Influence of mining rent on the efficiency of using natural potential: the paradox of plenty and its Russian specifics

- Ph.D., Dr.Sci. Professor Saint Petersburg Mining University ▪ Orcid

Abstract

The most powerful potential of Russia's natural resources is only partially realized, and determining the reasons for the insufficient efficiency of its use is a current research topic. The exploitation of mineral resources that bring mining rent (primarily oil and gas) gives rise to the so-called “paradox of plenty” (PP), which in some cases manifests itself as a significant slowdown in economic development. The purpose of the article is to clarify the signs, degree and forms of PP manifestation and related problems (“resource curse”, “oil curse”, etc.) in the Russian economy. Since the causes of these phenomena are usually associated with rent extraction and peculiarities of the institutional structure of the economy, the works of leading economists who support the theories of “rent-oriented behavior” and the role of public institutions in the process of the PP emergence were critically analyzed. To determine the signs and degree of PP manifestation and related problems, an analysis of determining the shares of oil and gas in the structure of exports, revenues from their sale in the federal budget, and oil and gas products in the structure of GDP, was made. It is concluded that there are no sufficient grounds for ascertaining clear signs of a “rent-oriented” Russian economy and a “resource curse”; important counteracting factors that refute the unambiguous conclusions about the high degree of PP impact on the Russian economy were identified. The author's interpretation of the role of public institutions, the factors of formation and forms of PP manifestation, the specifics of differential mining rent and its role in the formation of PP are proposed; options for solving problems generated by PP – directions for improving the tax system in the field of oil and gas, etc.; substantiation of the need to develop a strategic state program for diversifying the sectoral structure of the Russian economy; directions for adjusting economic policy in the field of oil and gas industry development, etc.

Introduction

Russia is the richest country in the world in terms of mineral reserves, including the most valuable – oil and gas. The bowels of Russia have a colossal amount of precious, non-ferrous and ferrous metals, rare earth elements, coal, and many other minerals. But this powerful potential for economic growth and the well-being of the people, for a number of reasons, receives only partial realization: it is believed that this is the result of the manifestation of the so-called “paradox of plenty” (PP).

The paradox lies in the fact that often countries with significant reserves of natural resources begin to experience socio-economic problems during their exploitation, the occurrence of which is associated with the extraction of natural rent and the formation of a “rent-oriented” economy. A stri-king example is Venezuela, which ranks first in the world in terms of oil reserves (proved reserves at the end of 2019 – 303.806 billion barrels) [1], at the same time, it also leads in terms of poverty, inflation, crime, etc. Such a significant PP manifestation is defined as a “resource curse”. Conversely, almost devoid of natural resources (and opportunities for extracting mining rent), Japan is listed among countries with a high level of prosperity and GDP per capita. This country is also a typical example of the profitability of combining imports of raw materials and exports of high value-added (VA) products.

Natural wealth is only potential wealth. The effective implementation of the potential inherent in nature, taking into account the overcoming of the negative PP consequences, requires the presence of a very important resource that is created not by nature, but by man himself. This resource is often referred to as “public institutions”, but, in fact, it is a type (model) of an economic system.

To overcome the negative consequences of PP, it is necessary to find the real reasons for their origin; for Russia, this has become even more important in connection with the emergence of a new political and economic reality. The purpose of the article is to identify the symptoms of the “resource curse” in the economy of the Russian Federation, to determine the forms, degree and causes of their manifestation; give suggestions for adjusting economic policy.

Methodology

The mechanism of the “paradox of plenty” action

The PP manifestations are often defined by other similar concepts: “Dutch disease in the economy” (DD), “resource curse”, “oil curse”, “oil dependence”, “rent-oriented economy”, etc. The term “resource curse” was introduced in 1993 by the English economist R.Authy to analyze the reasons for the decline in growth rates and living standards in oil-exporting countries in the face of rising oil prices [2]. Further, this topic was developed by foreign and Russian authors – J.Sachs, E.Warner [3], M.Humphreys, J.Stiglitz (Nobel Prize winner), R.J.Barro, M.Ross, A.N.Lyakin, V.V.Ivanter, V.L.Inozemtsev, B.Yu.Titov, V.Poltero-vich, T.V.Ponomarenko, A.E.Cherepovitsyn, M.M.Khaikin and others. The definition of “Dutch disease in the economy” arose due to the fact that a gas field was discovered in the north of Holland in 1959, which led to significant economic problems. The concept of “rent seeking behavior” (rent seeking) has become widespread thanks to the works of G.Tulloch, A.Kruger, R.Kongleton, A.Hillman, K.Conrad, K.Gaddy, B.Murphy, K.Shleifer, G.Appelbaum, E.Katz and others [4-8]. The possibility of obtaining unearned income from the extraction of high-rent natural resources determines the corresponding motivation – the desire to obtain high incomes based on unproductive activities. This is the “rent-oriented behavior” that gives rise to the “rent-oriented economy” with clear manifestations of DD in particular and PP in general. It should be clarified that “rent-oriented behavior” does not necessarily imply the appropriation of only natural rent (land, mining, etc.). The source of rent can be any excess of the economic result over the normal one obtained in competitive conditions, which is fixed due to access to administrative resources, the ability to set rules, etc.; namely due to all sorts of objective favorable conditions that allow to receive additional (“unearned”) income (A.Marshal defined it as “quasi-rent”). The article considers only mining rent and the rent-oriented behavior associated with it.

The causes and consequences of PP are usually explained through the DD mechanism in the economy. According to most theoretical postulates, the common cause of the DD emergence is an excessive passion for the appropriation of mining rent, which gradually leads to contradictory consequences (Table 1).

Table 1

Factors and manifestations of the “paradox of plenty”

|

Growth |

Slowdown |

|

Production of extractive industries products (+) |

Production of products and services with high VA – |

|

State budget revenues (+) |

Demand for innovation (–) |

|

Export of energy carriers (+) |

Investment in human capital (–) |

|

The influx of foreign currency and the strengthening of the national currency (+) |

Scientific and technical progress (–) |

|

Imports of products with high VA, including high-tech goods and services (–) |

Investment multiplier effects (–) |

|

Dependence of state budget revenues on world energy prices (–) |

Investment Acceleration Effects (–) |

|

Dependence on countries exporting high-tech products (–) |

Economic growth rates (–) |

|

Problems of economic security (–) |

The growth of the welfare of citizens (–) |

As it should be for the paradox, even the growth factors in some cases are negative (with a “–” sign). Factors with a “+” sign are presented as the main reasons for the consolidation of trends, leading in the long term to the predominance of negative consequences. For the subjects of economic management, they are powerful short-term stimulants, hence the term “oil curse”. Nevertheless, when determining long-term economic policy, one cannot ignore the fact that not all PP manifestations are negative.

The most important factor in strengthening (or easing) the PP symptoms is the dynamics of world energy prices, which gives rise to contradictory consequences. High energy prices significantly increase the rent component in the structure of revenues from energy exports, which, according to generally accepted rent theories, is precisely what gives rise to problems associated with PP. An increase or decrease in world energy prices gradually leads to the consequences shown in Table 2.

