Assessment of the role of the state in the management of mineral resources

- 1 — Ph.D., Dr.Sci. rector Saint Petersburg Mining University ▪ Orcid ▪ Elibrary ▪ Scopus ▪ ResearcherID

- 2 — Ph.D. Head Federal Agency for Subsoil Use

- 3 — Ph.D., Dr.Sci. Assistant Deputy Prime Minister RF Government Office ▪ Orcid ▪ Scopus

- 4 — Ph.D., Dr.Sci. Rector Diplomatic Academy of the Russian Foreign Ministry ▪ Orcid

- 5 — Head of Department Saint Petersburg Mining University ▪ Orcid ▪ Scopus

- 6 — Deputy Head of Department Saint Petersburg Mining University ▪ Orcid

Abstract

Mineral resources as natural capital can be transformed into human, social and physical capital that guarantees the sustainable development of a country, exclusively through professional public management. Public management of a country's mineral resource potential is seen as an element of transnational governance which provides for the use of laws, rules and regulations within the jurisdictional and sectoral capabilities of the state, minimising its involvement as a producer of minerals. The features of the ideology of economic liberalism, which polarises the societies of mineral-producing countries and denies the role of the state as a market participant, have been studied. The analysis of the influence of the radical new order of neoliberal world ideology on the development of the extractive sector and state regulation has been presented.

Introduction

The report of the International Resource Panel of the United Nations Environment Programme [1] states that worldwide management of mineral resources is characterized by a widespread lack of planning of mining activities and well-defined state policies in the sphere of natural capital management both at the national and sub-national level. Achieving the UN Sustainable Development Goals [2] requires the introduction of innovative technologies that consume a wide range of minerals [3], and therefore the introduction of new rules and regulations for the exploitation of resources that reduce the negative effects of their use [4]. Today's 2030 Agenda for Sustainable Development marks a new era of global progress, characterized by the urgent need to integrate social, environmental, and economic benchmarks. The realization of the diverse requirements that are part of the ESG principles depends on appropriate and responsible approaches to the extraction and use of natural resources around the world, including recycling and consumption. Transnational governance is a definite feature of world politics, but a full-fledged state policy that focuses on mineral resources and the development of extractive industry as well as institutionalisation of disclosure of the information of sustainability of its operations are almost non-existent [5, 6].

Analysis of the global demand for rare earth resources [7, 8], the reasons that hinder the implementation of technological innovations [9], the state of resource availability [10] show that the absence of an international mechanism for forecasting the development of the mineral market already has a negative impact on the sustainability of supplies of certain types of natural resources. The observed artificial reduction of investment in field development [11] also negatively affects the volume of supply by reducing it, whereas the demand is not falling, it is growing [12]. The trend towards the global implementation of the environmental and social ESG principles [12-17] requires additional efforts from mining companies, including financial ones, since formal indicators often prevail in the preparation of reports, there is no direct public participation in the analysis of their reliability and transparency. This does not take into account the fact that more than 85 % of all mineral deposits are in the hands of the states [18]. In this situation, ESG principles cannot fully reflect the balance between environmental and social requirements and the financial sustainability of the companies.

Government decisions regarding the extractive industries have historically been targeted and implemented by specific government agencies or companies involved in a particular sector – mining operations, radioactive waste disposal, groundwater protection, etc. Such a fragmented approach significantly narrows perceptions and often limits the diversity of knowledge and perspectives that can be relied upon in the decision-making process. The imperfection of such management becomes more evident in case of conflicts, delays in supply, serious damage to ecosystems. The world must change the paradigm and move from disparate resource management to a more integrated model. The influence of the state on the financial stability of the extractive industry in these conditions is obvious, as the state is committed to its economic growth. Analysis of the future availability of rare earth elements raises concerns due to monopolistic supply conditions, environmentally unsustainable extraction methods and dynamically growing demand [19, 20]. “Green” economy requires not only environmentally friendly materials, but also more advanced industrial technologies and efficient techniques of their recycling [21]. Building the facilities necessary for the development of renewable energy requires an increase in the extraction of a whole group of metals, such as copper, nickel, and many others. The result of the growing demand for those materials should be the intensification of the search and exploration of new deposits, as well as the growing consumption of energy [22], including through the creation of new transport and social infrastructure. All these factors justify the relevance of the tasks outlined in the article, aimed at modernizing the mining industry of the world economy, which originally represented an integral part of colonial expansion, imperialism and global capitalism [23, 24]. The consequences of this circumstance are now reflected in both the physical extraction process and mixed assessment of the mineral resource complex by society. At the same time all large countries are now heavily dependent on the production of fossil fuels and metals and some of them on imports of raw materials [25].

In our research, we are guided by the need for more active actions to develop a methodolo-gical approach to state management of natural resources. At the second session of the UN Environment Assembly, the states recognized that for the sustainable development worldwide, it is necessary to fundamentally change the patterns of consumption and production dominating in the countries [26].

Methodology

The authors consider the rational resource management as a unity of policy, strate-gy, legal regulation, investments, actions and opportunities within the framework of public, state, private, public partnership. It is based on environmental and socioeconomic feasibility, as well as technical capabilities, on the basis of which society determines which resources, when and how will be developed, extracted, consumed, processed and reused. All mineral resources belong to the state as the subject of the civil law, the government, on behalf of the people, manages the process of subsoil use through administrative and legal rules or various forms of civil law acts. A license has been used as the main regime of subsoil use as an administrative and legal agreement and concession as a civil law contract that regulate relations between the state and the subsoil user. At the same time, the authors have taken into account that nowadays various forms of civil law treaties face problems of sustainability of social relations in those countries where they are applied. [27, 28]. In this context, national governments are forced to seek ways to influence extractive companies by creating and implementing social licenses [29], thereby restoring their influence on business profitability.

The studies were aimed at determining the role of the state in regulating the entire process of working with mineral resources located on its territory, taking into account internal and external factors.

