Technological sovereignty of the Russian Federation fuel and energy complex

- Ph.D. Leading Researcher A.V.Topchiev Institute of Petrochemical Synthesis, RAS ▪ Orcid ▪ Elibrary ▪ Scopus ▪ ResearcherID

Abstract

The review to achieve technological sovereignty of the Russian fuel and energy complex (FEC) in the ongoing geopolitical situation is presented in the article. The main scope has been to identify the key technology development priorities, restrictions and internal resources to overcome these utilizing the developed by the author the innovative methodology that consists of novel approaches to calculate level of local content, digitalization, business continuity andinteractions with military-industrial complex. Some organizational changes have been proposed to intensify the development of hi-tech products for the FEC and related industries, including establishment of the state committee for science and technology and the project office of lead engineers for the critical missing technologies. Two successful examples to utilize the described in the paper methodology is presented: the first domestic hydraulic fracturing fleet and polycrystalline diamond compact cutter bit inserts.

Introduction

The Russian fuel and energy complex (FEC), which includes the oil and gas industry, the coal industry, and the electric power industry, fully satisfies the needs of the Russian economy. According to the results of 2021, 524.5 Mt of gas condensate and oil (43 % supplied to foreign consumers in the form of raw materials) and 762.8 billion m3 of gas (32 % supplied outside the Russian Federation) were produced. Drilling footage amounted to 27 million m, extraction of 439.5 million tons of coal (51 % supplied abroad), 1131 billion kWh electricity was generated (2 % of which was supplied abroad)1.

Russia is simultaneously a major producer, consumer, and exporter of all types of carbon energy resources and electricity. On average, about 20 % of the country's electricity generation comes from hydropower, 20 % from nuclear power, and just over 0.5 % (5.9 billion kWh) from non-traditional renewable energy sources [1]. In the Russian economy, the fuel and energy complex is the main customer for most other industries [2].

Maintaining hydrocarbon production at the current level, combined with an increase in the efficiency of their beneficial use and a gradual increase in the share of renewable energy sources in the country's energy balance, will ensure maximum social and industrial development of the entire Russian economy. A qualitative and subsequent quantitative increase in the volume of exports of energy resources with high added value is possible only through engineering and digital expansion [3], especially in the field of high-tech products for both traditional fuel and energy complex and non-traditional renewable energy [4].

The Energy Strategy of the Russian Federation sets tasks to maintain oil and gas condensate production at the level of 490-555 Mt until 2035.2 To accomplish this task, it is critically important to involve hard-to-recover reserves (HRR) of hydrocarbons in active development, to ensure the development of oil and gas production centres in extreme climatic and geographical conditions: in the north of the European part of the country, in the Caspian region, in Eastern Siberia, on the shelf of the Arctic and the Far East. The government has also set a target for increasing the oil recovery factor (ORF) from the current average of 25 % to 40 % by 2035, excluding hard-to-recover reserves. The estimated share of HRR in the total volume of oil and gas reserves as of May 2022 exceeded 66 %, 52 % of them with degraded reservoir properties. Consequently, the task of creating and developing domestic engineering solutions for the industrial development of HRR becomes urgent [5].

The oil refining industry, within the framework of public-private partnership, will face a large-scale modernization in the next 5-10 years: the reconstruction of many engineering units for the secondary processing of oil, as well as auxiliary units and off-site facilities. This work can be largely carried out by domestic developers and manufacturers, but a number of engineering processes in the Russian Federation, such as hydrocracking, steam methane reformation to produce hydrogen, and hydrotreatment of raw materials, have not yet been mastered [6].

It is necessary to continue efforts to create a domestic industry for the production and maintenance of liquefied natural gas terminals, gas carriers due to existing and potential restrictions on pipeline gas supplies [7].

In the coal industry in the last 5-10 years, mining and geological conditions for the development of existing and planned coal mines became more complicated. There is a need to modernize key assets and widely introduce multifunctional safety systems into the sector [8]. The dependence on foreign equipment in quarries and mines is much higher than in the electric power industry and the oil and gas industry [9].

In the traditional electric power industry, there remain the tasks of ensuring the independence of the power engineering, electrical and cable industries from foreign-made equipment, raw materials, and components, creating a digital unified trusted environment for interaction between the electric power industry entities, as the basis for risk-based management of strategic energy facilities of the Russian Federation. It is required to continue increasing the domestic technical component when implementing the existing state plans for the introduction of smart power supply systems in all regions of the Russian Federation until 2025 and beyond [10].