Table 2

Consequences of world energy prices impact

|

High prices |

Low prices |

|

Increasing state budget revenues (+) |

Decrease in state budget revenues (–) |

|

Strengthening the exchange rate of the national currency (+) |

Drop in the value of the country's currency (–) |

|

Stimulation of exports of high-rent products with low VA (–) |

Import slowdown (+) |

|

Growth of foreign exchange inflow (+) |

Reviving the production of goods with high VA (+) |

|

Production growth in extractive industries with low VA (–) (+) |

Promoting exports of products with high VA (+) |

|

Stimulation of imports of products and services with high VA (–) |

Acceleration of scientific and technological progress (+) |

|

Stimulating the progress of the “Dutch disease” in general (–) |

Increasing economic growth (+) |

As can be seen from Table 2, both high and low prices have their pros and cons. However, in theory, as a rule, it is the negative consequences that are emphasized, hence the negative assessment of such concepts as “rent-oriented behavior” and “rent economy”. When absolutizing certain consequences, it turns out that high prices stimulate the progression of the “Dutch disease” in the economy, and low prices stimulate the acceleration of scientific and technological progress, economic growth rates, etc., which even at first glance looks strange. The causes of all problems are usually attributed to the “rent-oriented economy” and the extractive industries, primarily oil and gas companies. To determine an effective economic policy, it is necessary to take into account not only the disadvantages of the oil and gas complex development, but, above all, its advantages, taking into account the natural potential of the country. The absolutization of the factors and consequences of the PP manifestation leads to misinterpretations of this paradox causes and to false guidelines for the economic policy of curbing the development of extractive industries.

As an example of these contradictory consequences, one can cite the default in August 1998, when a five-fold depreciation of the ruble (within five months) against the backdrop of low world oil prices led to an empty budget and an almost complete halt in imports. But this was followed by the revival of many sectors of the Russian economy due to the emergence of the effect of “forced protectionism”. This circumstance, combined with the growth of world energy prices, led to the strengt-hening of the ruble, restoration and even expansion of imports, which were dominated by goods with a high VA, the economy again became a “resource-based”, the symptoms of the “Dutch disease” reappeared.

As already noted, PP is usually associated with the appropriation of rent and the emergence of a “rent-oriented economy”, in this case, it is “mining rent” that is meant.

Influence of mining rent

Rent is one of the factor incomes, sometimes defined as an “expense”. For the seller of a resource, its price is income, for the buyer it is an expense, by analogy, for a lessee, rent is an expense, and for the owner of a resource it is income. Pricing takes into account the following features: natural rent; land value; nature restoration works; ecological measures to protect the environment during extraction and enrichment of mineral resources; increase in the cost of work due to the development of hard-to-reach areas (continental shelf, Arctic coast, tundra, etc.); additional labor costs, including social costs; the use of special, usually expensive equipment; accelerated depreciation, etc. [9].

However, the situation with rent is more complicated: if the owner of a commodity changes during the sale and purchase, then in rent relations the property is divided into two levels: disposal and possession. The lessee of a natural resource (deposit) is the owner, and the owner of the subsoil, the state, disposes it. Thus, one part of the rent is received by the lessee, and the other part by the owner in the form of taxes, rent, license, etc. The most important problem in the field of mining rent distribution is to achieve a balance of interests of society, which in relations with the lessee is represented by the state, and the operating economic organization.

The concept of “mining rent” historically arose in the form of a mining tax, which was levied by the state from private miners for the rights granted to them to develop the subsoil. The mining tax proceeded from the mining regalia, i.e. the exclusive right of the state to subsoil. In Russia, the mining tax was introduced under Peter I.

As already noted, rent often refers to “unearned” income, not only by Marxists, but also some modern institutionalists. In their view, rent is any income other than labor and capital investment income. In this interpretation, the appropriation of rent does not contribute to the growth of GDP and the efficiency of the economy, in the worst case, it even causes harm, manifesting itself as a “curse of resources”. Rent is often defined as any income other than labor income. In this view, rent is an excess product, due to the different quality of plots “and not requiring entrepreneurial activity from its recipient” [10]. The owners of mineral deposits are paid simply because they are owners, they add nothing to the national income; at best, rent does not help the growth of production efficiency in any way, at worst, it harms as PP manifestations. In general, rent-seeking is comparable to the receipt of income in the secondary financial markets, participation in gambling, etc.

In our opinion, it is difficult to agree with the institutionalists’ approach, since the extraction of oil, gas and other mineral resources, of course, increases both the current national income and annual GDP. We can see a clear refutation of this approach on the example of a number of producing countries: Norway, Canada, the United Arab Emirates, Saudi Arabia, Malaysia, partly Russia, etc. It is obvious that oil and gas production, process of servicing operating organizations, delivery of extracted resources to world markets, organization and management of these processes is a large cost of living labor (creating VA) and capital; this is especially evident in difficult conditions of exploration and exploitation of deposits, which is especially typical for Russia. In particular, the oil and gas complex of the Russian Federation uses a huge number of innovations in the process of introducing new equipment and various technologies, including digital ones.

Mining rent arises in deposits of mineral resources, primarily oil and gas. Differential mining rent, which is divided into two subspecies – I and II kind, is the most important of all types of rent in the economic sense (Table 3). There are two factors in the formation of differential mining rent of the first kind: additional natural productivity as a result of favorable conditions for exploitation of a deposit, and dislocation of this deposit.

Table 3

Factors of differential mining rent formation

|

Objective – differences in conditions for rent I |

Subjective – implementation for rent II |

|

Geographical-economic, geological-economic and mining |

New equipment |

|

Distances to sales and supply markets |

New technologies, including digital |

|

Availability and quality of communications and other infrastructure |

Innovations related to the sale of products and the supply of mining companies |

|

Degree of development of transport logistics systems |

– |

|

The quality of the recovered product |

– |

|

World price level |

– |

Additional natural productivity is the result of favorable natural conditions that arise during exploration, development and exploitation of deposits with the best and average mining and geological characteristics: high well flow rates, large productive horizons, large reserves of deposits, insignificant occurrence depth, etc. Additional (rental) income is also provided by favorable location of a deposit, quality of extracted product and high level of world prices.

Thus, differential mining rent I arises due to the influence of natural, climatic and other objective conditions that do not depend on the activity of a mining company, and mining rent II is formed as a result of the introduction of innovations by economic entities operating a particular deposit. Additional income received by the owner and owner of a deposit with more favorable objective conditions can be conditionally classified as “unearned”, but this does not apply to differential rent II. In Russia, where difficult conditions prevail for exploration, development and exploitation of deposits, this type of rent is much more important than in a number of other countries.

Hence the general principles for the distribution of mining rent – the owner of the subsoil should receive the differential rent I, i.e. society represented by the state, and differential rent II – a mining company, regardless of the form of ownership. But here two important problems arise: determining the ratio of the two subspecies in the total amount of rent and determining the share of rent in the amount of income of the economic organization operating this deposit. For an approximate separate quantitative determination of differential mining rent I and II, in practice a system of variable rent payments and preferential discounts is used.

On the presence of a “resource curse” in the Russian economy

Opinions about the presence of the “paradox of plenty”, “resource curse” and the degree of “rent-oriented” in the Russian economy vary from complete denial to a statement of their inveterateness and impossibility to overcome.

Representatives of the first direction (V.V.Ivanter, K.V.Simonov and others) believe that there is no “oil curse” in the Russian economy, and oil and gas resources are a fundamental competitive advantage of Russia, the export of which should be constantly ramped up. However, the vast majority of authors point out the existence of a “resource curse”, “Dutch disease” and even an “oil depen-dence”, resulting from the excessive “rent-oriented” nature of the Russian economy.

The symptoms of the “Dutch disease” in the Russian economy do take place, a typical example is the development of high-speed passenger transport. In 1991, RAO High-Speed Lines was formed with the aim of creating a high-speed (up to 350 km/h) Sokol train. The unfinished project was closed in 2003, more than 1 billion euros were invested in Siemens for the purchase and maintenance of Velaro (Sapsan) trains; this is a clear example of the negative consequences of the raw materials way of development [11]. Huge investments, instead of supporting domestic producers, left Russia in the presence of an acute shortage of investment resources. In 2007, the parties entered into an agreement on the maintenance and repair of high-speed trains, based on which the German contractor received quite decent income for almost 10 years. However, in the spring of 2022, Siemens announced the termination of all maintenance agreements with the Russian railway operator, including the supply and maintenance of Sapsan and Lastochka trains.

