Impact of EU carbon border adjustment mechanism on the economic efficiency of Russian oil refining

- 1 — Ph.D., Dr.Sci. Professor National Research University “Higher School of Economics” ▪ Orcid

- 2 — Senior Researcher National Research University “Higher School of Economics” ▪ Orcid

Abstract

The carbon border adjustment mechanism (CBAM) leads not only to the expected environmental changes, but also to the transformation of market environment. The study estimates the losses of the oil refining sector from the introduction of CBAM for the export of oil products from Russia to the countries of the European Union. An approach to assess the impact of CBAM on the cost of oil products has been formed and the mechanisms of its impact on the economy of Russian oil refineries have been identified. The study was carried out on the basis of actual data on the volume of greenhouse gas emissions in accordance with the current rules of the European emissions trading system. Decomposition of assessments of the CBAM impact was carried out into direct and indirect effects, as well as the effect of adaptation. It is shown that with the introduction of the CBAM mechanism, the prices of oil products in the domestic market will be determined not only by the logistical factor, but also by the requirements for environmental friendliness of oil refining. The introduction of CBAM will have a significant impact on the economics of oil refining, including refineries that do not export to the EU. The total impact of CBAM on the economy of Russian oil refineries will be about 250 mln dollars.

Introduction

Political tension and the uncertainty that has arisen due to anti-Russian sanctions do not cancel the impact of the global trend of decarbonization of the developed economies of the world on the economy of traditional energy projects. The implementation of the already announced instruments of carbon border adjustment mechanism (CBAM) by the countries of the European Union (EU), aimed at reducing the carbon intensity of imported products, can have a significant impact on the economic efficiency of the Russian energy sector. At the same time, energy security issues dictate the need to ensure a variety of energy resources in the economy, both through renewable energy sources and traditional ones (oil, gas, coal) [1]. Therefore, although in the coming decades the share of traditional energy in the global energy balance will decrease, it will remain significant [2, 3].

The carbon border adjustment mechanism proposed by the European Commission, should, according to the developers, encourage EU trading partners to reduce the carbon intensity or carbon footprint of products exported to the EU [4]. The CBAM involves the obligatory purchase by importers of certificates for greenhouse gas emissions in accordance with the carbon intensity of products (in this case, exporters can record the cost of carbon paid within the national emissions accounting system [5] to avoid double taxation). Due to the high share in exports for Russia, an important topic is the application of CBAM to refined products. Due to the peculiarities of the carbon intensity calculation for multi-product industries [6], the main oil products have not yet been included in the system.

The market of the European Union countries has long been the main direction for the sale of Russian oil products [7]. Prior to the coronavirus pandemic in 2019, imports of Russian oil products by the EU countries amounted to almost 55 million tons, which is more than a third of all Russian exports of oil products (142.8 million tons).

The CBAM mechanism will significantly affect the efficiency of Russian oil refineries (ORs): due to a decrease in competitiveness, the export of petroleum products will decrease, the volume of oil refining will change, which will also affect the domestic market. The adoption of similar instruments in other regions of the world can also significantly affect the economy of oil refining in Russia [8].

The purpose of this work is to analyze the consequences for the Russian oil products market and the economy of individual enterprises of the introduction of the CBAM, for which it was necessary to solve the following tasks: to form an approach to assessing the impact of the CBAM on the products of oil refining facilities; to identify the mechanisms of CBAM impact on the economy of Russian oil refineries; to assess the direct and indirect impact of CBAM on the economy of the refinery; identify the implications for the markets for oil products in Russia and importing countries.

Methods

In the field of scientific discussion, certain aspects of CBAM have already been discussed, from the justification for the use of CBAM as a regulatory tool to the consequences of its use. From the position of the EU, European researchers consistently substantiated the need for CBAM for the effective functioning of the environmental initiative of the European Emissions Trading System (ETS EU, hereinafter referred to as EU ETS) [9], formed approaches and presented assessments of the impact of CBAM on the EU economy [10], and also developed models to assess the impact of CBAM on international trade and bilateral trade relations [11]. Other works, on the contrary, are aimed at identifying and assessing risks for export-oriented industries in countries with high carbon intensity of products [12]. In the works of domestic researchers, the emphasis is on the potential losses of the Russian economy as a whole [13] from the implementation of CBAM and individual sectors of production oriented to the European market [14].

The consequences of the spread of CBAM on products of the oil and gas industry (including petroleum products) are analyzed in studies conducted independently by consulting companies KPMG, Boston Consulting Group (BCG), VYGON Consulting [15] and an independent research center “Institute for Natural Monopoly Problems” (INMP) [16]. The assessment of the CBAM impacts considers various ways in which it can be applied to refined products: excise/VAT on products, tax/customs fee based on carbon content, or extending EU Emissions Trading Scheme (ETS) obligations to imported products. The studies propose approaches to potential assessments of the consequences for the sectors of the Russian economy from the introduction of the CBAM for exported products to the EU. The calculation of the estimates presented in them (due to the lack of detailed data in the public domain) was carried out on the basis of aggregated values – at the level of the industry as a whole. The estimates obtained in this way make it possible to understand the scale of the threat, but without further detailing to the level of individual enterprises or their categories, the average estimates are insufficient both for making decisions at the corporate level and at the level of industry regulation. For multi-product industries, it is important to take into account the carbon intensity of the products of a particular enterprise, which can vary significantly within the industry [17].

Given the current need for more detailed assessments of the impact of a potential expansion of CBAM on refined products, this paper analyzes the impact of CBAM on the Russian refining industry, both at the industry level and at individual refineries. The article examines the mechanisms of CBAM impact on the economy of refineries, which allows, in addition to the direct impact, to single out the indirect one due to the pricing mechanism in the domestic market and the ability of refineries to change the volume of production and the structure of product sales, minimizing negative effects.