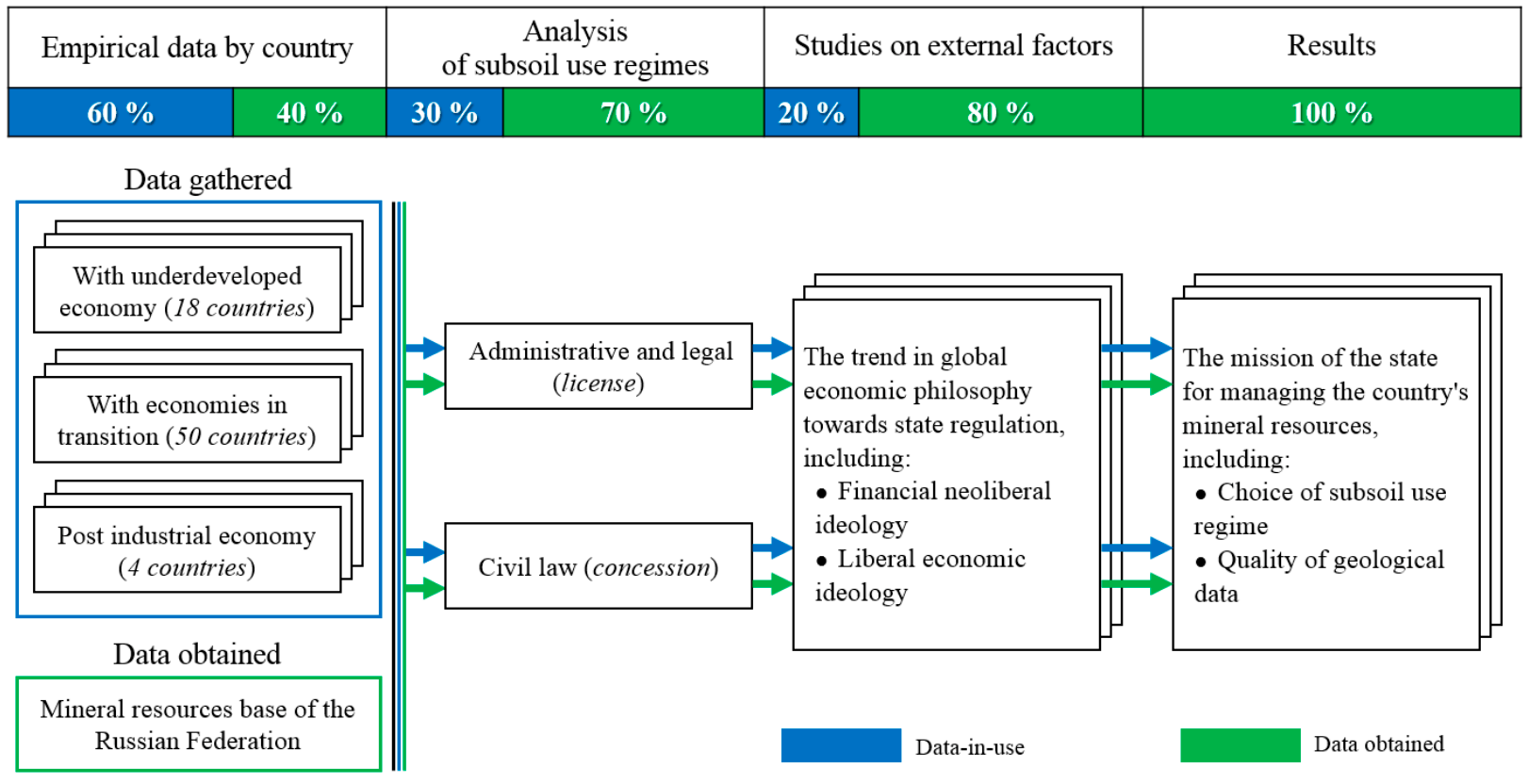

An outline of the research methodology is presented in Fig.1. An interdisciplinary approach was used in collecting [30-33] and obtaining its own empirical results, and their analysis considered all the processes affecting mineral resource management performance as a process with a complex global network of relationships [34-36], involving a large number of actors, normative frameworks, hierarchical relationships and associated spatial boundaries [37, 38]. By global governance, we mean the many ways in which individuals and institutions, public and private, manage their sector in the context of implications for natural resource efficiency [18, 39, 40].

Fig.1. The outline of the research methodology

The actors involved in resource and mineral management in our study include: governments, inter-governmental organisations, extractive and processing commercial companies, the non-profit sector, civil society [37], multinational companies. Decisions made by various actors regarding resources have been shaped by a wide range of regulatory frameworks and formal regulations, including treaties, laws, rules, policies, contractual relationships and technical standards [41, 42]. Administrative, commercial, professional, cultural, ethnic, interpersonal practices have also been taken into account to better define the key features of global resource management and the importance of public administration in this process. The studies have identified those external factors that demonstrate the urgent need for more effective involvement of the state in the regulation of the whole process of use of mineral resources in their territories. These are the protection and definition of rights related to resources, the impact on resources in selected sectors, borders and globalised value chains, recognition of multiple public and private benefits from the use of resources [18]. Such responses are evident at local, national, regional and global levels in both underdeveloped and post-industrial economies.

The study of the trends in the geopolitical environment has taken into account those external factors that may increase the uncertainty affecting the governance of the mining industry, using the data on the state of the problem in general and the importance of the governance system. Based on the above-mentioned scientific findings, as well as on research conducted by the International Resource Panel [1], the authors of this article have used the ideology of a new global sustainable development agenda, considering that the Sustainable Development Goals can provide a new impetus to improve the economic well-being of society through more efficient exploitation of extractable resources while increasing the efficiency of government regulation.

In assessing the role of the state in solving the economic problems of field exploitation management, the authors used a three-dimensional model to estimate reserves and resources of deposits based on methods of fractal analysis.

Results and discussion

The study of the mechanisms of state regulation of the system of development of mineral resources of many countries has taken into account new knowledge related to the underlying problems of the industry, their impact on the eco environment and the sustainability of investment returns. Given the role of mineral resources complex in carrying into effect the interests of the state, local population, and consumers, we have taken into account the imperative for changes and the challenges associated with the management of mineral resources:

- The complexity of the political environment, which provided that resources are largely owned by the state. Companies that work professionally with the deposit build their activities on the basis of both national and international (transnational) laws, which in some cases creates conflicts and leads to monopolization of the market.

- Specific features of financial investments in the extractive industry sector are a long payback period and the demand for a large volume of investments. Moreover, there are characteristic fluctuations of income as well as problems of macroeconomic risk management and absorptive capacity.

- The need to create market-based regulatory mechanisms, the environment of trust in extractive companies, and participation of local communities in assessing their compliance with ESG principles. This is extremely relevant, since minerals are a guarantee for the government, which governs on behalf of the entire state, of the sustainability of the economy, the preservation and creation of new jobs, and balanced socio-economic development of society. This process, on the one hand, requires the intensification of the extraction of mineral resources, due to which mankind should obtain material benefits, including, for future generations, on the other hand, to address problems of resource management and provision of constant income from the subsoil user for the right to extract minerals.

There is an observed weak state management of natural capital and other factors that have a negative impact on the result of subsoil use. This is primarily about the insufficiently developed mechanism and the form of the contract between the state and the subsoil user (administrative and various forms of civil law documents); the complexity of state regulation, the need for a social contract, scientific support of works and activities to preserve the environment. The dynamics of the political vector in the economy in relation to extracted resources becomes particularly “attractive” due to exhaustibility, scarcity and high liquidity. These features of the commodity sector create internal and (or) cross-border conflicts. In this regard, local interest groups are more radicalized. There is a growing pressure on the government of external factors and stakeholders of technological progress, the growing influence of social networks and the process of digitalization in general, changes in global positions in the field of social norms, fundamental transformation of the ways of coordination and decision-making at the individual, organizational and societal levels.