Another typical example of the symptoms of the “Dutch disease” is the relatively slow creation and dissemination of innovations, including information technology. The most profitable exports are goods and services with high VA, in particular, software. However, Russian software exports are rather limited: in 2017 it amounted to $ 7.5 billion, and in subsequent years it increased very slightly. Even in the Russian oil and gas complex, about 80 % of the software is imported. For comparison, the income from the export of Indian IT services exceeds the Russian income from gas exports. India continues to amaze with the pace of progress in the field of information technology, in an agrarian country in which more than 40 % of the population is illiterate, hundreds of computer firms with a total turnover of about $ 10 billion operate.

From what has been mentioned, it follows that there are indeed some symptoms of the “Dutch disease” in the Russian economy, but there are no clear signs of the “resource curse” and the “oil dependence”. To determine the degree of PP action, a more detailed analysis of the reasons for its occurrence is needed, which involves taking into account the following indicators:

- share of natural resources with a low degree of processing in the structure of exports;

- share of products and services with high VA in the structure of imports;

- share of income from the sale of resources in the federal budget and other levels of the budget system;

- share of primary industries in the structure of GDP;

- number of employees in the primary and non-primary sectors.

Share of oil and gas sector products in Russian exports

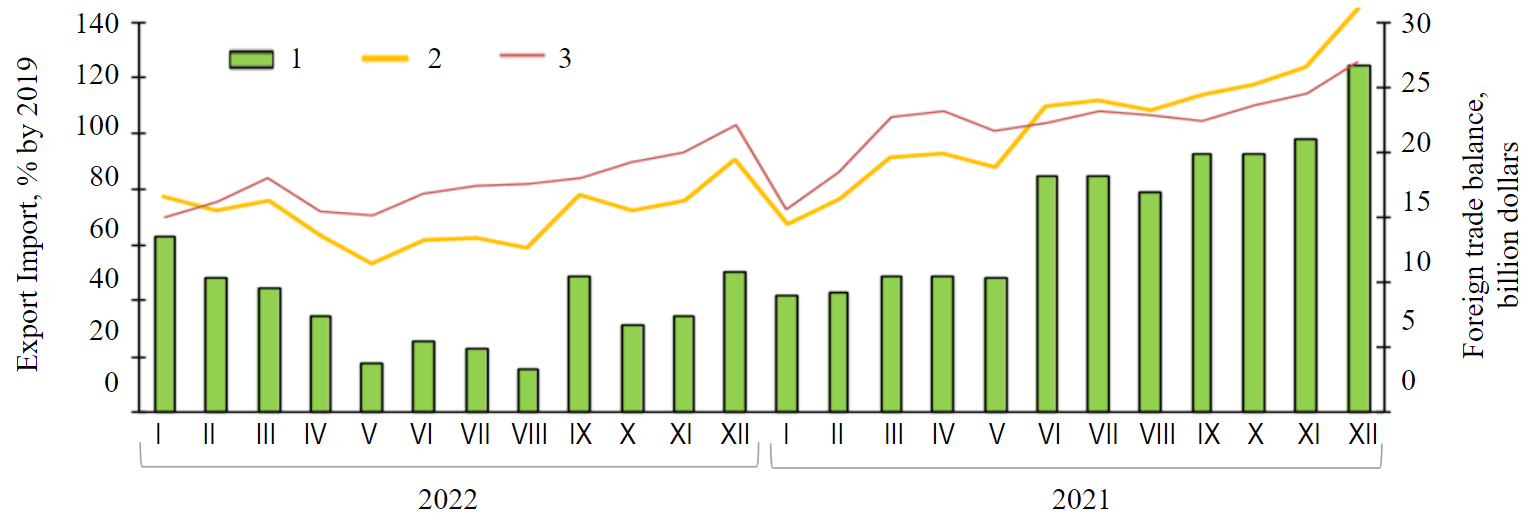

In 2021, Russia's foreign trade turnover amounted to $ 798 billion (139.3 % by 2020), including exports – 494 billion dollars (148.2 %), imports – 303.9 billion dollars (126.8 %) (Fig.1). The trade balance remained positive – 190.1 billion dollars.

Exports of fuel and energy products in 2021 amounted to $ 267,035 million, including crude oil, including natural gas condensate – $ 110,171 million, i.e. 22.3 % of the export amount; natural gas – 55507 million dollars (growth – 2.2 times by 2020). The total amount of oil and gas exports is 165,678 million dollars, which is 33.5 % of the total exports. At the same time, the export of machinery, equipment and vehicles amounted to 32631 million dollars – this is only 6.6 % of the amount of exports. In addition to oil and gas, a significant share of exports is made up of other goods with low VA: non-ferrous and ferrous metals, timber, grain, etc.

Structure of Russian imports

Imports of machinery, equipment and vehicles in 2021 amounted to 144299 million dollars (growth – 130.8 % by 2020), i.е. 47.5 % of the amount of imports, this figure is stable over a long period. The predominance of exports of raw materials and imports of machines, equipment and vehicles are clear symptoms of the “Dutch disease” in the economics of the Russian Federation.

The given data show that for 2020-2022 in terms of the exports and imports structure, the dependence of the Russian economy on raw materials has increased to some extent. In general, the export-import structure cannot be considered efficient for the following reasons: a high share of raw materials and products with low VA; a high share of imports of machinery and equipment; a high share of revenues from energy exports in the structure of the federal budget; high volatility in oil prices and instability of the ruble exchange rate; duration of this situation.

Fig.1. Dynamics of exports and imports in 2020-20212 1 – balance of foreign trade; 2 – export; 3 – import

The share of oil and gas production in budget revenues and GDP

In addition to the structure of exports, an important criterion for dependence on raw materials is the share of oil and gas in budget revenues and their share in the structure of GDP. In general, the share of budget revenues from oil and gas revenues is less significant than in the structure of exports. In 2022, revenues from this sector should provide 38 % of all revenues (9.5 trillion rubles with total revenues of 25 trillion rubles), which follows from the law on the budget for 2022-2024. According to the Ministry of Finance, for January-June 2022, oil and gas revenues have already arrived at 66 % of the budgeted plan and amounted to 6.4 trillion rubles. But in 2022, against the background of rising world oil and gas prices caused by sanctions pressure on Russia and subsequent shortage of energy resources in the world, the share of oil and gas revenues in the budget increased again. In January 2022, according to Rosstat, exports of fuel and energy products amounted to 188.5 % compared to January 2021.