The paper uses an economic-mathematical method to model the activities of Russian refineries in the case of CBAM spread to refined products. For the solution, the optimization technical and economic model of Russian refineries developed by the authors, which is based on the production function of enterprises, is used [18]. The model solves the problem of optimizing economic profit (EBITDA) by determining the effective volume of production, the structure of which is determined by a set of oil refining units, based on price parameters and regulatory conditions [19]:

where VPi – volume of production of the i-th oil product, t; Pi – price of the i-th oil product, rub./t; VP – volume of refined crude oil, t; Po – crude oil price, rub./t; С – operating costs for processing, rub.; K – reverse excise tax rate, K = 0,1; Kreg – regional coefficient; Аvp – reverse excise tax, calculated in accordance with the Tax Code of the Russian Federation, rub./t.

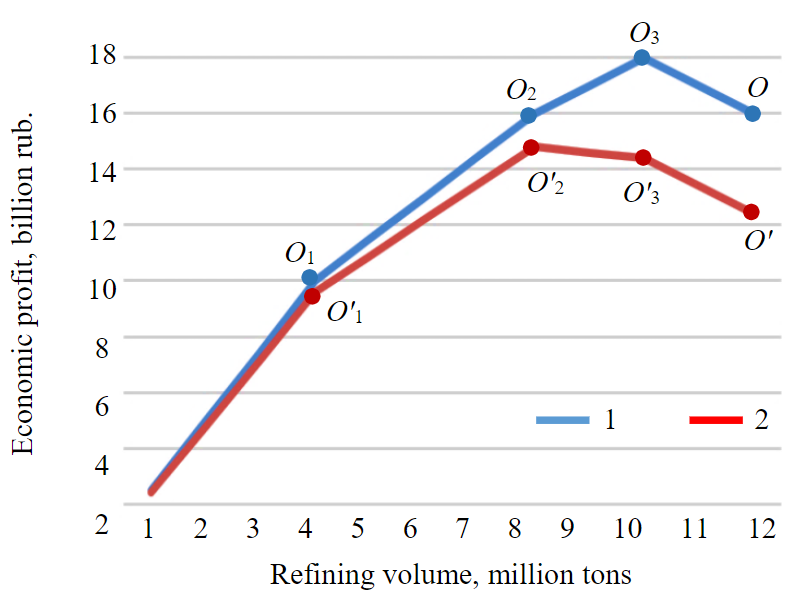

The EBITDA (economic profit) curve of a refinery of complex configuration is depicted as a convex upward line with several breaks, which account for the full load of one or another installation of secondary manufacturing processes [20]. Based on the production function embedded in the model, the optimal volume of О3 processing is determined (Fig.1). As a result of the CBAM introduction and the change in the price ratio, the curve (O) will shift down (O'), while there may be cases when the optimum point can move along the curve (from the point О'3 to О'2).

In the course of the work, 55 of the largest refineries in Russia were analyzed, which account for more than 99 % of the total volume of oil refining. 11 facilities do not export oil products to Europe, and among them only one refinery has a processing volume of more than 1 million tons per year due to geographical remoteness and their focus on the Asian export market. The remaining 44 refineries were divided into two groups – oriented to the domestic market (the share of supplies of petroleum products to the European market is less than 40 %) and export-oriented to Europe (the share of supplies to Europe is more than 40 % of the volume of crude oil refining).

Price indicators of product exports are determined on a netback basis relative to the prices of the main export markets, including the EU [21, 22]. The potential introduction of CBAM in relation to refined products will lead to a modification of the calculation of the Russian refineries price-netbacks due to the emergence of a new term CBAMaj, which in turn will lead to a change in the market equilibrium and economic efficiency of oil refineries [23]. When modeling the export direction, the assumption that the entire volume of the i-th oil product intended for export is supplied to the j-thexport market, which provides the largest netback, was used.

The netback price of the i-th oil product, calculated from the quotation on the corresponding export market j:

where Prij – quotation of the i-th oil product on the basis of j, dol./t; Т i – export duty on i-th oil product, dol./t; Frij – freight rate (including the cost of cargo insurance), dol./t; Tsij – cost of cargo transshipment in the port, dol./t; CBAMaj – the impact of CBAM on the a-th refinery in the corresponding export market j, dol./t; R – exchange rate, rub./dollar.; Laj – logistics costs for transportation from the a-th refinery to the port, rub./t.

Fig.1. Refinery EBITDA curve depending on crude oil refining volume 1 – before the CBAM introduction; 2 – after the CBAM introduction

For this study, the model was supplemented with a block for calculating domestic prices and determining the optimal structure for the sale of petroleum products. The calculation is based on the algorithm that ensures simultaneous achievement of minimization of regional internal prices and maximization of the domestic refinery market premium:

- when using data on the domestic demand of Russian regions for petroleum products, netback prices and transportation costs, a matrix of price-regions is formed, upon reaching which it is equally profitable for refineries to send products for export or to the corresponding regions;

- for each region, refinery prices are ranked, after which the price of the region is taken equal to the corresponding lowest price of the refinery; then the prices of the regions are successively increased to the level necessary to achieve full market saturation;

- to take into account in the model of market power of enterprises in conditions of low competition, prices are determined as the netback of the next refinery in the ranked list of the region minus one;

- refineries allocate supply volumes based on maximizing domestic market premium.

Based on these parameters, the market equilibrium is iteratively determined, at which consumers costs are minimized and producers' profits are maximized [24]. Using data on the domestic demand of Russian regions for petroleum products, netback prices and transportation costs of refineries, the model allows to obtain a matrix of supplies of refined products to Russian regions, the countries of Central Asia, as well as exports to the European and Asian markets. As a result of modeling market interaction, prices of the domestic market are determined for each region of the Russian Federation.