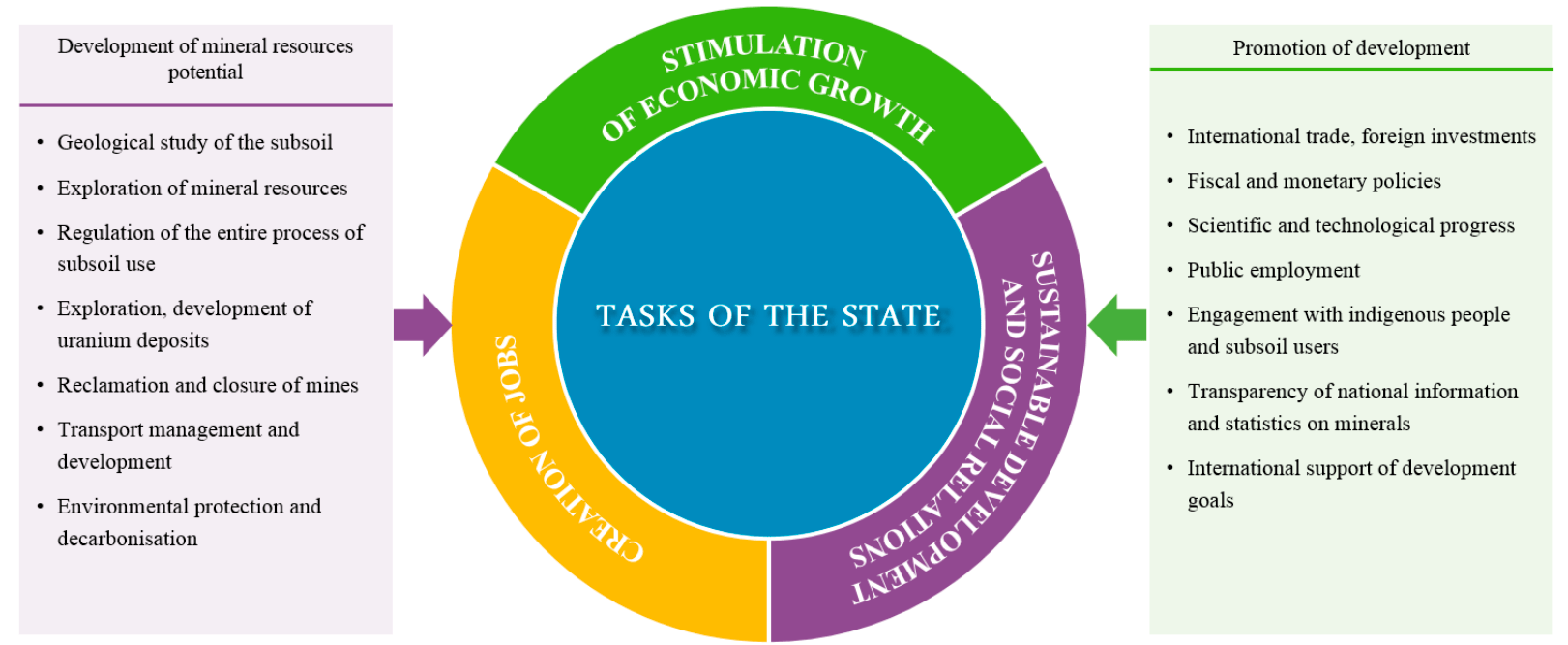

Fig.2. The main functions of the state in managing mineral resources of the country

The main tasks of the state to manage the country's mineral resources do not take into account the specifics and capabilities of both the state itself and its ability to improve the efficiency of mineral use. It is necessary to solve the whole complex of problems related to resources in the context of the unity of economic, environmental and social objectives, taking into account the goals of sustainable development (Fig.2).

In many countries the governments lack flexibility in their activities aimed at supporting the mining industry. In particular, they do not fully recognize the responsibilities and functions of regional governments, whose decisions often determine the ability to respond appropriately to the challenges posed by the economic situation and emerging challenges faced both by the state and the mining companies, given the current conditions characteristic of a heterogeneous mining industry. However, in most countries, the state continues to act as an economic entity. Its main mission, that should undoubtedly be to regulate the industry, in particular, to create conditions to attract investments on mutually beneficial terms for lenders and borrowers, is constrained by the influence of external factors, above all the loss of state sovereignty.

Global economic philosophy regarding mineral resources.

The analysis of the activities of large transnational companies, as well as the reasons why states receive low rents from the use of even super-liquid deposits owned by them, clearly shows that the current global economic philosophy regarding natural resources completely denies the need for state regulation, and it subconsciously gives mineral resources the status of “international property”. The main challenge for any subsoil user working with a deposit is to secure sales and access to credit financing. From the perspective of global geopolitical laws, the moral values of any society lie in confronting the owners of industries, as it is publicly recognised that income derived from mineral resources, which are public property, should serve the development of the economy of a society and its statehood. As a rule, all legitimately elected leaders are vested with the full right to manage operations with their country's natural capital for the implicit economic purpose of democracy: the promotion of general welfare and mutual benefit. Virtually all countries with weak economies and at least 85 percent of transition economies with highly liquid deposits are unable to resist external factors that allow lenders and buyers of raw materials to make super profits. And in at least 80 percent of the countries, the coming to power of a new leader cannot affect the situation at all, including the protection of the debtor from the creditor, because the deposits located on their territory are in external management. In fact, these countries have lost their state sovereignty.

Development of subsoil resources for the purpose of extraction of minerals is a national activity. The markets for this product, except for inert minerals, are international in nature. In this regard, our research on development trends in global economic philosophy and their impact on the role of the state as the main regulator of the entire technological chain of work with the field takes into account the desire of the global community to achieve the Sustainable Development Goals (SDGs) at all stages: geological exploration of the territory, geological prospecting, exploration, development, operation and decommissioning of production facilities.

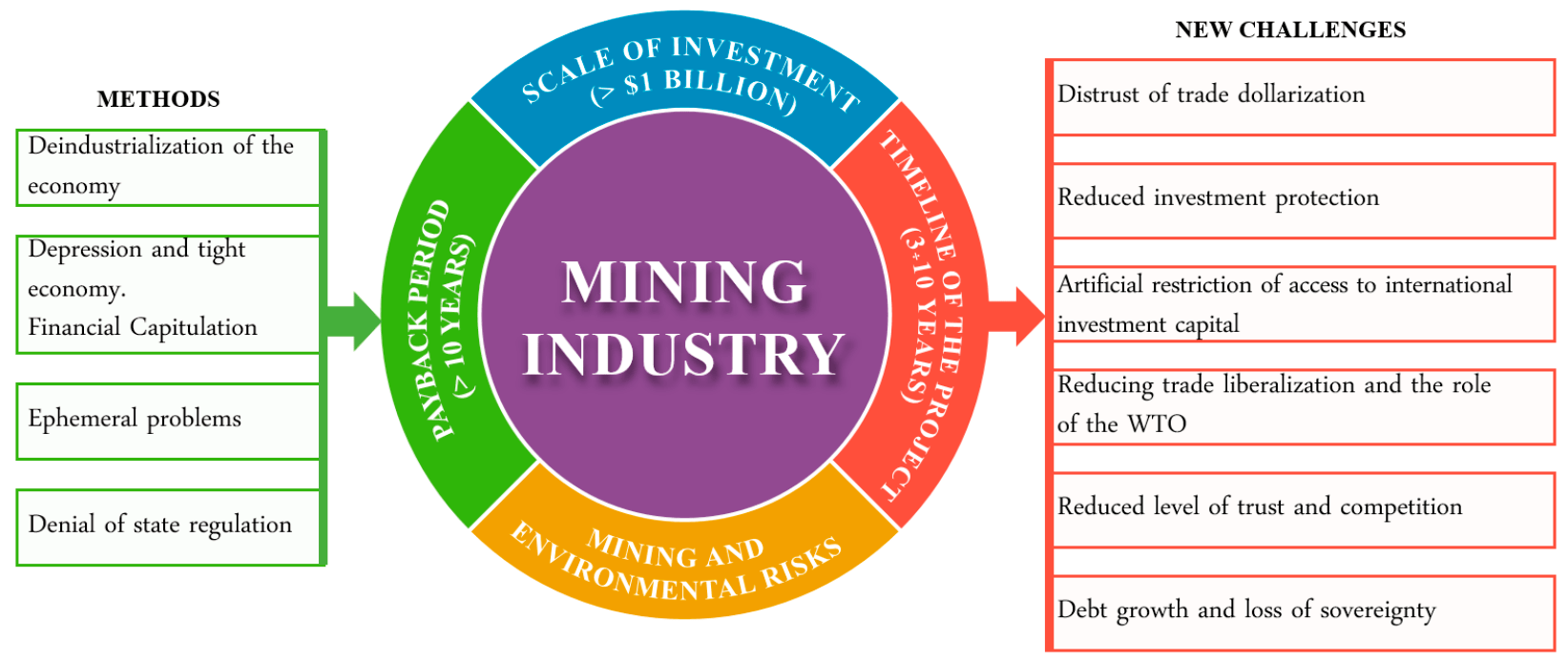

The peculiarities of investment in field infrastructure are: long payback periods (from 8 to 12 years); the scale of investment; long project implementation periods (from 3 to 10 years); high mining risks and negative consequences for the ecosystem. Let us highlight the international nature of the traditional problems faced by the mining industry in almost all states, including highly develo-ped ones:

- Competition for investment capital, especially at the level of interstate cooperation in the construction of common transport infrastructure.

- Environmental impact of technological operations such as: extraction of mineral raw materials; their enrichment and processing; use; storage; reuse; production of goods of direct consumption; transportation; recycling; waste disposal and burial.

Against the background of these problems, new, previously unnoticed ones have appeared, such as:

- A sharp decline in investment protection, especially for long-term investments.

- The emergence of ephemeral problems hindering access to international investment capital.

- Failure of the WTO (World Trade Organization) to ensure equal competition in the global market.

- Distrust of trade dollarization on the global commodities market.

- Increased influence of sanctions mechanisms.

- Reduced level of trust and competition due to the large-scale use of the unipolar mechanism of sanctions.