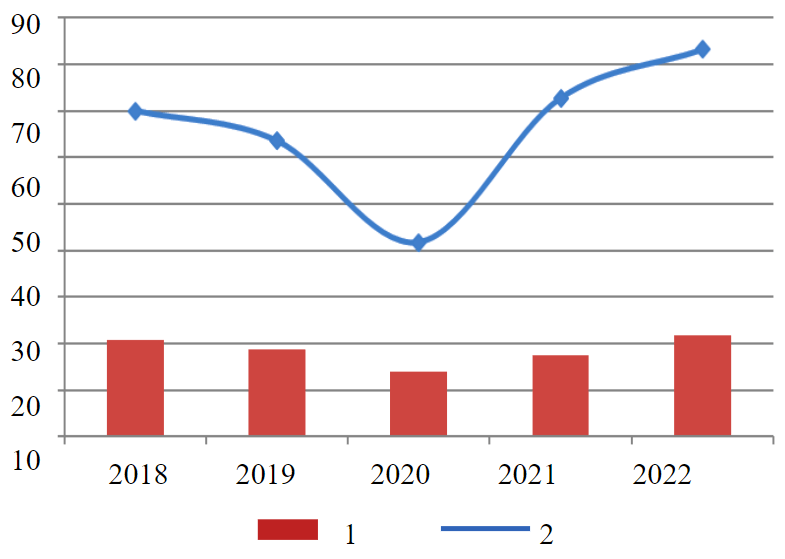

It should be borne in mind that we are not talking about a significant increase in physical supplies, the reason for the growth is a significant increase in world energy prices. Only the nominal rather than the real volume of supplies has grown, but at the same time, the share of oil and gas revenues in the budget has increased actually due to an growth in interstate rent (in this case, we mean different incomes from the same energy carriers as a result of different natural and climatic conditions at the same world prices). Figure 2 shows a clear correlation between the dynamics of world oil prices and the share of the oil and gas sector in the country's GDP.

The oil and gas sector includes enterprises engaged in the production of crude oil, natural gas and products of their processing (primary subsector) and related to their processing, transportation and sale (secondary subsector), as well as ancillary activities to ensure the operation of oil and gas sector facilities. According to Rosstat, the share of the oil and gas sector in Russia’s GDP over the past five years was 20.7 % in 2018, 18.8 % in 2019, 13.9 % in 2020, 17.4 % in 2021, 21.7 % in 2022 (Fig.2).

Over the past five years, world oil prices have changed as follows: in January-August 2022, the average oil price was $ 83.13/bbl; 2021 – 72.71; 2020 – 41.73; 2019 – 63.59; 2018 – 70.01 (Fig.2).

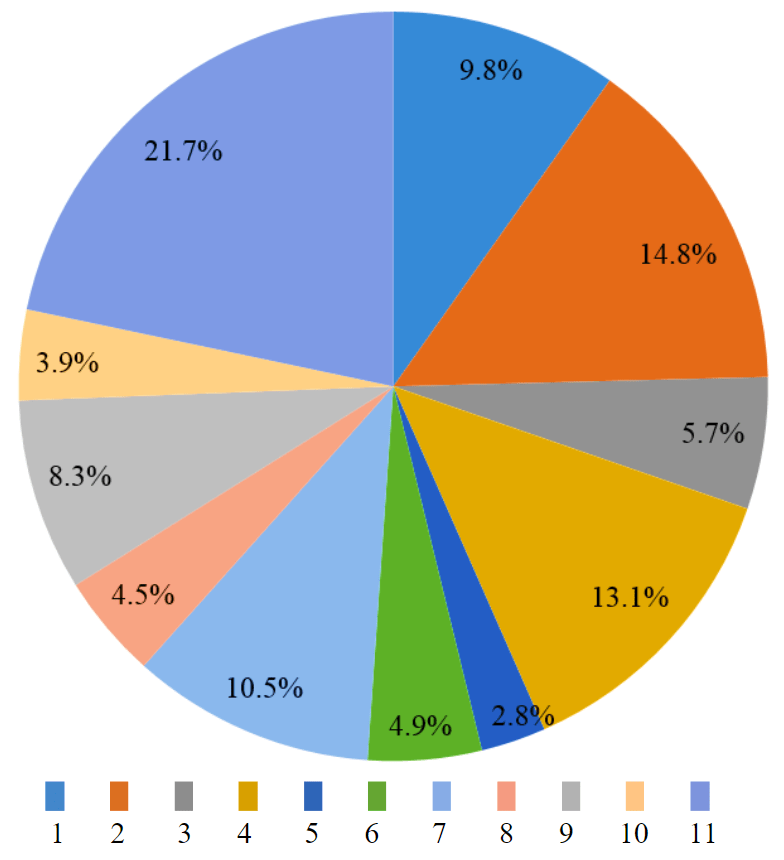

In addition to the share of the oil and gas sector, Rosstat makes calculations of the indicator of the share of minerals. In 2020, extraction of mineral resources accounted for 9.8 %, manufacturing – 14.8 % of the total GDP. The general sectoral structure of GDP is shown in Fig.3. The structure of GDP, in particular, the ratio of the shares of mining and manufacturing industries, indicates the absence of clear signs of the “paradox of plenty” and “resource curse”.

The index of physical volume of GDP and gross value added for mining and manufacturing (in constant prices, as a percentage of the previous year) in 2021 amounted to 104.2 and 104.6 %, respectively, i.e. manufacturing industries grew slightly ahead of mining.

Fig.2. Share of the oil and gas sector in Russia's GDP, % (1) and dynamics of world oil prices, $/bbl. (2)

Fig.3. Sectoral structure of GDP 1 – extraction of mineral resources; 2 – processing production; 3 – construction; 4 – wholesale trade and retail; repair of motor vehicles and motorcycles; 5 – information and communication; 6 – financial and insurance activities; 7 – operations with real estate; 8 – professional, scientific and technical activity; 9 – public administration and military security, social security; 10 – health care and social services; 11 – other sectors

On the whole, the given statistical and actual data are not unambiguous in terms of the presence or absence of the “paradox of plenty” in the Russian economy. If the symptoms of the “Dutch disease” are clearly visible in the structure of imports and exports, then the share of exports of oil and gas products in the federal, and especially in the consolidated budget, is less, and in the structure of GDP it is not critical.

Opposing factors

The following facts also testify against unambiguous conclusions about the existence of the “plenty paradox” in general and the “oil dependence” in particular.

- A significant share in Russia's GDP is occupied by the so-called non-tradable goods: products and services of construction, transport, trade, services, etc., which are not exported, there is no doubt that these sectors, as well as manufacturing industries, attract both investment and innovation (Fig.3). This structure is stable over a long period.

- The non-critical level of dependence of the Russian economy on extractive industries is also evidenced by the share of those employed in extractive industries – over the past 10 years it has been 1.8-2.2 % of the employed population.

- Manufacturing industry occupies a larger share in the structure of GDP than extractive industries: in 2020 extraction of mineral resources – 9.8 %, manufacturing – 14.8 %. It is important to take into account that the technical and technological level of the manufacturing industries, their international competitiveness is determined by the production and export of products not only for civilian, but also for military purposes. In terms of arms exports, the Russian Federation ranks second in the world after the United States and remains among the largest arms exporters. This sector of the economy is highly innovative.

- Over the past few years, a number of large-scale investment projects have been successfully implemented. Revenues from the export of fuel and energy products serve as one of the most important sources of financing for large projects, including the development of cosmonautics, the construction of seaports, nuclear and hydroelectric power plants, bridge building, the construction of railways, airports, sports complexes, roads, large ships.

- Numerous large investment projects are carried out directly in the Russian oil and gas complex. The fuel and energy complex is the most important part of the Russian economy, energy companies are major customers of the products of manufacturing industries [12]. The existing oil refineries in Russia continue their reconstruction and commissioning of new technological capacities as part of the national modernization program. The main goals of this program are to increase the production of high-octane gasolines that meet Euro-5 and higher standards, and to organize oil-free production. As a result, the depth of oil refining in recent years has increased by almost 15 % and currently stands at over 83 %, at some refineries it is brought up to 100 %.

For example, the Moscow Oil Refinery of Gazprom Neft, when building a complex for deep oil refining, will increase the depth of oil refining to almost 100 %, will be able to abandon the production of fuel oil and switch to waste-free production. The complex is a key project of the third stage of mode-rnization carried out by Gazprom Neft. The project is scheduled to be completed by 2025. The project is being implemented with the participation of several foreign companies, but equipment from Russian manufacturers is primarily used in construction.