Using a technical and economic model of the Russian oil refining industry, the paper assesses the impact of the potential introduction of CBAM on the economy of Russian refineries (in relation to pre-pandemic conditions). The use of such an information base is associated not only with the need to ensure the comparability of the data used, but also with the observed trend of reducing the volume of economic and corporate data published in the public domain, which may raise doubts about the objectivity of the assessment of economic processes.

In addition to detailing the estimates for oil refineries, the cumulative CBAM impact is decomposed into components (by the nature of the corresponding effects appearance): direct and indirect effects, the effect of industry adaptation. In order to obtain correct estimates and draw relevant conclusions regarding the scale of the CBAM impact in future, the values corresponding to the pre-pandemic level (data for 2019), which do not take into account the restrictions introduced later (anti-Russian sanctions) and reflect the potential for the production and consumption of petroleum products, are used.

The direct effect is the immediate cost of acquiring greenhouse gas (GHG) emission certificates for oil product exporters in accordance with the carbon intensity of their products, taking into account the cost of carbon paid under the national emissions accounting system. It is calculated as the product of the annual average European Emissions Trading Market (EU ETS) price and the taxable carbon footprint minus the cost of carbon paid under the national emissions accounting system. The resulting value is multiplied by the share of the actual export volume to the total refinery refining volume:

where PETS – average annual price of the European market for trading in quotas, dol./t; Emi – actual volume of direct greenhouse gas emissions of the i-th refinery, t; FAi – allowable emissions of the i-th refinery, determined on the basis of EU benchmarks, t; – carbon cost paid by the i-th refinery within the framework of the national emission accounting system, dol.; Exi – export of the i-th refinery of oil products to the EU countries, thousand tons; Prodi – volume of oil refining of the i-th refinery, thousand tons.

Russian carbon regulation lags behind the legislation of foreign countries (in particular the EU). The first steps towards introducing its own carbon regulation in Russia were taken in June 2021 – the law “On Limiting Greenhouse Gas Emissions” was adopted. This should be followed by a number of regulatory and policy documents. The set of tools being implemented and the

dynamics of the formation of the national market for trading greenhouse gas emission allowances do not let national producers claim to ease the use of CBAM, therefore, in the calculations, the value PiNES was assumed to be 0.

To estimate the actual volume of petroleum products exports to the European direction of each of the refineries, data from the national railway statistics on the final destinations of Russia were used. Exports to Europe included deliveries to the ports of the Black and Azov, Baltic and Barents Seas, as well as direct rail shipments to the EU countries. When calculating the assessment of the CBAM introduction impact of on the economy of Russian enterprises, the entire volume of supplies to the European direction was used, since there are no more accurate estimates of the export of petroleum products to the EU by specific oil refineries in the public domain [25]. In addition, theoretically, a side effect of the CBAM introduction could be the appearance of a discount to EU prices (comparable to the size of the CBAM influence) when selling oil products in the markets of other European and border countries where there is no CBAM, in order to avoid the possibility of obtaining arbitrage profits. Taking into account the territorial proximity of the analyzed markets, this premise will not have a strong impact on the estimates obtained.

The indirect effect of CBAM influence is carried out through the pricing mechanism on the wholesale market of oil products in Russia [26]. Refineries, realizing their logistical advantage in transportation costs over competitors, set prices for certain regions of the Russian Federation above the level of export netback. CBAM influences both the refinery netback price (2) and the premium through the competitive pricing mechanism. As a result of the CBAM introduction, prices for petroleum products on the domestic market will be determined not only by the logistical factor of the plants location, but also by the environmental friendliness of the production of petroleum products at refineries.

The actual volume of oil refining and the product distribution structure of Russian refineries are economically optimal in the current environment, when the environmental factor does not affect the economy of enterprises. As a result of the CBAM introduction and subsequent changes in price indicators, domestic refineries can adapt their production program and product sales directions to optimize profits in the new regulatory environment. Changes in the economic performance of Russian refineries as a result of these actions constitute the effect of industry adaptation.

The main focus of the study is made on the proposal and the possibility of its adaptation to new conditions. As a result of the CBAM introduction, the prices for oil products both in the EU countries and in the exporting countries of products will undergo changes, reaching a new equilibrium [27]. Regardless of the degree of change, the main result for exporters of petroleum products will be a decrease in income from the sale of products by the amount of CBAM. Due to the low price elasticity of demand for energy [28], the article does not consider the factors of a decrease in demand for petroleum products in the EU countries and an increase in demand for petroleum products in Russia.

Calculation of the CBAM for petroleum products exported to the EU

When assessing the CBAM impact, the method of determining the carbon footprint of imported products of multi-product industries remains a debatable issue. The simplest option is to use benchmarks (a single greenhouse gas emission factor per unit of production for all suppliers) [16], since it greatly simplifies the calculation of the carbon intensity of production and does not require systematic work to collect and verify information from a significant number of foreign product suppliers in the EU. In the case of the introduction of non-alternative benchmarks, there is a risk of explicit discrimination of some companies in relation to European manufacturers that pay for greenhouse gas emissions not according to benchmarks, but for the real volume of emissions [15]. In addition, during the discussion of the draft mechanism of the CBAM, there was a movement of expert opinion towards a more accurate methodology for assessing the carbon intensity of products and multi-product industries, which would accelerate the transition from benchmark to actual carbon emissions measurements (BCG presented the Russian government and companies with proactive strategies to respond to the implementation in the EU transboundary carbon levy. URL: https://www.atomic-energy.ru/news/2021/08/06/116216).