- Widespread implementation of environmental and social principles of ESG without taking into account the fact that more than 90 percent of the world's deposits are publicly owned.

- The dominance of digital information networks, which act in the interests of transnational corporations and financial elites who control the global commodities market and exert geopolitical influence on certain types of industries and entire states.

- The dominance of a unipolar world economy, functioning at the expense of financial profit: bank interests; income from investments in foreign projects, as well as the disbursement of loans for their implementation by the World Bank, the International Monetary Fund and other financial institutions to inflate returns on capital.

Renowned American economist and University of Missouri professor Michael Hudson says that the current trend in global economic philosophy towards government regulation is “to put people, industry and even governments in debt to an oligarchic elite which is exactly what has happened in the West, that is now trying to impose on the world the modern version of this debt-fuelled economic regime – US-centric neoliberal financial capitalism”. [43]. He believes that today's diplomatic confrontation in the world is based on the desire to “maintain the prosperity of our own financial elite at the expense of exploiting foreign nations, dragging foreign economies into dollar debt that must be repaid through the imposition of depression and austerity”[43]. At the same time, it is assumed that all economic problems are self-healing, and state regulation is considered ineffective and inefficient, and therefore unnecessary.

Analyzing the available empirical evidence of the “shock therapy” of the post-Soviet space in the 1990s through the privatization of major factories, institutions and entire industries, including access to the largest mineral deposits, it can be argued that this was associated with the beginning of a large-scale deindustrialization of the American economy, and the beginning of a period of distrust in the dollarization of the global economy. This process is associated with the relocation of employment and production to Asia. Post-industrial countries have imposed on society the view that banks and financial mechanisms are most effective as regulators and can ensure the highest prosperity of the entire economy through the management of deposits and cash flows. By accepting China into the WTO in 2001, the West hoped to strengthen its influence on that country's state sovereignty using the same proven international rules, but this was countered by a clear state policy to protect its national interests through the introduction of state regulation, including in the management of natural resources. This allowed China to change the export-oriented vector of its economy to the economy of domestic demand with a full cycle of scientific and technological sovereignty. Reasonable state re-gulation in the field of mineral resources has made it possible to monopolize the market for many types of raw materials, especially rare earth metals, significantly increasing the natural rent from the use of this commodity for its economy, not to sell semi-finished products, but to produce and sell the end-use goods derived from minerals to the West, but with a higher surplus value.

Post-industrial countries are trying to build the world economy to suit their geopolitical interests, based on financial profits. They lie in sharply reducing the share of income from industrial production on their territory, but significantly increasing it at the expense of external management of other nations' minerals. This policy has created a serious distrust to dollarization in trade and the existing investment environment in the world.

Under these conditions, raw materials, especially hydrocarbons, as a commodity, become a special, most important geopolitical resource. The peculiarities of any deposit development, such as the long payback period of investments, the need for huge financial investments require any state to build a clear long-term policy in the field of state regulation and guarantees for investors to receive a fair income, taking into account the long payback period of the core projects. This is the main problem of development in most resource-rich countries. They are theoretically rich, but practically poor and unable to independently provide long-term investments and create national venture capital to work on high-risk deposits. In fact, these countries have lost their state sovereignty and their ability to earn a decent profit from the exploitation of their own deposits. The oligarchic Western economy has historically for centuries created a colonial system of resource management on all continents at the expense of creating a geopolitical environment incapable of protecting nations and ridding them of the world proprietors-creditors.

The mechanism created by the ideologues of the Fourth Industrial Revolution allows the global financial elite to receive the bulk of the natural rent from the exploitation of deposits, turning resource-rich countries into debtors, thereby forcing them to become the states under control. Debts and oligarchy have led to the fact that the main part of the countries with weak economies and most of the transition economies which have enormous investment potential for working with the deposits have become heavily indebted and are under external management. These states are forced to build primitive primary processing plants on their territories and use low-wage workers and sometimes child labor to maximize their profits.

On the example of the Russian economy, it is possible to trace approximate forms of international influence on the use of mineral and raw material potential. After the collapse of the Soviet Union, the signing of the Belovezh Agreements and the transition of our country from a planned to a market economy, its ability to self-regulate was considered to be an undeniable characteristic. The most common interpretation of the law of supply and demand accepted as a fundamental truth was that the price of a good or service would in any case reach the equilibrium and be optimal for both the consumer and the seller. Growing demand in a particular segment will contribute to its development due to the entry of new manufacturers into the market, while falling demand will reduce supply as the least competitive producers leave the market. In this paradigm of relations, the state was assigned the role of an observer, any of its actions aimed at exercising control was perceived as interfering with business and achieving a natural market balance. The fact that in reality Russia was living in hyperinflation was not taken into account by liberal economists. A certain part of society still adheres to liberal ideology and believes that government interference in the market regulation process is not desirable because it threatens to slow down economic growth and even recession because of the bureaucratic hurdles that business would then face. It is obvious that the primary factor that, at the beginning of the 21st century, stopped the price rise in Russia and sharply increased the well-being of the citizens of the country was the “anti-liberal” actions of President V.V.Putin [44] in the field of strengthening state regulation of the mining industry and the oil and gas sector. It is therefore logical to assume that more active government actions in this direction, related for example to creating conditions for the emergence within the country of long process chains, which start with raw material extraction and end with high-value-added products, would help to intensify economic growth.

Fig.3. The impact of neoliberal capitalism on the business climate in the mining industry

The analysis of the impact of neoliberal capitalism on the business climate in the mining industry (Fig.3) reflects the main methods of influence on the commodity market and their influence on the business climate and sovereignty of the state. State regulation of the process of subsoil use is highly dependent on the influence of the global oligarchy and debts. A defining characteristic of the Western economy is the emergence of a fundamentally different elite, composed of a new generation of people, in particular the creators of IT companies and virtual trading platforms. They often use their capital not to produce end-use goods and saturate the market with minerals, but to invest in a product that has not yet been created or exists as a prototype. By imposing on society such ephemeral problems as the Fourth Industrial Revolution; uncertainty in climate policy; hydrocarbons as primitive fuel; hydrogen economy and others, they provoke the growth of world debt, by diverting more than 2 trillion dollars a year, which are spent to solve these problems. At the same time they limit access to global investment capital for representatives of the mineral complex, preventing its development. Uncontrolled increases in debt are destroying the global economy, because new investments in the means of production are not being made in necessary quantities Money is invested in bonds and real estate, sent to stock exchanges to artificially increase the value of shares of mining companies, as well as “green” companies, which often have no future, but are artificially kept afloat by Western governments. This strategy burdens countries with profitable mineral resource potential with debt, forcing them to sell or sometimes transfer control of deposits or state infrastructure for free. This vector of dominant neoliberal policies on subsoil use polarizes the economies of much of the deve-loping world and greatly slows down their progress because of high indebtedness.

The impact of economic liberalism

Most of the society in countries that have highly liquid raw materials and at the same time an underdeveloped or transitional economy welcomes the ideology of economic liberalism, as it advocates minimal government intervention. In this regard, the emerging norms of public law completely reject the need for state regulation in subsoil use. This ideology preaches complete freedom for individuals, leaving to the government only antimonopoly regulation and formation of correct inside information. State regulation in this case is replaced by the concept of intervention.

The economies of many underdeveloped countries have all the characteristics of a mobilization economy. Their governments, given their high dependence on foreign debts and external geopolitical challenges, are trying to reduce internal confrontation and tension by concentrating national resources and their powers in that part of the economic system that determines the response to the threat hanging over society. In some cases, law enforcement structures and the support of external forces are used.