Gazprom Neft and the Ministry of Energy of the Russian Federation signed an agreement on providing the company with investment allowances for returnable excise tax on crude oil for the construction of new complexes for deep oil refining at the Moscow and Omsk refineries. Gazprom Neft is carrying out a refinery modernization program to improve environmental and technological performance, the program is designed until 2025.

- The term “rent-oriented economy” is generally not applicable to the Russian economy, since the extraction of energy resources in most cases is associated with significant costs of both investments and human labor. In Russia, unlike, for example, the Arab countries, in most cases the deve-lopment of deposits with complex mining and geological characteristics takes place, meaning well flow rates, productive horizons, reserves of deposits, the depth of the extracted product, etc.

The analysis showed that, according to the totality of statistical and actual data there are no sufficient grounds to speak seriously about the presence of such phenomena as the “resource curse” and the “oil dependence” in the economy of the Russian Federation. There are also no serious grounds to talk about the presence of clear signs of a “rent-oriented” Russian economy. However, the structure of export-import and the relatively high share of income from it in the state budget leads to the conclusion about excessive dependence on raw materials. To determine the key directions for its reduction, it is necessary to identify underlying causes of its occurrence. As such, “bad” socio-economic institutions are usually called.

The concept of strong institutions

Many foreign and Russian analysts, when discussing the reasons for the “paradox of plenty” in resource-rich countries, put the presence of “strong” political and economic institutions at the forefront. For example, the authors of works [13, 14] define the causes of the “resource curse” primarily as a shortage of human capital and the low quality of institutions. These primarily include private property and a democratic form of government of the Western type. Western liberal economists traditionally consider private property to be the most important “strong” economic institution. To overcome the “resource curse”, it is proposed to reduce the volume of oil revenues with the transition to alternative sources, etc. Such conclusions are also supported by many Russian analysts, for example, in [15] it is noted that “strong institutions can turn oil plenty into a gift, weak ones into that same curse.” “Today, most of the exploration, production, processing and transport of the world's energy resources, namely 80 %, is under state control and only 20 % remains in private hands. Nevertheless, it would be necessary to finally turn state-owned companies into private ones” [16].

Thus, according to a number of authors, “strong” institutions contribute to overcoming the “resource curse”, while “weak” institutions (authoritarian form of government and state ownership) create conditions for inefficient spending of rental incomes, entire states – rentiers – appear.

The above theses are not always confirmed by practice, which is reflected in theoretical approaches. Even among Western experts, not everyone agrees with the need for the dominance of private property. For example, article [17] notes the distinctive features of the Russian case, which arose “because of the unique transition from a command economy to a market model and from authoritarianism to democracy.” Back in the mid-1980s, scientists suggested that mechanisms of active state intervention in the economy in a number of industrialized countries have become one of the most important factors in the rapid economic growth in these countries [18].

As successful examples of the use of state entrepreneurship in the oil and gas complex, one can cite companies from the list of “seven sisters”. In 2007, the Financial Times newspaper and executives of mining companies identified the seven most influential energy corporations – the new “seven sisters”: 1) Aramco (Saudi Arabian Oil Company), 2) PAO Gazprom, 3) CNPC (China National Oil and Gas corporation), 4) NIOC (National Iranian Oil Company), 5) PDVSA (Petroleos de Venezuela, Sociedad Anonima), 6) Petrobras (Petroleo Brasileiro S.A), 7) Malaysian Petronas (Petroliam Nasional Berhad). These companies, outperforming the “seven old sisters” (in 1940-1970 – BP, Exxon, Gulf Oil, Mobil, Royal Dutch Shell, Chevron and Texaco) in the competitive struggle, control almost a third of the world's oil and gas production and more than a third of their stocks. Currently, in terms of their scale and efficiency, such companies with state participation as the Chinese Sinopec Group and the national offshore oil corporation CNOOC, the Russian oil company NK PAO Rosneft, Indian Indian Oil and Bharat Petroleum can also claim the title of “new sisters”.

Thus, most of the companies from the “new sisters” (except for the Venezuelan one, which is going through a difficult period due to sanctions) refute the theses about the inefficiency of public administration in the oil and gas complex. Equinor, the largest Norwegian oil company, was both privately and publicly owned at various times. In general, one can agree with the opinion of the Nobel laureate G.Simon: “In modern management, there are often more differences between small and large organizations than between public and private” [19]. This means that in general, in the economic system and in the oil and gas complex in particular, there should be a variety of both forms of ow-nership and organizational and legal forms of entrepreneurial activity.

The foregoing refutes the thesis [14] about the key importance of “strong institutions”, meaning private property and a democratic form of government. As practice shows, authoritarian regimes, like democratic ones, can create conditions for the spread of innovations, which explains the rapid and effective economic development of a number of countries in Asia and Latin America. One can recall the military dictatorships of South Korea and Chile, which created economic conditions for further effective development and prosperity, modern Arab monarchies, etc. These countries, while not being democratic in the Western sense, nevertheless managed to create quite effective inclusive institutions that ensure both economic growth and overcoming the negative consequences of the “plenty paradox”.

In our opinion, the role of “strong” institutions in economic development is greatly exaggerated and absolutized. For example, the Russian economy, in the presence of the same resources and the “shock” formation of new, democratic institutions and private property in the 1990s quickly rolled into the abyss and “slid” to default in 1998. Whereas in China, which, according to some analysts, retained an authoritarian form of government and the predominance of state ownership, already in the first years of reforms (1980s) there was a stable economic growth.

Practice shows that in a number of countries, even in the absence of “strong” institutions (in the Western sense), favorable conditions are created for economic growth and overcoming the consequences of the “resource curse”. For example, the PRC state administration system, which is based on the National People's Congress (NPC), while not being a Western-type democracy, is a fairly effective public administration mechanism comparable to meritocracy (which is often identified only with Western-type democracy). China, in our opinion, not unreasonably declares the construction of “socialism with Chinese characteristics”. They retained practically the same bodies of state admi-nistration, the leading role of the party in society and the leading role of the state in the economy.

Institutions, like the model of the economy, determine the rules of behavior for a particular subject in the economy or in society as a whole. However, the concept of “economy model” gives clearer guidelines for the necessary changes in solving the problem of increasing the efficiency of the economy. The model of the national economy is its organizational and managerial structure, which determines the ways of motivating the behavior of economic entities and, accordingly, the efficiency of functioning.

Stable, fundamental and long-term sources of development lie, first of all, in an effective model of the national economy. Important problems, such as a negative investment climate, slow diffusion of innovations, unfavorable conditions for the development of small and medium businesses, an inefficient tax system, excessive centralization of finances and bureaucratization of economic relations, are solved by optimizing organizational and managerial structure of national economy. In addition to sectoral, regional and other, the national economy has an organizational and managerial structure, which is a functional invariant. An organizational structure is a set of links (rules) that determine behavior of each of its elements and entire system as a whole, resources movement. Both efficiency of costs (investments) and results of economic activity depend on this. Thus, the concept of “organizational and managerial structure” is generally consonant with the term “institutional structure”. The first definition gives more clear guidelines for the necessary transformations, while the second often leads to non-coincidence of theoretical postulates with practice. Concepts such as “good” or “bad” institutions, in fact, belong more to sociology than to economics.