Based on the logic of the regulator, the latest changes made to the conditions for the functioning of the TRP and the approaches used [15, 16], the most relevant way to assess the carbon footprint of imported products is to extend the current EU ETS rules to oil refineries that supply products to the EU. This assumption is most likely, as it corresponds to the general logic of the regulator to equalize the conditions for the activities of domestic enterprises within the EU and foreign exporters (For industries with a high risk of carbon leakage, such as the oil refining industry, the regulator allocates free greenhouse gas emission allowances, which are systematically reduced.The article accepts the premise that with the start of the CBAM implementation, the allocation of free quotas to EU enterprises will stop). However, according to published documents, the key difference between the EU ETS and CBAM is that the former regulates the carbon intensity of processes and installations (including refineries), and the latter regulates the carbon intensity of products [15]. The proposal to extend the CBAM to such a multi-product industry as petrochemistry has not been accompanied by a methodological explanation of its calculation at present. In this regard, the work uses the approach of proportional distribution among all manufactured products of the cost of purchasing greenhouse gas emission quotas to cover the taxable carbon footprint.

Oil refineries have been subject to regulation since the first stage of the EU ETS implementation, and petrochemical enterprises, which are often part of the deep oil refining complex, have been included in the list of industries subject to carbon regulation in the third stage since 2013 [29]. Refineries have a complex production process, so there are various difficulties when comparing greenhouse gas emission rates. Refineries produce different products requiring different processes, and the carbon intensity of these products depends on the availability of other refineries. Therefore, for refineries, the carbon weighted ton method (CWT) is used to estimate CO2 emissions [29].

The CWT indicator defines refinery performance not simply as the sum of inputs or outputs, but as a function of process unit activity levels. To take into account the efficiency of the enterprise in terms of greenhouse gas emissions, the only product of the refinery is CWT. Its production is calculated on the basis of a certain common technological unit, each element of which was weighted with an emission factor in relation to the distillation of crude oil [15].

Emissions coverage for the calculation of CBAM for exporters of oil products is estimated in accordance with the current EU ETS standards, which take into account only direct emissions – carbon dioxide emissions resulting from the combustion of fuel by an enterprise, without taking into account the carbon footprint resulting from the production of electricity purchased from third-party companies [29]. Thus, the carbon intensity of petroleum products depends on the structure of the consumed energy resources of the refinery and its configuration. Inclusion in the calculation of greenhouse gas emissions of Scope 2 coverage in accordance with the latest proposals for the development of CBAM [4] and obtaining estimates of its impact for individual enterprises is currently impossible due to lack of data.

To estimate the actual volume of greenhouse gas emissions, data on the volume and structure of energy resources consumed for the production of petroleum products were used. The main data sources for Russian enterprises are the forms of the Federal State Statistics Service of the Russian Federation, which are presented in a regional context. In the case when more than one large oil refining facility is located in one region, the volume of fuel consumed is distributed among the refineries according to the methodology for calculating the EU CWT, based on the composition of the units and the volume of oil refining.

The taxable base for greenhouse gas emissions (taxable emissions) is the excess of the actual volume of direct greenhouse gas emissions from the activities of oil refineries over the allowable amount of emissions (free allowance) [29]. The estimate of the actual volume of greenhouse gas emissions is determined as the sum of the products of the volume of fuel consumed and its carbon intensity (varies from 56.1 CO2/GJ for natural gas to 97.5 CO2/GJ for petroleum coke).

The allowable level of greenhouse gas emissions is calculated in accordance with the EU ETS methodology [30] and takes into account the value of the fuel efficiency benchmark, as well as an indicator characterizing the configuration and load level of refinery units. As a benchmark used for comparison in the oil refining industry, the average value (10 %) of the most efficient enterprises of the European Union is used, in 2008 it was 0.0295 t CO2/ CWT. Taking into account the EU plan to reduce emissions, the size of the benchmark [31] used for the oil refining industry was reduced by 1.74 % annually until 2020, so the benchmark value of 0.0239 was used in the calculations, which corresponds to the level of 2019.

The resulting amount of the taxable base is multiplied by the cost of a ton of CO2, determined on the ETS stock [32]. European CO2 market prices are dynamically changing, and, for example, in 2022, on some January days, it exceeded 97 dol./t CO2. To achieve data comparability, further calculations were carried out taking into account the average annual payment rate of the pre-pandemic period, equal to 27.81 dol./t CO2. A possible increase in rates in the long term entails a proportional increase in the impact of CBAM for exporters of petroleum products.