The analysis of the main factors influencing the efficiency of the use of minerals in the economy of such countries shows that their development is restrained by supporters of economic liberalism. Representing the superstructure of society, they influence such intangible factors as moral, ethical, and psychological factors. They lie at the heart of the sustainability and credibility of society, and directly affect the state's ability to achieve its goals in the economy, and therefore to be self-sufficient and self-reliant with the available resources. Geopolitical struggle and the influence of liberal economic policies are aimed at reducing the rents from the use of minerals by countries at the expense of building up the debt. The growth of debt is destroying the economy because it is not being used to finance new investment in raw material projects. Liberal economic ideology is the method used to increase the credit debt of all commodity economies, to maintain the “privilege of the Dollar” as the key currency in trade and to maintain the “dollar standard” created in the last sixty years. At the same time, paper dollars pose a threat to global trade based on dollarisation as they inflate the prices of stocks and bonds, which are the backbone of business, the motivation for private capital investment in commodity projects and building trust in the stock market.

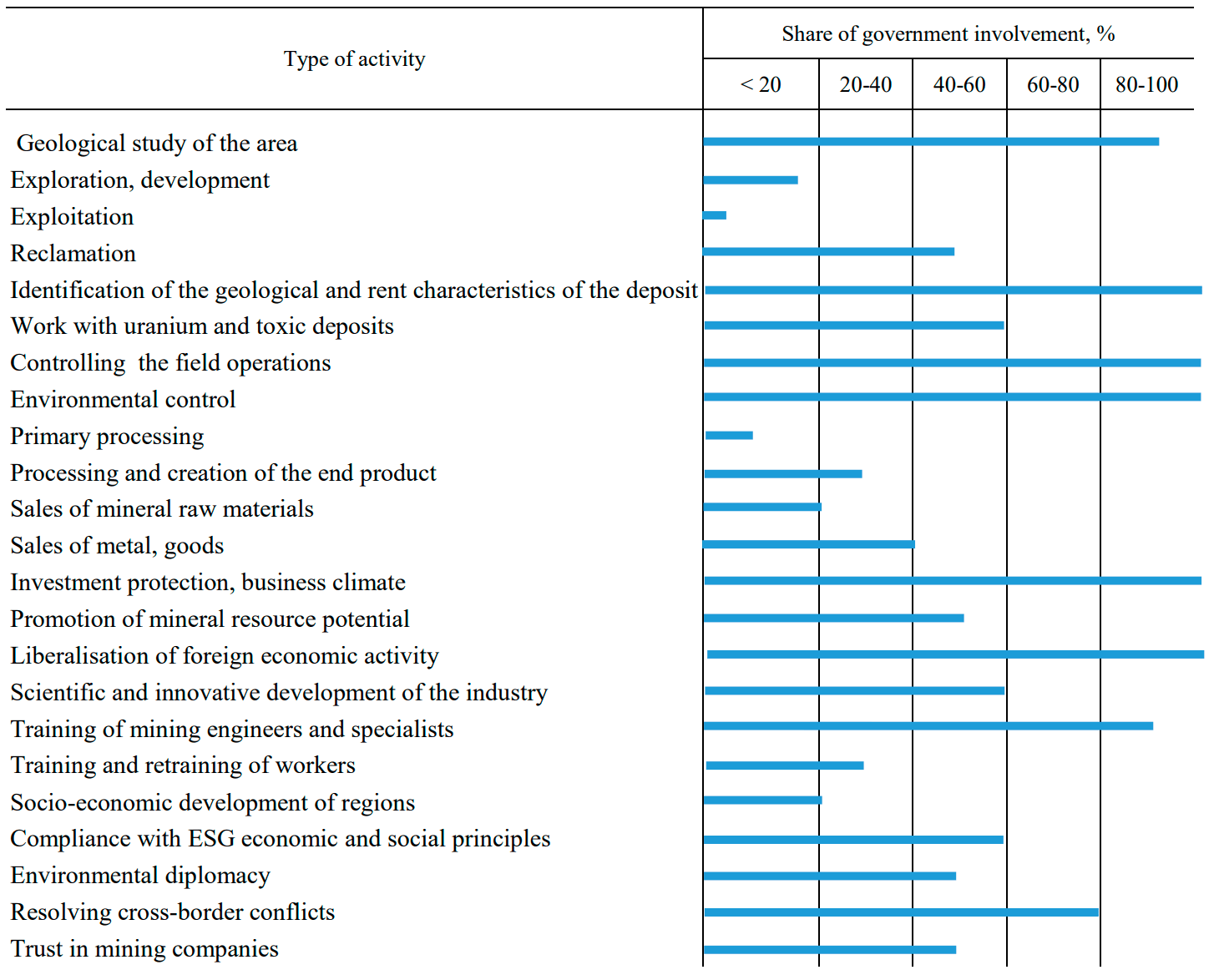

The resulting analysis of empirical data, shows that public debate about the path of further socio-economic structure of the world economy has recently intensified, taking into account the great dynamics in the commodity market, especially the market of raw hydrocarbons. The question arises: is it necessary to maintain the old export-oriented system, which allows countries to extract a relatively small but immediate profit, or to move away from the liberal ideology to the ideology of strengthening state regulation, which will increase the marginality of the national economy? The term “state regulation” is perceived rather negatively by the society, as it is associated with the infringement of various rights and freedoms. It is believed that each state's pursuit of the main goal – to preserve statehood – supposedly interferes with the solution of secondary, but very important for progress momentary tasks, which is detrimental to small and medium-sized entrepreneurship. Ano-ther illusion of liberal ideology is the claim that resources can only be mobilised if they are placed under the full control of the state, which must strengthen its role as a producer. Our research on determining the share of the state as a regulator of the entire technological and economic supply chain of minerals (extraction, processing, use and reuse) is shown in the Table.

The state's share in the activities of mining companies

The obtained average indicators demonstrate that the mission of the state in this activity should be radically different from the postulates imposed on society by liberal economic ideology. It consists in the development of a market-oriented state policy of working with its own mineral resources through the use of public law and a transparent mechanism of state regulation. In this case the state acts as a highly professional regulator. This makes it possible to manage the entire process of working with mineral resources in the most efficient way, to put into operation deposits, taking into account the motivated balance policies. It is the balance that is the most important instrument of state regulation in a market economy, as it allows eliminating the mismatch between supply and demand, including the creation of equal investment attractiveness of deposits using rent mechanisms that affect the elasticity of the mining tax, which is currently not fully taken into account by many governments.

Transnational management of deposits is a geopolitical goal to ensure long-term control of the world's natural capital and free access to mineral raw materials that many post-industrial powers do not possess. The tools to achieve it are sanction pressure on those states that do not want to play by the rules of neoliberal financial ideology, and even direct confiscation of private property.

The regime of subsoil use

Geological and mining features of the deposits, their size and geographic location, the efficiency of their use is not taken into account by many states, especially in view of their impact on state sovereignty. The relationship between the state and the subsoil user must be based on the norms of public law and the national regulations of subsoil use. Analysis of the collected empirical data, as well as the use of experience and practice of different types of relations in the sphere of subsoil use allowed to highlight their features, and to define them as a key issue of state regulation of the entire mining process.

There is a de facto increase in the opposition of civil and administrative regimes, however, they are not ideal both from the position of the state and the subsoil user. Business in many cases does not have long-term certainty, given the lack of transparency in the application of basic laws in many countries. Canada is the only state that not only has a mineral strategy, but also applies it as a mechanism of consolidation for politicians, government and business, acting as a single team [45].

A license is an administrative legal act that determines the right of its holder to work on a deposit owned exclusively by the state on the terms set forth in the mandatory appendix to it. As a rule, these are the duties exclusively in the field of mining and geological aspects. The analysis of the current licensing form of relations shows the following:

- Mining companies operating in the countries with a high level of statehood work within the framework defined by the license agreement. In all countries there are additional agreements to the license, aimed at the participation of the subsoil user in the socio-economic development of the region in which the deposit is located.

- Additional requirements for tightening the ESG environmental and social principles are virtually absent from licenses, despite the fact that control over their compliance is one of the priority tasks of the owner of the field, i.e. the state. The lack of transparency and digital threshold indicators for their determination, ignoring the participation of representatives of local communities in determining the actual ESG indicators, insufficient level of competence of mining engineers and mining company management create the circumstances for formulation of additional requirements for the license user, usually related to payment of additional royalties to local communities.