The behavior of an organized system as a whole is determined not so much by properties of its individual elements as by properties of the structure. At the same time, structure of the organization is a mechanism for coordinating the goals (interests) of its constituent elements. Systems that are significantly different in composition (mentality) may have similar properties due to commonality in the methods of organization, and vice versa, similar or identical in composition – have different properties and efficiency of functioning. Thus, an effective model of the national economy is the most important resource that is created not by nature, but by man himself. As an illustrative example, China can be cited, which, having the same resources, climate, national traditions and other civilizational characteristics, as a result of the reform of the economic model (organizational and managerial structure) has become one of the leading powers in the world in all political and economic indicators.

Discussion of the results

The analysis showed that there are no sufficient grounds to seriously talk about the presence in the national economy of the Russian Federation of such phenomena as the “resource curse”, “oil dependence” and the predominance of “rent-oriented”. However, effectiveness of the implementation of Russia's powerful natural potential is clearly insufficient, even though the total GDP of the Russian Federation occupies 10-11th place in the world, GDP in terms of purchasing power parity is sixth-seventh. But taking into account the fact that Russia ranks first in terms of proven gas reserves, and sixth in terms of oil reserves (and at the same time, in terms of living stan-dards, only 65-90s), the overall assessment of the efficiency of using natural potential is not very high. The volume of Russian GDP also does not correspond to the resource potential. China's GDP, with a clearly smaller amount of natural resources, has been 10 times larger than Russia's over the past few years (whereas in the mid-1990s this figure was approximately the same). In particular, according to the results of 2021, China's GDP amounted to 17734 billion dollars, Russia – 1775 billion dollars. Another example is that the level of Russian GDP in recent years is comparable to the GDP of the Republic of Korea (1,798 billion dollars), which has significantly fewer natural resources. Nominal GDP is one of the key quantitative indicators of economic development used all over the world, including in the statistics of the Russian Federation, for the most general characterization of the results of the country's economic activity for the year, i.e. these data are broadly comparable. Due to objective significant differences in the economy and population, GDP per capita indicators are more comparable: in 2021 – China 12556 dollars (63rd place in the world), Russia 12173 dollars (66th place). In this sense, the situation inspires greater optimism (for greater objectivity, one should not forget that for many years Russia was ahead of China in this indicator, and last year they reversed roles). Russia's GDP per capita is less than in countries such as Costa Rica (12,509 dollars) and Nauru (12,252 dollars), which does not correspond to Russia's economic potential.

Many analysts see the reason for the lack of efficiency of the natural potential use in the presence of a “resource curse” and even an “oil dependence”. The task of the study was to identify the symptoms of the “resource curse” in the economy of the Russian Federation, to determine the forms, extent and causes of their manifestation and directions for adjusting economic policy to eliminate them. According to the degree of manifestation of PP symptoms, excessive dependence on raw materials is determined, which manifests itself in the following forms: 1) inefficient export structure – goods with low VA prevail; 2) inefficient structure of imports – high-tech goods prevail, including equipment and software for oil and gas companies, which gives rise to excessive dependence on exporting countries; 3) a high degree of dependence of federal budget revenues on world energy prices; 4) slow diversification of the sectoral structure of the economy; 5) inadequate distribution of rental income.

The solution to the first two problems is to carry out sectoral diversification in order to increase the production of goods and services with high VA, which will increase their share in the structure of exports and reduce them in imports. The third problem is solved in several ways. The first is streamlining the income and expenses of the NWF. Currently, there is a certain lack of system in this as a result of the lack of clear targets. For example, in May 2022, the following operations were carried out: the purchase of preferred shares of OAO Russian Railways, bonds of the State Corporation – the Fund for Assistance to the Reform of Housing and Public Utilities, foreign currency, etc.The investment of the NWF funds was carried out in the following areas: construction of a high-speed railway line in the Urals; renewal of the rolling stock of Russian Railways; construction of the Central Ring Road in the Moscow region; modernization of the Trans-Siberian Railway; construction of a terminal for coal shipment in the port area in the Far East; increasing the level of digitalization of a number of Russian regions. Thus, significant reserves were accumulated in case of low oil prices, but in the absence of a clear plan for their use, including the adoption of certain anti-crisis decisions. The reserve fund is not just a “financial pillow” that allows you to sleep peacefully; systematic, purposeful actions should be taken both for the formation and expenditure of funds. The main purpose of using the resources of the reserve funds, formed at the expense of the revenues of the oil and gas complex (differential mining rent I), should be, in addition to increasing the level of well-being of citizens, the diversification of the sectoral structure of the Russian economy. Diversification, among other things, is the second way to reduce the dependence of federal budget revenues on energy exports.

For the effective management of these processes, a strategic state program is needed to diversify the sectoral structure of the Russian economy, in which clear guidelines for its implementation would be indicated. As rightly noted in [20], “strategic programs are the most important component... of management based on a balanced scorecard, as well as an implementation tool”.

Targeted programs provide a means of increasing the scientific validity of managerial decisions by strengthening their targeting, developing ways and options to achieve long-term goals, linking goals to resource opportunities, and providing a more detailed idea of what are the stages of sequential problem solving [21-23].

The Accounts Chamber of the Russian Federation, not episodically, but systematically, should control the expenses and incomes of the National Welfare Fund, having a benchmark – the implementation of the tasks specified in this strategy. The approved targets and monitoring of their implementation would not allow officials to get carried away by the short-term benefits of high rental incomes (which manifests itself as symptoms of the “Dutch disease”). The importance of developing such a strategy is increasing in the context of freezing foreign exchange assets of the NWF (since March 2, 2022); an adjustment of the management strategy is required in relation to the placement of gold and foreign exchange reserves, as well as an increase in government subsidies for the development of domestic production and import substitution. An effective factor in stabilizing revenues from energy exports may be the sale of gas for rubles. It is interesting that this measure was proposed by the management of Gazprom back in 2007. Thus, the systematization of the income and expenditure side of the NWF based on the approved strategy of intersectoral diversification would also help to solve the fourth problem from our list – low rates of economic diversification.

The fifth problem is that the low efficiency of rental income distribution is manifested in the fact that, on the one hand, redistributed rental income has little effect on the growth of the living standards of the country's citizens, on the other hand, oil and gas companies, even backbone enterprises, have insufficient funds for investment. It is unacceptable to forget that “economic interests are an essential component of the functioning of the economic system, and the search for solutions in regulating the management of subsoil use is directly related to the interests of economic agents” [24]. Moreover, the industry faces difficult tasks of continuing to upgrade oil refining capacities to improve the quality characteristics of the technological process and products: the depth of oil refining, the yield of light oil products [25-27]. The adjustment of the tax system in the oil and gas complex, in particular, the introduction of Excess-Profits Tax instead of the MET, is intended to contribute to the solution of these problems. The new tax is intended to contribute to a more equitable distribution of mining rent between the state budget and oil and gas companies. Analysts note that this tax, in contrast to the MET, provides a progressive withdrawal of rent for high-margin projects and stimulates high-cost projects at the initial stage, which will bring revenues to the budget later. Excess-Profits Tax better takes into account changes in the economic and geological conditions of production during the operation of the field. As the field is depleted, the income of the mining enterprise decreases, but the amount of tax also decreases. The release of funds at the initial stage of field development stimulates investment in new technologies for both oil production and exploration.

The problem is that the Federal Law “On Excess-Profits Tax” adopted in July 2018 provides for the transition to Excess-Profits Tax for only a limited number of pilot projects. Another important problem is instability: constant fluctuations in the tax burden – the introduction and cancellation of numerous benefits, dampers and tax maneuvers negatively affect the operation of oil and gas companies, especially in terms of long-term investment. For individual enterprises (small and medium), there is a risk of closure altogether.