The discussion of the results

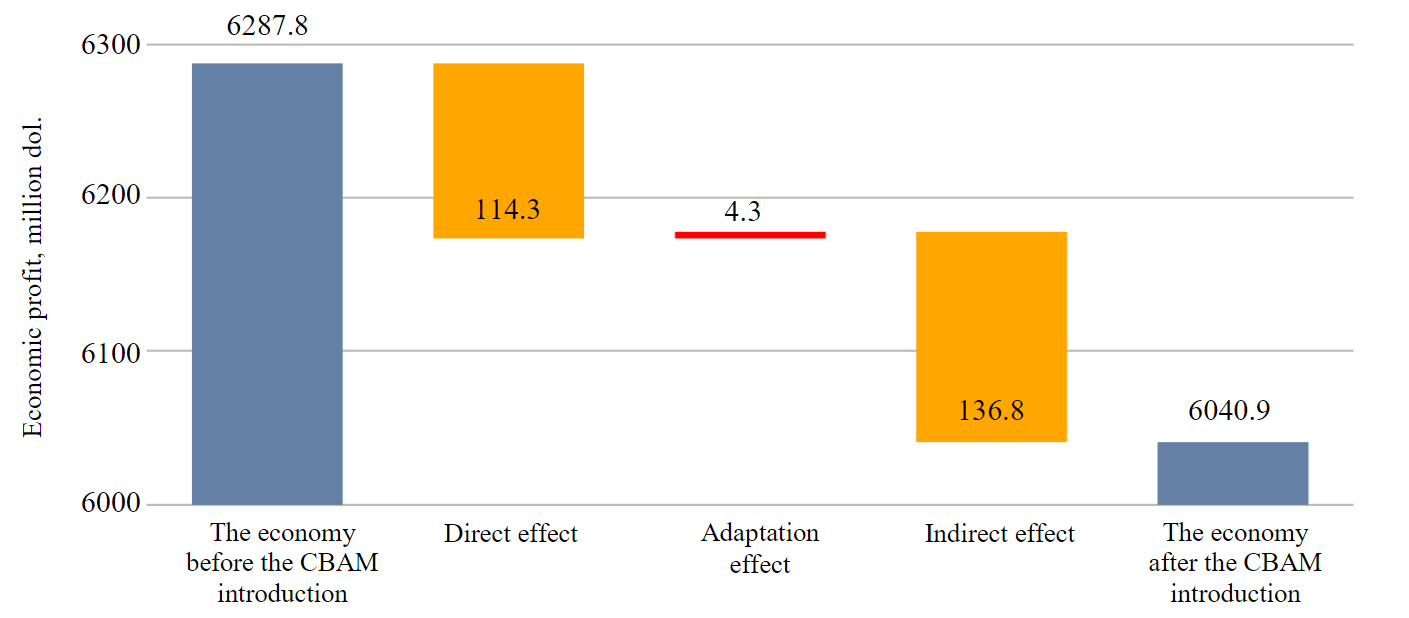

As a result of applying the developed model, calibrated on the actual data of 2019, the total economic profit of the objects under study amounted to about 6,287.8 billion dol. With the actual energy consumption of various energy resources by Russian refineries and with the actual volumes of supplies of petroleum products from Russian refineries in the European direction, the total cost of purchasing emission allowances under the EU ETS rules would amount to 114.3 million dol. Given the volumes of production of petroleum products and the structure of sales due to changes in domestic prices, indirect losses from the introduction of CBAM would exceed 136.8 million dol. Having put into the model the scenario conditions for the CBAM implementation, without fixing the actual volume of production and the structure of sales of products, the result of the economic profit of the refinery was obtained, equal to 6,040.9 million dol. Thus, due to optimization, the industry was able to reduce the effect of the introduction of CBAM by 4.3 million dol., which amounted to the effect of adaptation (Fig.2).

Due to the fact that in most of the previously cited studies there is clearly no assessment of the CBAM impact only on oil refining facilities, it is incorrect to assess the comparability of the results. At the same time, the results obtained by the authors of the article lie between the assessment of VYGON Consulting for the scenario of applying import duties on direct CO2 emissions and the scenario of expanding the EU ETS on direct and indirect emissions (Table 1). Given the comparability of the results, the approach outlined in the article has the advantage of being able to refine estimates to the level of individual enterprises.

Table 1

Comparative analysis of estimates of the CBAM impact from various studies

|

Forecast author |

Sector coverage |

Calculation methodology |

СО2 cost |

Coverage |

Annual losses, billion |

|

KPMG |

Production of petroleum products |

Extension of the EU ETS |

– |

Direct emissions |

0.9-1.5 euro |

|

BCG |

Oil and gas sector |

Extension of the EU ETS |

30 dol. |

Direct emissions |

1.4-2.5 dol. |

|

VYGON |

Oil refining |

Import duty on direct СО2 emissions |

40 euro |

Direct emissions |

0.14 euro |

|

VYGON |

Oil refining |

Extension of the EU ETS |

40 euro |

Direct and indirect emissions |

0.78 euro |

|

IPEM |

Upstream (Production of petroleum products, metal products, chemical products) |

Extension of the EU ETS |

27.81 dol. |

Direct emissions |

0.7 dol. |

|

IPEM |

Upstream (Production of petroleum products, metal products, chemical products) |

Extension of the EU ETS |

27.81 dol. |

Direct and indirect emissions |

1.12 dol. |

|

Authors' calculations |

Oil refining |

Extension of the EU ETS |

27.81 dol. |

Direct emissions |

0.25 dol. |

Fig.2. Analysis of the potential introduction of CBAM effects on the economy of oil refining in Russia according to the authors’ calculations and data from the Federal State Statistics Service of the Russian Federation (form 4-FER – consumption of fuel and energy resources by type of activity in the context of regions of the Russian Federation for 2019) and RAIL-TARIF (tariff for the carriage of goods across selected destinations for 2019)

The analysis of the cumulative impact of the introduction of CBAM and its components was carried out for two groups of refineries that differ in the directions of product sales (according to the data of the Federal State Statistics Service of the Russian Federation and RAIL-TARIFF) (Table 2). The distribution of the direct CBAM impact between the two groups of plants, while maintaining the structure of exports at the pre-pandemic level, is almost proportional to the volume of exports of products to Europe and is fair. At the same time, netback prices for the supply of petroleum products to the EU for many Russian refineries located in the European part of the country are a benchmark in determining sales prices in the domestic market. Due to the inability to sell products at high prices in the traditional export market, an excess supply in the domestic market will pull prices down until reaching the initial parity. As a result, additional competition in the domestic market due to the CBAM introduction will have a negative impact on the economy of refineries that do not export to Europe at all. The indirect effect for refineries focused on the domestic market will be 78.1 million dol., which is 19.4 million dol. more than the impact of a similar effect on export-oriented refineries.

