 10. N 4, p. 513-521. DOI: 10.1134/S207997052004005X

- Pavlovich A.A., Korshunov V.A., Bazhukov A.A., Melnikov N.Ya. Estimation of Rock Mass Strength in Open-Pit Mining. Journal of Mining Institute. 2019. Vol. 239, p. 502-509. DOI: 10.31897/PMI.2019.5.502

- Sidorenko A.A., Dmitriyev P.N., Yaroshenko V.V. Integrated justification of technological structure for coal mine. Mining informational and analytical bulletin. 2021. N 8, p. 5-22 (in Russian). DOI: 10.25018/0236_1493_2021_8_0_5

- Sudarikov A.E., Merkulova V.A., Bogoliubova A.A. The impact of mining technology on stability of open cast mine. International Journal of Applied Engineering Research. 2017. Vol. 12. Iss. 20, p. 10385-10388.

- Saaty T.L. Decision making with the analytic hierarchy process. International Journal of Services Sciences. 2008. Vol. 1. N 1, p. 83-98.

- Khaikin M.M., Plotkin B.K. Primary and secondary material resources in the recycling system: recommendations and perspectives. Novye idei v naukakh o Zemle. 2019. Vol. 6, p. 222-226 (in Russian).

- Khaikin M.M., Nevskaya M.A. Regulation of economic relations in the field of mining waste. Problemy sovremennoi ekonomiki. 2016. N 4, p. 64-71 (in Russian).

- Zagorskaya A.V., Lapidus A.A. Application of expert judgments methods in scientific research. determination of the required number of experts. Construction production. 2020. N 3, p. 21-34 (in Russian).

- Pirogova O., Plotnikov V., Uvarov S. Risk-based approach in the assessment of infrastructure transport projects. Transportation Research Procedia. 2022. Vol. 63, p. 129-139. DOI: 10.1016/j.trpro.2022.05.015