The main drawback of tax system in the oil and gas complex is its pronounced fiscal nature, which does not take into account the possibility of increasing the tax base with moderate total tax payments. For example, if in the MET, by means of various coefficients, conditions for the formation of differential mining rent I are taken into account, then this cannot be said with respect to accounting for differential mining rent II, in the Excess-Profits Tax it is taken into account more clearly. Under the conditions of new political and economic reality, oil and gas companies need tax breaks. This is not at all fraught with an increase in losses in the future. The example of the Russian IT industry confirms the correctness of A.Laffer's ratio. A very important problem is the instability of the tax system - tax maneuvers and excessively frequent changes in taxes, export duties and benefits on them. Analysts believe that the problem of modernization is primarily “related to tax maneuvers on the part of the state” [28-30], which led to a slowdown and postponement of investment in this sector. According to the Ministry of Energy, compared to 2014, in 2020 the number of investments by Russian oil companies in oil refining projects decreased from 250 to 150 billion rubles in year. Only 38 % of the modernization program has been completed (in fact, 29 units have been launched with a plan of 78 modernized units) [31].

In 2021, Russian IT companies received significant tax breaks. Thanks to them, Russian developers of electronics and software were able to pay income tax at a rate of 3 % instead of 20 %, as well as to reduce the rate of insurance premiums. Thanks to benefits, the income of IT companies in 2022 increased significantly, and tax revenues to the country's budget increased accordingly. This is a very illustrative example, such an approach on the part of the fiscal authorities is primarily needed in relation to oil and gas companies as the “locomotive” of the Russian economy.

Summary

In general, economic policy in the field of eradicating the “paradox of plenty” causes should be focused on achieving the following indicators: a decrease in the share of low-processed raw materials and a significant increase in the share of products and services with high value added in the export structure; reduction in the share of revenues from the sale of resources in the federal budget and other levels of the budget system; reduction in the share of primary industries in the structure of GDP; change in the ratio of employment in the raw and non-primary sectors of the economy, etc.

The achievement of these and other targets is due, first of all, to an increase in the efficiency of the organizational and managerial structure of the state management of the economy. This, in turn, involves the following transformations:

- debureaucratization, i.e. significant simplification of the administrative structure of the economy, primarily in the sectoral aspect (reduction in the number of sectoral departments, elimination of duplication of their functions, etc.);

- development and adoption of a long-term strategy for diversifying the sectoral structure of the Russian economy, which should list priority sectors, sources of financing for their development, in particular, subventions and tax incentives (mainly);

- since the structure of mining rent in Russian conditions is dominated by differential rent II, and taking into account the role of the oil and gas complex as a “locomotive” of economic development, in this sector of the economy it is necessary to introduce preferential taxation for the long term, accelerate and expand the Excess-Profits Tax use, ensure long-term stability of tax rates;

- tax system in the oil and gas complex should be focused on stimulating the introduction of innovations, primarily digital technologies;

- stimulating the development of small and medium businesses in the oil and gas complex (along with the creation of clusters) as the basis of a competitive sector, the presence of which is an incentive to accelerate the introduction of innovations;

- stimulation of the diversity of forms of ownership and organizational and legal forms of enterprises in the oil and gas complex;

- streamlining the income and expenses of the National Wealth Fund based on the guidelines of the strategy for diversifying the sectoral structure of the economy, taking into account the tasks of increasing the welfare of society as a subject of appropriation of differential mining rent I, etc.

Conclusion

Solving the problems associated with PP puts development of the Russian economy in front of an alternative: either go further along the “resource innovative way” of development, or, having made a sharp turn, follow the “innovative way” of development. The authors who deny the existence of the “resource curse” suggest the first, their opponents suggest the second, provided that the oil and gas complex is curtailed, in their opinion, in order to prepare for the coming “post-oil future”, Russia should immediately change priorities – consume less oil and not increase its production. One cannot agree with this, since in the foreseeable future it is the oil and gas complex that will remain “the foundation of the economy and the main driver of its development” [32]. The development of alternative energy sources in the required volumes is a long process, “the possibility of obtaining relatively cheap and decentralized RES energy (renewable energy sources) is associated with instability of energy generation process and the lack of methods for storing excess energy for subsequent use” [32]. Moreover, “energy security issues dictate the need to ensure a variety of energy resources in the economy, both at the expense of renewable energy sources and traditional ones (oil, gas, coal)” [33]. Of course, the above does not mean denying the need to develop RES: “Russia demonstrates sufficient potential to transform the energy balance towards a wider use of RES” [34]. As the calculations of the authors of this article show, small and even micro-business enterprises can be used in some areas of RES, which is very important for improving the efficiency of the oil and gas complex sectoral structure.

In addition to the two named, there is a third development option – “resource-innovative”, which allows to combine the natural potential of Russia with the latest technologies. It is the resource-innovative development option that should be taken as the basis of the strategic program for diversification of the Russian economy. In this strategy, you can use both your own experience and experience of other countries with significant oil and gas resources, in particular, Norway, where related sectors were created and reached the export level – the construction of oil platforms, the creation of software used in exploration and exploitation deposits in other countries. Other measures should also be planned to increase the VA in the oil and gas complex itself, since “against the background of significant sales of oil and gas raw materials, Russia lags behind the world leaders in terms of production and consumption of petrochemical and chemical products, whose share in the country's gross domestic product is only 1.1 %”[31].

The following can be said about the reasons for insufficient effectiveness of natural potential implementation. An important shortcoming of organizational and managerial structure of the economy as a whole and oil and gas complex in particular is the insufficient diversity of both forms of ownership and organizational and legal forms of entrepreneurial activity. Thus, first of all, the Russian economy suffers not so much from PP or the “resource curse” as from the “curse” of inefficient management not only of the oil and gas complex, but also of the economy as a whole. As shown above, oil and gas complex is a powerful center of the income multiplier effect, or, in other words, a locomotive that pulls metallurgy, mechanical engineering, transport, construction, and stimulates development of fundamental and applied science. The “paradox of plenty” manifests itself primarily in the chaotic actions of officials who determine false guidelines for economic policy that hinder the development of both oil and gas complex and the Russian economy as a whole. It is not natural resources in themselves that are the cause of the “curse”, but inadequate economic policy generated by an insufficiently effective organizational and managerial structure of the national economy [35].

The “paradox of plenty”, like many other socio-economic problems, arises primarily as a result of the insufficient efficiency of the organizational and managerial structure of the national economy. In the context of the emergence of a new political and economic reality, it is important to understand that the management model of the economy is not stationary, it should be adjusted in a timely manner depending on changes in endogenous and exogenous conditions of functioning in the range from normal to extreme and vice versa. Horizontal (market) links of national economy management change to vertical ones, which, after overcoming the extreme situation, again give way to horizontal ones. But even under normal operating conditions, management of strategic industries, in particular the oil and gas complex, requires predominantly state administration, and even more so in extreme conditions.

References

- OPEC launches its 2020 Annual Statistical Bulletin/N 12/2020, Vienna, Austria 13 Jul 2020. OPEC: OPEC launches its 2020 Annual Statistical Bulletin. URL: https://www.opec.org/opec_web/en/press_room/6045.htm (accessed 25.09.2022).