Table 2

The impact of the potential CBAM introduction on the economy of Russian oil refineries

|

Indicator |

Direct effect of the |

Cumulative effect of the |

|

Refineries focused on the domestic market |

||

|

Oil refining, million t |

122.7 |

119.7 |

|

Export of petroleum products to Europe, million t |

23.6 |

26.6 |

|

Share of exports to Europe from the volume of processing, % |

19.2 |

22.2 |

|

Impact of CBAM, mln dol. |

25.5 |

29.4 |

|

Influence of CBAM on a ton of export of oil products, dol./t |

1.082 |

1.106 |

|

EBITDA of refineries, mln dol. |

2959.6 |

2877.6 |

|

Refineries focused on export to Europe |

||

|

Oil refining, million t |

126.0 |

125.7 |

|

Export of petroleum products to Europe, million t |

83.3 |

78.3 |

|

Share of exports to Europe from the volume of processing, % |

66.1 |

62.3 |

|

Impact of CBAM, mln dol. |

88.8 |

80.7 |

|

Influence of TUR on a ton of export of oil products, dol./t |

1.066 |

1.031 |

|

EBITDA of refineries, mln dol. |

3213.8 |

3163.2 |

Another consequence is the adaptation of operating refineries to the CBAM introduction by changing the volume of output and the direction of product sales. Modeling results show that in response to the introduction of a mechanism for cross-border carbon regulation, the refining volume of Russian refineries will decrease by 3.3 million tons, and exports to the EU by 2 million tons. Exports of products from Russia to other countries that do not have a CBAM will also decrease by 1.3 million tons. With the introduction of CBAM, there will be an (expected) redistribution of product suppliers: large volumes will be provided by factories with the lowest carbon footprint.

The impact of CBAM on a ton of exported oil product of refineries oriented to the domestic market is higher than the impact of CBAM on a ton of exported oil product of export-oriented refineries. This situation arises as a result of the fact that the key refineries supplying fuel to the domestic market were built back in Soviet times and are inferior in energy efficiency to modern models. Export-oriented refineries built or reconstructed in the 21st century use more efficient technologies. Export-oriented refineries mostly have a simple structure and fewer secondary processes.

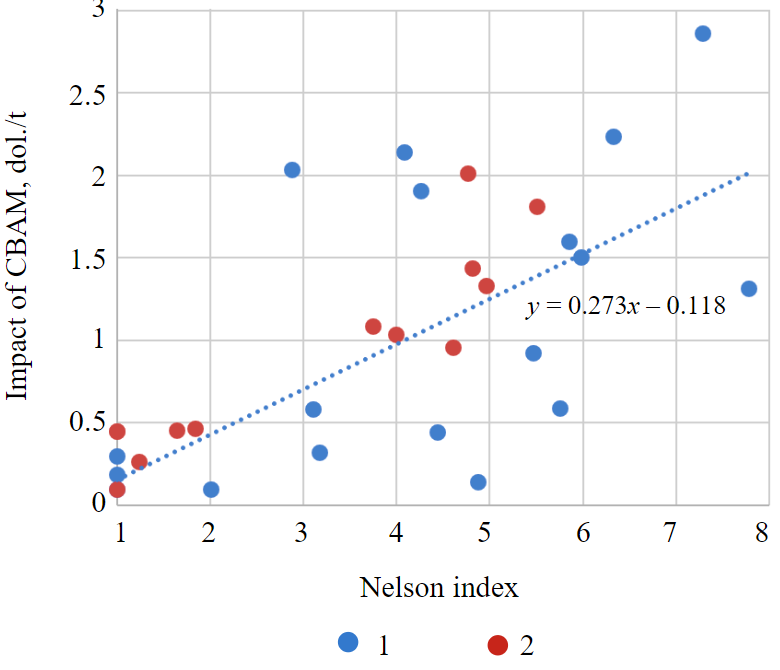

To identify the impact of the CBAM on the economics of oil refining of simple refineries and refineries of complex configuration, the relationship between the calculated value of the CBAM influence per ton of exported products and the Nelson index (characterizes the technological complexity) of oil refineries was analyzed (Fig.3). The wide range of values is the result of two factors: the energy efficiency of the installations and the fuel consumption pattern of the refinery. As a result, despite the use of the EU ETS methodology in the calculations (designed in such a way as to ensure the comparability of energy intensity for refineries of different configurations), a positive dependence of the size of the CBAM impact per ton of exported products depending on the refinery Nelson index was found. The obtained results demonstrate that the simplest refineries (Nelson index less than 2.5) will feel the least impact of TDI – less than 0.5 dol./t of oil products export. CBAM will have the greatest impact (more than 1.3 dol./t) on technologically advanced refineries, whose Nelson index is more than 6. At the same time, a linear approximation of the obtained values shows that, on average, an increase in the Nelson index by one unit can lead to an increase in the impact of CBAM on the refinery's economy in the amount of 0.27 dol./t.

Fig.3. Analysis of the effects of the potential CBAM introduction on the economy of oil refining in Russia (according to the authors' calculations based on Rosstat and RAIL-TARIF data) 1 – refineries focused on the domestic market; 2 – for export to Europe

The results obtained in the context of the policy pursued in Russia to develop the oil refining industry (stimulating investment in the construction and reconstruction of processing units) may have unexpected consequences. Initially, support in the form of an investment surcharge on the reverse excise tax on oil was conceived as an opportunity to stimulate plants with a simple configuration to develop and deeper processing [33]. The revealed dependence of the magnitude of the CBAM impact on a unit of exported products with an increase in the level of technical equipment based on the total sample of the analyzed objects can be fair as a result of the development of a particular refinery. Confirmation of this dependence as a result of the development of a certain refinery may prompt companies to take this factor into account in long-term planning or even adjust investment projects. Large refineries with a high Nelson index, in the face of declining margins, may receive an additional incentive to replace obsolete equipment. The modernization of such enterprises to a greater extent will be aimed not at increasing the depth of processing, but at increasing energy efficiency [34, 35]. Under these conditions, state support measures for the oil refining industry may require additional rethinking in order to form a balanced system as a whole.

Conclusion

Increased uncertainty due to anti-Russian sanctions regarding future deliveries of petroleum products to the EU countries does not remove from the agenda the issues of taking into account by business units approved and promising regulatory instruments aimed at solving environmental problems, and adapting long-term development programs to improve production efficiency in these conditions. The implementation of the declared goals of the CBAM leads not only to the expected environmental results, but also to a change in the market situation, business efficiency, etc. In the future, determining the effectiveness and other regulatory measures becomes more important for both global and national economies.