- The licensing regime is most effective in countries that have competitive extractive companies and their own state mechanism for regulating their activities with a full range of supervisory functions. These include: assessment of the accuracy of the choice of exploration models and mining technologies; storage and reliability of cores obtained by the subsoil user, geological information and primary digital geophysical data; determination of qualitative and quantitative rent features of the field; determination of the timing of work on the field; ongoing control over the execution of the license; application of new advanced technologies; availability of personnel training system; use of safe technologies.

- Many countries, supporting national companies, establish certain benefits as part of additional license supplements, including the creation of jobs in low-margin fields, reduction in extraction taxes, or the creation of transport infrastructure for the company.

- The license agreement is most preferable for all countries that seek to ensure their own state sovereignty, comply with market admission mechanisms to conclude a subsoil use contract, have a framework law based on the norms of public law, and a favorable business climate.

Classical mineral concessions, as a civil legal regime of subsoil use, are the most widely used, since most of the states rich in mineral resources do not have their own investment capital and are largely dependent on loan obligations. Often these states do not even have primary geological information on their deposits. In fact, the subsoil users take on the responsibilities of the state, including exceptions to national regimes. There is no universal form for these contracts due to the fact that they contain a wide variety of reciprocal obligations. The most common are: concession agreement; license with civil law clauses; service agreement, risk-service agreement, lease; joint venture; production sharing agreement (PSA), a special form of concession that provides for the state to pay its obligations to the subsoil user not with money, but with the minerals extracted. The analysis of the impact of these regimes at the macroeconomic and microeconomic levels in weak and transitional economies shows that more than 90 percent of these countries use the individual civil law regime. Analysis of the effectiveness of its application for these states shows the following:

- Raw material concessions in their classic form are widely used by the countries with underdeveloped economies that are highly dependent on loans and creditors. There is no state mechanism of professional management of mineral resources, competent personnel, its own mining companies, transport infrastructure, and the ability to independently sell raw materials on the global commodity market and provide project lending. After a deposit is placed under concession by these countries, the subsoil user begins to make the promised payments, usually 2-5 years after the deposit is put into operation. The state, as a rule, receives minimal funds in the budget. Thus, the economies of most countries receive no more than 5 percent of the natural resource rent from the exploitation of deposits on the grounds that the minerals are exported to other countries and processed there into direct-use goods. The main natural resource rent unreasonably goes to the subsoil user.

- The commodities sector, despite huge risks, remains a highly liquid business. At the same time, the use of the civil-law regime creates a serious degree of conflict intensity, since there is an expectation of budget growth and social development within the public consciousness, but the concession does not meet the societal expectations of well-being.

- Commodity concessions are widely used when significant capital investment is required and the state is unable to take on either the role of an investor or the role of an effective manager. Often these are the facilities that require not only financial investments, but also the involvement of competent engineering personnel who can ensure the profitability of the project through the introduction of innovative technologies and training of personnel to work with them.

- A feature of the classic mineral concession is the creation of unfair conditions for access to subsoil due to additional requirements for the subsoil user, which create distrust in society towards the country's leadership.

- Concession in the form of a production sharing agreement in Russia led to the creation of the environment for competition between the license and contractual regimes of subsoil use. Russian experience in the management and regulation of PSA projects shows that this format of the agreement made it possible to attract foreign investors at a time when there were practically no financial injections into the country. But after a few years, there was a clear public understanding of the specific nature of such solution. Foreign investors were not committed to placing orders with domestic enterprises or employing local staff, including highly skilled engineers. They used only their own resources and suppliers, which nullified the prospects of a domestic core industry or the creation of new jobs. As a result, this regime was preserved only at a few fields; moreover, the amendments introduced under the pressure of the government practically create conditions for the creation of joint-stock companies on their basis, whose relations with the state will be regulated by license agreements.

- The “Golden share” regime is widely used to maintain control over the activities of foreign-owned mining companies during the transition period of the economy.

The overall analysis of the activities of mining companies, in view of the applied subsoil use regime , was carried out with the consideration of the tightening of the monetary policy of the International Monetary Fund, the World Bank and the European Central Bank. This created additional problems for countries with mineral-resource based economies, especially those using various forms of mineral concessions. An increase in key rates would put more pressure on their economies as debtors (it could be more than two trillion dollars a year) and scale up their dependence on external influence, leading to a debt crisis that would devaluate the currency of a debtor country.

The quality of geological information

The trend in the development of mineral resources is unrestricted exploitation of deposits and local communities by business. The current depletion of easily accessible mineral reserves is the result of profit motives and the lack of a public resource management strategy in most states. The importance of primary geological information provided by mining companies is underestimated by many countries and they do not have a significant impact on its evaluation. Classical mineral concessions largely ignore the very fact that it needs to be transferred to the state.

It is clear that the key to creating a favourable business climate and minimising human impact on the environment is the ability of the government and business to objectively assess the qualitative and quantitative characteristics of the deposit. It is also the basis for determining the boundaries of areas to be exploited; the rent to be paid for the exploitation of deposits; natural resource reserves; and the rational exploitation of subsoil resources.

Federal and regional authorities and financial and investment institutions are continually tighte-ning requirements for the reliability and validity of geological information. This trend a priori increases the amount of funding for mineral projects and increases the risks of such investments. In this regard the importance of a high level of independent and professional geo-economic evaluation of natural resource deposits is increasing, irrespective of the existing business model.

Expertise of reserves, including state expertise, as an integral part of controlling their accuracy and validity, is a mandatory element in the process of monetising natural capital and transforming it into natural, social and human capital. The reliability of these figures is subject to particular oversight in almost all industrialised countries. After all, mining companies use this data to raise capital on stock exchanges by issuing securities.

However, in many states, the functions of expertise are divided between different agencies, which do not contribute to the harmonisation of the sector. Often there is no clear delineation of the responsibilities and powers of various state institutions, which creates additional difficulties for business, does not contribute to the efficiency of state regulation and directly affects the reliability of estimates towards underestimation.

Uniform standards and rules governing the methodology of exploration and geological and economic examination of deposits and contributing to the international integration of enterprises can be developed and adopted solely on the basis of the results of an authoritative, streamlined system of state expertise. This includes classifying reserves and developing guidelines for their application that ensure that they are not abused in the case of excessive liberalisation of the economy and establishment of a fair rent for the exploitation of each specific mineral deposit.

Conclusions

Public opinion in all countries is unanimous that raw materials are the basis for the development of our and future civilisations. Their effective management requires the creation of a planetary environment of trust, transparent state regulation, and professional state action, based on a strategy for predicting progress and maximizing mineral productivity. The scale of the complexity and uncertainty of these challenges creates a societal need to develop new ways of thinking, identifying problems and addressing them. Mankind has specific strategic objectives: to prolong the period of exhaustion of easily accessible minerals, to provide technical and technological access to the deep- seated riches of the Earth. Their achievement faces the problems and challenges of the actively emer-ging unipolar global financial neoliberal ideology and economic liberalism, which, including through sanctions pressure on competitors, create an environment of distrust in the dollarization of global trade and reduce business confidence in protection of its investments. Moreover, new international financial elites influence public opinion through IT-technologies, in connection with which there is no common understanding in the society of the events taking place in the world, which accelerates its stratification. New scientific knowledge is not sufficient for the progress in this matter. The problems that many researchers deal with: the genesis of deep-seated hydrocarbons, the influence of thermodynamic processes of the Earth [32, 46], technologies of deep subsurface development [47-49], and problems of subsurface use [50-53], are comparable with humanity's conquest of space. For example, drilling parametric ultra-deep boreholes requires not just large investments, but also the pooling of new knowledge and resources that are in the hands of political and financial elites.