- Auty R.M. The Political Economy of Resource – Driven Growth. European Economic Review. 2001. Vol. 45. Iss. 4-6, p. 839-846. DOI: 10.1016/S0014-2921(01)00126-X

- Sachs J.D., Warner A.M. Natural Resource Plenty and Economic Growth. National Bureau of Economic Research. 1995. N 5398. DOI: 10.3386/w5398

- Congleton R.D., Hillman A.L., Konrad K.A. Application Pert 2- Economic Development and Growth. 40 Years of Research on Rent Seeking. Heidelberg: Springer, 2008. Vol. 1-2, p. 27-28. DOI: 10.1007/978-3-540-79182-9

- Gaddy C.G., Ickes B.W. Resource Rents and the Russian Economy. Eurasian Geography and economics. 2005. Vol. 46. Iss. 8, p. 559-583. DOI: 10.2747/1538-7216.46.8.559

- Murfhy K.M., Shleifer A., Vishny R. Why is Rent-Seeking so Costly to Growth? American Economic Review. 1993. Vol. 83. N 2, p. 409-414. DOI: 10.1007/978-3-540-79247-5_11

- Hillman A.L., Riley J.G. Politically Contestable Rents and Transfers. Economics and Politics. 2008. Vol. 1. Iss. 1, p. 17-39. DOI: 10.1111/J.1468-0343.1989.TB00003.X

- Appelbaum E., Katz E. Seeking Rents by Setting Rents: The Political Economy of Rent Seeking. Economic Journal. 1987. Vol. 97. Iss. 387, p. 685-699. DOI: 10.2307/2232930

- Plotkin B.K., Khaikin M.M. Formation and development of theoretical principles for mineral resources logistics. Journal of Mining Institute. 2017. Vol. 223, p. 139-146. DOI: 10.18454/pmi.2017.1.139

- Nikolaichuk O.A. Land rent in the system of agrarian relations. St. Petersburg: Izd-vo SPbGU, 2003, p. 158 (in Russian).

- Khaikin M.M., Lapinskas A.A. Competitiveness of resource-oriented economic systems. St. Petersburg: Asterion, 2021, p. 156 (in Russian). DOI: 10.53115/978001880929

- Ulanov V.L., Ulanova E.Y. Impact of External Factors on National Energy Security. Journal of Mining Institute. 2019. Vol. 238, p. 474-480. DOI: 10.31897/PMI.2019.4.474

- Karl T.L. The Perils of the Petro-State: Reflections on the Paradox of Plenty. Journal of International affairs. 1999. Vol. 53. N 1, p. 31-48.

- Acemoglu D., Johnson S., Robinson J. Institutions as the Fundamental Cause of Long-RunGrowth. National Bureau Eco-nomic Research. 2004. N 1048. DOI: 10.3386/w10481

- Shcherbak A.N. The “oil curse” of political development. Neft. Gaz. Modernizatsiya obshchestva. St. Petersburg: Ekonomicheskaya shkola GU VShE, 2008, p. 31-52 (in Russian).

- Kapustkin V.I., Morganiya O.L. Milestones in the Development of the International Oil Industry and the World Market. Neft. Gaz. Modernizatsiya obshchestva. St. Petersburg: Ekonomicheskaya shkola GU VShE, 2008, p. 54-100 (in Russian).

- Goorha P. The Political Economy of the Resource Cursein Russia. Democratizatsiya. 2006. Vol. 14. N 4, p. 602. DOI: 10.3200/DEMO.14.4.601-611

- Lange P., Garrett G. The Politics of Growth: Strategic Interaction and Economic Performance in Advanced Industrial Democracies: 1974-1980. Journal of Politics. 1985. Vol. 47. N 3, p. 792-827. DOI: 10.2307/2131212

- Saimon G.A., Smitburg D.U., Tompson V.A. Large organizations: the trend towards centralization. Management in organi-zations. Мoscow: Ekonomika, 1995, p. 211-222 (in Russian).

- Al-Saadi T.A., Cherepovitsyn A.E., Semenova T.Y. Iraq Oil Industry Infrastructure Development in the Conditions of the Global Economy Turbulence. Energies. 2022. Vol. 15. Iss. 17. N 6239. DOI: 10.3390/en15176239

- Glushchenko V.V. Formation of the Concept of the State’s Transition to Activity in the Conditions of a New Technological Orde. International Journal of Scientific Advances. 2021. Vol. 2. Iss. 4, p. 641-651. DOI: 10.51542/ijscia.v2i4.31

- Samigulina G.A., Samigulina Z.I. Development of theoretical foundations for the creation of intelligent technology based on a unified artificial immune system for complex objects control of the oil and gas industry. Journal of Physics: Conference Series. 2021. Vol. 2094. N 032038. DOI: 10.1088/1742-6596/2094/3/032038

- Asmara Y.P., Kurniawan T. Corrosion prediction for corrosion rate of carbon steel in oil and gas environment: A review. Indonesian Journal Science Technology. 2018. Vol. 3. N 1, p. 64-74. DOI: 10.17509/ijost.v3i1.10808

- Vasilenko N., Khaykin M., Kirsanova N. et al. Issues for development of economic system for subsurface resource man-agement in russia through lens of economic process servitization. International Journal of Energy Economics and Policy. 2020. Vol. 10. Iss. 1, p. 44-48. DOI: 10.32479/ijeep.8303

- Litvinenko V.S., Tsvetkov P.S., Molodtsov K.V. The social and market mechanism of sustainable development of public companies in the mineral resource sector. Eurasian Mining. 2020. N 1, p. 36-41. DOI: 10.17580/em.2020.01.07

- Nedosekin A.O., Rejshahrit E.I., Kozlovskij A.N. Strategic approach to assessing economic sustainability objects of mineral resources sector of Russia. Journal of Mining Institute. 2019. Vol. 237, p. 354-360. DOI: 10.31897/PMI.2019.3.354

- Rejshahrit E.I. Features of energy efficiency management in refineries. Journal of Mining Institute. 2016. Vol. 219, p. 490-497. DOI: 10.18454/PMI.2016.3.490

- Pashkevich N.V., Tarabarinova T.A., Golovina E.I. Problems of reflecting information on subsoil assets in International Financial Reporting Standards. Academy of Strategic Management Journal. 2018. Vol. 17. N 3, p. 1-9.

- Dmitrieva D.M., Romasheva N.V. Sustainable development of oil and gas potential of the Arctic and its shelf zone: The role of innovations. Journal Marine Science and Engineering. 2020. Vol. 8. Iss. 12. N 1003. DOI: 10.3390/jmse8121003

- Information and Analytical Agency Central Dispatch Office of the Fuel and Energy Complex “Petrochemical Projects”.20 March 2019. URL: http://www.cdu.ru/tek_russia/Articles/2/558/ (accessed 02.08.2021).

- Marinina O., Tsvetkova A., Vasilev Y.et al. Evaluating the Downstream Development Strategy of Oil Companies: The Case of Rosneft. Resources. 2022. Vol. 11. Iss. 1. N 4. DOI: 10.3390/resources11010004

- Litvinenko V.S., Tsvetkov P.S., Dvoynikov M.V., Buslaev G.V. Barriers to implementation of hydrogen initiatives in the context of global energy sustainable development. Journal of Mining Institute. 2020. Vol. 244, p. 428-438. DOI: 10.31897/PMI.2020.4.5

- Ulanov V.L., Skorobogatko O.N. Impact of EU carbon border adjustment mechanism on the economic efficiency of Russian oil refining. Journal of Mining Institute. 2022. Vol. 257, p. 865-876. DOI: 10.31897/PMI.2022.83

- Smirnova O., Kharitonova E., Babkin I. et al. Small-Scale Biofuel Production: Assessment of Efficiency. International Journal of Technology. 2021. Vol. 12. N 7, p. 1417-1426. DOI: 10.14716/ijtech.v12i7.5401

- Lapinskas A.A. Types and features of the functioning of economic systems. St. Petersburg: Institut khimii SPbGU, 2001, p. 380 (in Russian).