The introduction of the CBAM as a key tool for solving the problem of “carbon leakage” by the EU countries within the framework of the “European Green Deal” concept (or similar instruments in other regions of the world) can significantly affect the Russian oil refining economy, including those that do not export to the EU. In accordance with the approach to determining the carbon intensity of products according to the EU ETS rules, the assessment of the cumulative impact of the CBAM introduction on the economy of Russian oil refineries could amount to 246.9 million dol. Given the comparability of the results with other studies (KPMG, BCG, VYGON Consulting [15], IPEM [16]), the approach presented in this article has the advantage of being able to refine estimates to the level of individual enterprises.

An analysis of the pricing mechanism for oil products in the domestic market and an analysis of the consequences of the CBAM introduction at the enterprise level made it possible to assess the indirect effect of CBAM and the effect of the industry adaptation to new regulatory measures. The simulation results showed that the indirect CBAM impact through the pricing mechanism (–136.8 million dol.) even exceeds the direct effect in the form of direct costs for the purchase of greenhouse gas emission certificates by exporters of petroleum products (–114.3 million dol.), and the industry's ability to minimize losses is relatively limited (4.3 million dol.).

The direct CBAM impact is almost proportional to the volume of exports of products from refineries oriented to the domestic market and export. The indirect effect for refineries focused on the domestic market will be 78.1 million dol., which is 19.4 million dol. more than the impact of a similar effect on export-oriented refineries. With the introduction of the CBAM mechanism, the volume of refining in Russia will decrease by 3.3 million tons, and exports to the EU by 2 million tons. The CBAM introduction will have an impact not only on the markets of oil products in the EU and exporting countries, but also in third countries. With the introduction of CBAM, there will be a redistribution of suppliers of products for export to Europe in such a way that large volumes will be supplied by factories with a low carbon footprint.

The impact of CBAM per ton of exported oil product from refineries oriented to the domestic market is higher as a result of the historical factor – the key refineries supplying fuel to the domestic market are relatively old and inferior in energy efficiency to more modern examples, mainly oriented to export. Refineries specializing in the domestic market are at great risk due to netback pricing. The introduction of CBAM could potentially reduce the prices of petroleum products in the domestic market.

A positive dependence of the size of the CBAM influence on a ton of exported products depen-ding on the Nelson index of the refinery was revealed. In the context of the oil refining development policy pursued in the exporting countries, the results of the analysis may be unexpected: the growing influence of CBAM per unit of exported products with an increase in technical equipment will prompt companies to revise their investment plans. Large refineries with a high Nelson index in the face of declining margins may receive an additional incentive to replace obsolete equipment. The revision of development plans may significantly affect the situation on the oil products market.

The paper proposes analysis tools and methodology that are universal and can be used not only to assess the consequences of the implementation of EU transboundary carbon regulation, but also by other countries with advanced carbon trading systems, including China, Japan, South Korea, etc. – the results can be useful both for market participants and state regulators of the industry.

References

- Yurak V.V., Dushin A.V., Mochalova L.A. Vs sustainable development: scenarios for the future. Journal of Mining Institute. 2020. Vol. 242, p. 242-247. DOI: 10.31897/PMI.2020.2.242

- Makarov A.A., Mitrova T.A., Kulagin V.A. Global and Russian Energy Outlook 2019. Moscow: ERI RAS – Moscow School of Management SKOLKOVO, 2019, p. 210.

- Litvinenko V.S., Tsvetkov P.S., Dvoinikov M.V., Buslaev G.V. Barriers to implementation of hydrogen initiatives in the context of global energy sustainable development. Journal of Mining Institute. 2020. Vol. 244, p. 428-438. DOI: 10.31897/PMI.2020.4.5

- Proposal for a regulation of the European Parliament and of the Council establishing a Carbon Border Adjustment Mechanism (Text with EEA relevance). N COM (2021) 564 final. Brussels: European Commission, 2021.

- Ilinova A.A., Romasheva N.V., Stroikov G.A. Prospects and social effects of carbon dioxide sequestration and utilization projects. Journal of Mining Institute. 2020. Vol. 244, p. 493-502. DOI: 10.31897/PMI.2020.4.12

- Ulanov V. Business Development in Emerging Economies on the Basis of Limits and Conditions of National Strategies. Global Journal of Emerging Market Economies. 2019. Vol. 11. Iss. 1-2, p. 37-47. DOI: 10.1177/0974910119871376

- Morozov I., Potanina Yu., Voronin S. et al. Prospects for the Development of the Oil and Gas Industry in the Regional and Global Economy. International Journal of Energy Economics and Policy. 2018. Vol. 8. N 4, p. 55-62.

- Nedosekin A.O., Reishakhrit E.I., Kozlovskii A.N. Strategic approach to assessing economic sustainability objects of mineral resources sector of Russia. Journal of Mining Institute. 2019. Vol. 237, p. 354-360. DOI: 10.31897/PMI.2019.3.354

- Monjon S., Quirion P. Addressing leakage in the EU ETS: Border adjustment or output-based allocation? Ecological Economics. 2011. Vol. 70. Iss. 11, p. 1957-1971. DOI: 10.1016/j.ecolecon.2011.04.020

- Fouré J., Guimbard H., Monjon S. Border carbon adjustment and trade retaliation: What would be the cost for the European Union? Energy Economics. 2016. Vol. 54, p. 349-362. DOI: 10.1016/j.eneco.2015.11.021

- Rocco M., Golinucci N., Ronco S., Colombo E. Fighting carbon leakage through consumption-based carbon emissions policies: Empirical analysis based on the World Trade Model with Bilateral Trades. Applied Energy. 2020. Vol. 274. DOI: 10.1016/j.apenergy.2020.115301

- Ansari D., Holz F. Between stranded assets and green transformation: Fossil-fuel-producing developing countries towards 2055. World Development. 2020. Vol. 130. N 104947. DOI: 10.1016/j.worlddev.2020.104947

- Bashmakov I.A. CBAM and Russian export. Voprosy ekonomiki. 2022. Vol. 1, p. 90-109 (in Russian). DOI: 10.32609/0042-8736-2022-1-90-109

- Chupina D.A. Impact of the Green Deal on copper imports from Russia to the EU. Voprosy ekonomiki. 2022. Vol. 1, p. 110-125 (in Russian). DOI: 10.32609/0042-8736-2022-1-110-125

- Vygon G., Ezhov S., Kolbikova E. et al. Euro CBAM: issue price. Moscow: VYGON Consulting. URL: https://vygon.consulting/ products/issue-1894/ (accessed 12.06.2021) (in Russian).