Our study has shown that existing technologies used in the mining industry, accumulated scientific knowledge allow us to argue that humanity's dependence on the ecosystem has decreased due to the extensive possibilities of converting energy and producing goods and services, mainly from minerals. However, the biosphere around us is being transformed by the man into an environment with “destroyed nature” by strengthening of financial neoliberal and liberal economic ideology, which is changing everyday life, mentality, and, to a large extent, society itself. Understanding that there is no dogma in modern science and using the empirical data and analysis gathered, we consider that it is important to involve a broader community of scientists in the study to develop an optimal model of state participation in governance, and bring the following conclusions for discussion:

- Countries with resource-based economies must play a special role in minimizing the environmental problems that arise during the exploitation of natural resources, consider the social and economic consequences of such operations, and look for new ways to increase the sustainability of the mining industry.

- State policy on the management of mineral resources should take into account an in-depth ana-lysis of case studies, as well as a spatial analysis of the organization of the dialogue between the government and extractive companies, a systematic analysis of the dynamics of the development of mineral-rich economies. Thus, most of the states with huge reserves of raw materials have weak economies due to the absence of an effective system of state regulation of the process of subsoil management.

- The global neoliberal financial and liberal economic ideology, which denies the need for state regulation in subsoil use, is creating a radically new moral order and debt-based economic regime. This increases distrust of the dollarization of international trade, reduces public confidence, worsens the business climate, reduces the level of investment protection and competition through the sanction mechanism.

- Virtually all of these countries use various forms of civil law contracts between the government and the subsoil user. The growth of these economies, based only on an increase in the market value of resources without simultaneous institutional changes, has no fundamental basis and causes serious contradictions in social relations within these states. The local population actively opposes the perceived impact on the biosphere, changes in sedentary habitation and habitat shaped by generations, requires greater involvement in decision-making on the admission of subsoil users to the fields, the development of infrastructure, and the allocation of monetary compensation. There are serious problems with trust in the activities of mining companies and control by the local population of compliance with the ESG principles

- One of the current trends in the global economy is the increasingly insistent demands for the implementation of ESG principles in the activities of mining companies. However, it does not take into account the strong influence of national governments on business activities, since more than 85 % of the world's mineral resources are in the hands of the states. In various countries, various forms of civil law contracts are being concluded, and social licenses are being actively implemented, which have an ambiguous impact both on relations in society and on the financial stability of business itself.

- The general trend in the development of legal relations between the state and extractive companies is aimed at strengthening the administrative and legal form with some civil law reservation clauses. The effectiveness of this mineral management policy is a serious subject of discussions and debates at the local and broader level.

The need to increase reserves, the growing demand for mineral resources, and the growing expectations of local communities towards operating companies require new approaches to state management of the process of working with deposits. Only active, professional, transparent activities of the government concerning the management of the entire complex of minerals will allow to ensure the stimulation of economic growth and job creation; to strengthen statehood and confidence in the mining companies; to ensure sustainable development and stabilization of social relations in the state. These policies are important not only in dealing with the deposits, but also in dealing with such wide-ranging issues as environmental diplomacy and increasing confidence of local population while providing access to mineral resources, which are often located in places where professional workers are absent and even armed conflicts take place.

References

- Ayuk E.T., Pedro A.M., Ekins P. et al. Mineral Resource Governance in the 21st Century: Gearing extractive industries towards sustainable development. Nairobi: International Resource Panel, United Nations Envio, 2020. URL: https://wedocs.unep.org/bitstream/handle/20.500.11822/31639/MR21.pdf?sequence=1&isAllowed=y (accessed 18.11.2022).

- Schleussner C., Rogelj J., Schaeffer M. et al. Science and policy characteristics of the paris agreement temperature goal. Nature Climate Change. 2016. Vol. 6, p. 827-835. DOI: 10.1038/nclimate3096

- Ali S.H., Giurco D., Arndt N. et al. Mineral supply for sustainable development requires resource governance. Nature. 2017. Vol. 543, p. 367-372. DOI: 10.1038/nature21359

- Conde M., Le Billon P. Why do some communities resist mining projects while others do not? Extractive Industries and Society. 2017. Vol. 4. Iss. 3, p. 681-697. DOI: 10.1016/j.exis.2017.04.00

- Auld G., Betsill M., Vandeveer S.D. Transnational governance for mining and the mineral lifecycle. Annual Reviews of Environment and Resources. 2018. Vol. 43. Iss. 1, p. 425-453. DOI: 10.1146/annurev-environ-102017-030223

- De Villiers C., Low M., Samkin G. The institutionalisation of mining company sustainability disclosures. Journal of Cleaner Production. 2014. Vol. 84. Iss. 1, p. 51-58. DOI: 10.1016/j.jclepro.2014.01.089

- Dutta T., Kim K-Н., Uchimiya M. et al. Global demand for rare earth resources and strategies for green mining. Environmental Research. 2016. Vol. 150, p. 182-190. DOI: 10.1016/j.envres.2016.05.052

- Hayes S.M., McCullough E.A. Critical minerals: A review of elemental trends in comprehensive criticality studies. Resources Policy. 2018. Vol. 59, p. 192-199. DOI: 10.1016/j.resourpol.2018.06.015

- Ediriweera A., Wiewiora A. Barriers and enablers of technology adoption in the mining industry. Resources Policy. 2021. Vol. 73. N 102188. DOI: 10.1016/j.resourpol.2021.102188

- Henckens M.L.C.M., van Ierland E.C., Driessen P.P.J., Worrell E. Mineral resources: Geological scarcity, market price trends, and future generations. Resources Policy. 2016. Vol. 49, p. 102-111. DOI: 10.1016/j.resourpol.2016.04.012

- Brockway P.E., Owen A., Brand-Correa L.I., Hardt L. Estimation of global final-stage energy-return-on-investment for fossil fuels with comparison to renewable energy sources. Nature Energy. 2019. Vol. 4. Iss. 7, p. 612-621. DOI: 10.1038/s41560-019-0425-z

- McWilliams A., Siegel D. Corporate social responsibility: A theory of the firm perspective. Academy of Management Review. 2001. Vol. 26. Iss. 1, p. 117-127. DOI: 10.5465/AMR.2001.4011987

- Friede G., Busch T., Bassen A. ESG and financial performance: Aggregated evidence from more than 2000 empirical studies. Journal of Sustainable Finance and Investment. 2015. Vol. 5. Iss. 4, p. 210-233. DOI: 10.1080/20430795.2015.1118917

- Hilson G. Corporate social responsibility in the extractive industries: Experiences from developing countries. Resources Policy. 2012. Vol. 37. Iss. 2, p. 131-137. DOI: 10.1016/j.resourpol.2012.01.002

- Garcia A.S., Mendes-Da-Silva W., Orsato R. Sensitive industries produce better ESG performance: Evidence from emerging markets. Journal of Cleaner Production. 2017. Vol. 150, p. 135-147. DOI: 10.1016/j.jclepro.2017.02.180

- Wang Z., Sarkis J. Corporate social responsibility governance, outcomes, and financial performance. Journal of Cleaner Production. 2017. Vol. 162, p. 1607-1616. DOI: 10.1016/j.jclepro.2017.06.142

- Parsons R., Lacey J., Moffat K. Maintaining legitimacy of a contested practice: How the minerals industry understands its “social licence to operate”. Resources Policy. 2014. Vol. 41, p. 83-90. DOI: 10.1016/j.resourpol.2014.04.002

- Ekins P., Hughes N., Brigenzu S. et al. Resource Efficiency: Potential and Economic Implications. Paris: Report of the International Resource Panel, United Nations Environment Program (UNEP), 2016. URL: https://www.researchgate.net/publication/315722176_Resource_Efficiency_Potential_and_Implications (accessed 18.11.2022).

- Alonso E., Sherman A.M., Wallington T.J. et al. Evaluating rare earth element availability: A case with revolutionary demand from clean technologies. Environmental Science and Technology. 2012. Vol. 46. Iss. 6, p. 3406-3414. DOI: 10.1021/es203518d

- Zepf V., Reller A., Rennie C. et al. Materials Critical to the Energy Industry. London: BP Publications, 2014, p. 84.

- Larcher D., Tarascon J. Towards greener and more sustainable batteries for electrical energy storage. Nature Chemistry. 2015. Vol. 7, p. 19-29. DOI: 10.1038/nchem.2085

- Vidal O., Goffé B., Arndt N. Metals for a low-carbon society. Nature Geoscience. 2013. Vol. 6, p. 894-896. DOI: 10.1038/ngeo1993

- Roche C., Sinclair L., Spencer R. et al. A mining legacies lens: From externalities to wellbeing in extractive industries. Extractive Industries and Society. 2021. Vol. 8. Iss. 3. DOI: 10.1016/j.exis.2021.100961

- Söderholm P., Svahn N. Mining, regional development and benefit-sharing in developed countries. Resources Policy. 2015. Vol. 45, p. 78-91. DOI: 10.1016/j.resourpol.2015.03.003

- Mercure J.-F., Pollitt H., Viñuales J.E. et al. Macroeconomic impact of stranded fossil fuel assets. Nature Climate Change. 2018. Vol. 8, p. 588-593. DOI: 10.1038/s41558-018-0182-1

- Bringezu S., Ramaswami A., Schandl H. et al. Assessing global resource use: A systems approach to resource efficiency and pollution reduction. Nairobi: Report of the International Resource Panel. United Nations Environment Programme, 2017. URL: https://wedocs.unep.org/bitstream/handle/20.500.11822/27432/resource_use.pdf?sequence=1 (accessed 18.11.2022).

- Bebbington A.J., Bury J.T. Institutional challenges for mining and sustainability in Peru. Proceedings of the National Aca-demy of Sciences of the United States of America. 2009. Vol. 106. Iss. 41, p. 17296-17301. DOI: 10.1073/pnas.0906057106

- Szablowski D. “Legal enclosure” and resource extraction: Territorial transformation through the enclosure of local and indigenous law. Extractive Industries and Society. 2019. Vol. 6. Iss. 3, p. 722-732. DOI: 10.1016/j.exis.2018.12.005

- Prno J. An analysis of factors leading to the establishment of a social licence to operate in the mining industry. Resources Policy. 2013. Vol. 38. Iss. 4, p. 577-590. DOI: 10.1016/j.resourpol.2013.09.010

- Thurber M.C., Hults D.R., Heller P.R.P. Exporting the “norwegian model”: The effect of administrative design on oil sector performance. Energy Policy. 2011. Vol. 39. Iss. 9, p. 5366-5378. DOI: 10.1016/j.enpol.2011.05.027

- Fertel C., Bahn O., Vaillancourt K., Waaub J. Canadian energy and climate policies: A SWOT analysis in search of fe-deral/provincial coherence. Energy Policy. 2013. Vol. 63, p. 1139-1150. DOI: 10.1016/j.enpol.2013.09.057

- Litvinenko V.S., Kozlov A.V., Stepanov V.A. Hydrocarbon potential of the Ural-African transcontinental oil and gas belt. Journal of Petroleum Exploration and Production Technology. 2017. Vol. 7, p. 1-9. DOI: 10.1007/s13202-016-0248-4

- Kinnear S., Ogden I. Planning the innovation agenda for sustainable development in resource regions: A central Queensland case study. Resources Policy. 2014. Vol. 39. P. 42-53. DOI: 10.1016/j.resourpol.2013.10.009

- Conde M. Resistance to mining: A review. Ecological Economics. 2017. Vol. 132, p. 80-90. DOI: 10.1016/j.ecolecon.2016.08.025

- Laforce M., Lapointe U., Lebuis V. Mining sector regulation in Quebec and Canada: Is a redefinition of asymmetrical relations possible? Studies in Political Economy. 2009. Vol. 84. Iss. 1, p. 47-78. DOI: 10.1080/19187033.2009.11675046

- Hajkowicz S.A., Heyenga S., Moffat K. The relationship between mining and socio-economic well being in Australia's regions. Resources Policy. 2011. Vol. 36. Iss. 1, p. 30-38. DOI: 10.1016/j.resourpol.2010.08.007

- Speth J., Haas P. Global Environmental Governance: Foundations of Contemporary Environmental Studies. Washington: Island Press, 2006, p. 192.

- Biermann F., Pattberg P. Global environmental governance: Taking stock, moving forward. Annual Review of Environment and Resources. 2008. Vol. 33, p. 277-294. DOI: 10.1146/annurev.environ.33.050707.085733

- Weiss T., Thakur R. Global Governance and the UN: An Unfinished Journey. Bloomington: Indiana University Press, 2010, p. 448.

- Nye J.S.Jr., Donahue J.D. Governance in a Globalizing World. Washington: Brookings Institution Press, 2000, p. 368.

- Hunter D., Salzman J., Zaelke D. International Environmental Law and Policy. Foundation Press, 2022, p. 1560.

- Morrison J., Roht-Arriaza N. Private and Quasi-Private Standard Setting. The Oxford Handbook of International Environmental Law. Oxford: Oxford Press, 2008. DOI: 10.1093/oxfordhb/9780199552153.013.0021

- Hudson M. The End of Western Civilization? // Ninth South Forum on Sustainability. The Collapse of Modern Civilization and the Future of Humanity 8 July – 12 August 2022, Lingnan, China. Lingnan University, 2022. URL: https://commons.ln.edu.hk/cgi/viewcontent.cgi?filename=0&article=1061&context=ln_gardeners_newsletter&type=additional (accessed 15.11.2022).

- Putin V.V. Mineral Resources in the Development Strategy for the Russian Economy. Journal of Mining Institute. 1999. Vol. 144, p. 3-9.

- NRCAN. Minerals and mining. 2022. URL: https://www.nrcan.gc.ca/our-natural-resources/minerals-mining/10858 (accessed 18.11.2022).

- Vasiliev E.A., Kozlov A.V. Hydrogen in Diamond and Thermal History of Crystals. Zapiski of Russian Mineralogical Society. 2018. Vol. 147. N. 6, p. 103-112. DOI: 10.30695/zrmo/2018.1476.05

- Litvinenko V.S., Dvoynikov M.V., Trushko V.L. Elaboration of a conceptual solution for the development of the arctic shelf from seasonally flooded coastal areas. International Journal of Mining Science and Technology. 2022. Vol. 32. Iss. 1, p. 113-119. DOI: 10.1016/j.ijmst.2021.09.010

- O’Connor C., Alexandrova T. The geological occurrence, mineralogy, and processing by flotation of platinum group minerals (PGMs) in South Africa and Russia. Minerals. 2021. Vol. 11. Iss. 1. N 54. DOI: 10.3390/min11010054

- Dvoynikov M.V., Sidorkin D.I., Kunshin A.A., Kovalev D.A. Development of hydraulic turbodrills for deep well drilling. Applied Sciences. 2021. Vol. 11. Iss. 16. N 7517. DOI: 10.3390/app11167517

- Golovina E., Pasternak S., Tsiglianu P., Tselischev N. Sustainable management of transboundary groundwater resources: Past and future. Sustainability. 2021. Vol. 13. Iss. 21. N 12102. DOI: 10.3390/su132112102

- Ponomarenko T.V., Nevskaya M.A., Marinina O.A. Complex use of mineral resources as a factor of the competitiveness of mining companies under the conditions of the global economy. International Journal of Mechanical Engineering and Technology. 2018. Vol. 9. Iss. 12, p. 1215-1223.

- Tsvetkova A., Katysheva E. Present problems of mineral and raw materials resources replenishment in Russia. International Multidisciplinary Scientific GeoConference Surveying Geology and Mining Ecology Management, 30 June – 6 July 2019, Albena, Bulgaria. SGEM, 2019. Vol. 19, p. 573-578. DOI: 10.5593/sgem2019/5.3/S21.072

- Zhukovskiy Y.L., Batueva D.E., Buldysko A.D. et al. Fossil energy in the framework of sustainable development: Analysis of prospects and development of forecast scenarios. Energies. 2021. Vol. 14. Iss. 17. N 5268. DOI: 10.3390/en14175268