- Carbon Border Adjustment Mechanism in the European Union: how to prevent discrimination of Russian exporters: Executive summary. Moscow: Institute for Natural Monopolies Research. URL: http://ipem.ru/content/transgranichnoe-uglerodnoe-regulirovanie-v-es-kak-ne-dopustit-diskriminatsii-rossiyskikh-eksportyerov/ (accessed 12.06.2021).

- Marcu A., Mehling M., Cosbey A. Border Carbon Adjustments in the EU: Issues and Options. Brussels: European Roundtable on Climate Change and Sustainable Transition, 2020, p. 68.

- Skorobogatko O.N. Modeling of oil refining economy in conditions of limited information. Neftyanoye khozyaystvo. 2021. Vol. 10, p. 140-144 (in Russian). DOI: 10.24887/0028-2448-2021-10-140-144

- Ketabchi E., Mechleri E., Gu S., Arellano-Garcia H. Modelling and Optimisation Approach of an Integrated Oil Refinery and a Petrochemical Plant. Computer Aided Chemical Engineering. 2018. Vol. 44, p. 1081-1086. DOI: 10.1016/B978-0-444-64241-7.50175-0

- Oliveira F., Nunes P., Blajberg R., Hamacher S. A framework for crude oil scheduling in an integrated terminal-refinery system under supply uncertainty. European Journal of Operational Research. 2016. Vol. 252. Iss. 2, p. 635-645. DOI: 10.1016/j.ejor.2016.01.034

- Lahiani A., Miloudi A., Benkraie, R., Shahbaz M. Another look on the relationships between oil prices and energy prices. Energy Policy. 2017. Vol. 102, p. 318 331. DOI: 10.1016/j.enpol.2016.12.031

- Li Liu, Guofeng Ma. Cross-correlation between crude oil and refined product prices. Physica A: Statistical Mechanics and its Applications. 2014. Vol. 413, p. 284-293. DOI: 10.1016/j.physa.2014.07.007

- Cahen-Fourot L., Campiglio E., Godin A. et al. Capital stranding cascades: The impact of decarbonisation on productive asset utilization. Energy Economics. 2021. Vol. 103. N 105581. DOI: 10.1016/j.eneco.2021.105581

- Población J., Serna G. Is the refining margin stationary? International Review of Economics & Finance. 2016. Vol. 44, p. 169-86. DOI: 10.1016/j.iref.2016.04.011

- Razmanova S.V., Andrukhova O.V. Oilfield service companies as part of economy digitalization: assessment of the prospects for innovative development. Journal of Mining Institute. 2020. Vol. 244, p. 482-492. DOI: 10.31897/PMI.2020.4.11

- Klochko O.A., Grigorova A.A. Models of oil exporting countries’ inclusion into oil refining global value chains. World Economy and International Relations. 2020. Vol. 64. N 1, p. 99-109 (in Russian). DOI: 10.20542/0131-2227-2020-64-1-99-109

- Dzhonek-Kovalska I., Ponomarenko T.V., Marinina O.A. Problems of interaction with stakeholders during implementation of long-term mining projects. Journal of Mining Institute. 2018. Vol. 232, p. 428-437. DOI: 10.31897/PMI.2018.4.428

- Caldara D., Cavallo M., Iacoviello M. Oil Price Elasticities and Oil Price Fluctuations. International Finance Discussion Papers. 2016. N 1173. DOI: 10.17016/IFDP.2016.1173

- Directive 2003/87/EC of the European Parliament and of the Council of 13 October 2003 establishing a scheme for greenhouse gas emission allowance trading within the Community and amending Council Directive 96/61/EC (Text with EEA relevance). Official Journal of the European Union. Brussels: European Commission, 2003.

- Chiaramonti D., Goumas T. Impacts on industrial-scale market deployment of advanced biofuels and recycled carbon fuels from the EU Renewable Energy Directive II. Applied Energy. 2019. Vol. 251. N 113351. DOI: 10.1016/j.apenergy.2019.113351

- Report on the proposal for a regulation of the European Parliament and of the Council establishing a carbon border adjustment mechanism N (COM(2021)0564-C9-0328/2021-2021/0214(COD)). Brussels: European Parliament, 2021.

- Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions Empty 'Fit for 55': delivering the EU's 2030 Climate Target on the way to climate neutrality. № COM (2021) 550 final. Brussels: European Commission, 2021.

- Ruble I. The US crude oil refining industry: Recent developments, upcoming challenges and prospects for exports. The Journal of Economic Asymmetries. 2019. Vol. 20. N e00132. DOI: 10.1016/j.jeca.2019.e00132

- Shojaeddini E., Naimoli S., Ladislaw S., Bazilian M. Oil and gas company strategies regarding the energy transition. Progress in Energy. 2019. N 1. N 012001. DOI: 10.1088/2516-1083/ab2503

- Zhong M., Bazilian M.D. Contours of the energy transition: Investment by international oil and gas companies in renewable energy. The Electricity Journal. 2018. Vol. 31. Iss. 1, p. 82-91. DOI: 10.1016/j.tej.2018.01.001