Fundamentally new technical and engineering challenges are facing the fuel and energy complex of the Russian Federation as part of the global energy transition [11] in the following areas: ubiquitous introduction of industrial energy storage systems at generating facilities [12], production and use of hydrogen, development of the domestic market for gas motor fuel, capture and use of greenhouse gases, creation of fundamentally new types of drives for a qualitative and quantitative increase in the energy efficiency of industrial systems, petrothermal energy, monitoring and stabilization of “permafrost”, which occupies more than 65 % of Russia [13].

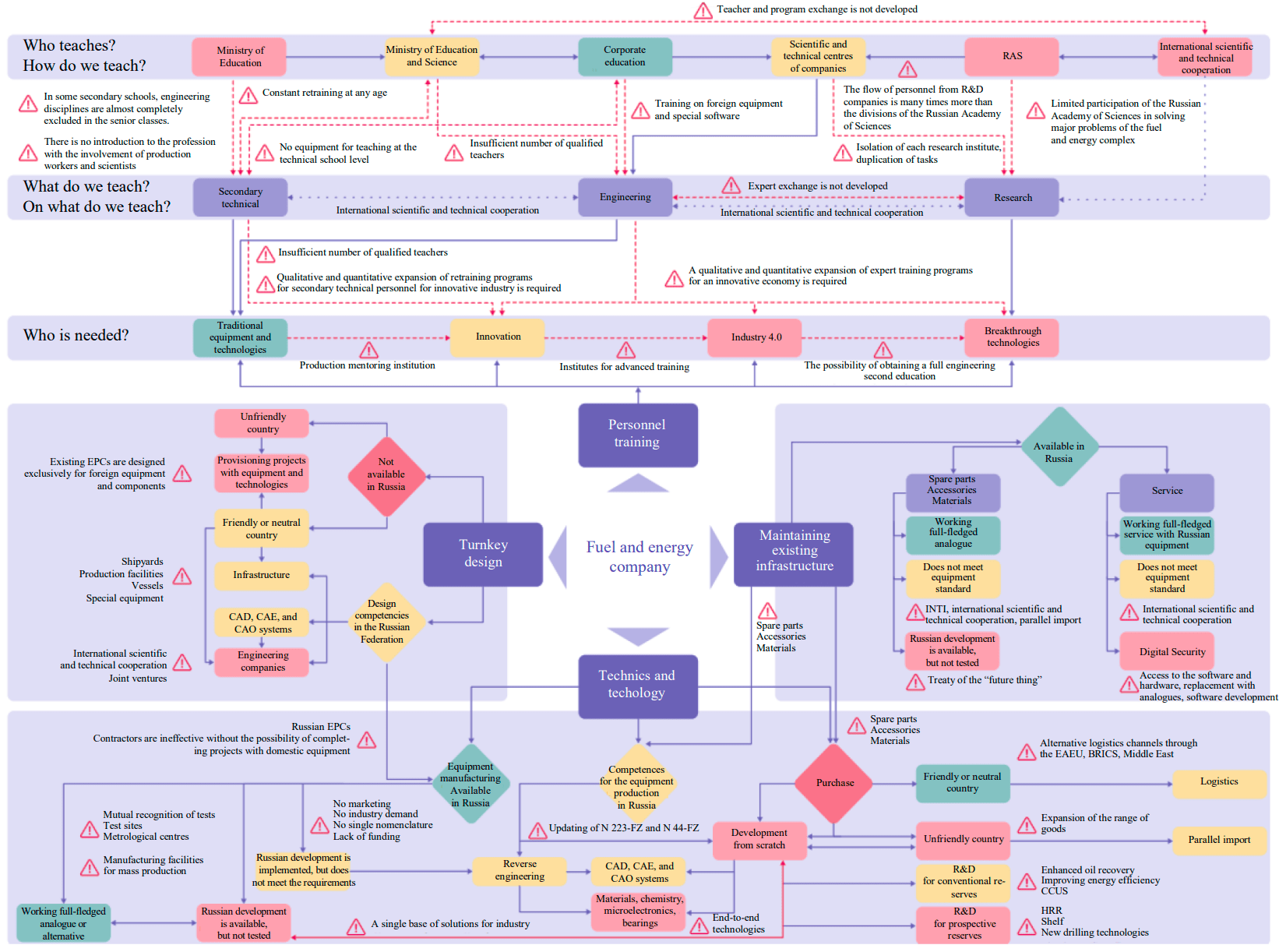

The key challenges for achieving technological sovereignty are shown in Fig.1.

Fig.1. Key challenges for achieving technological sovereignty

Technological independence: goals, objectives, research methods

The unifying goal of the integrated work carried out on systemic analytical methods to ensure the effective operation of the fuel and energy complex in the Russian Federation in the short and long term until 2050, the implementation of practical integrated and individual research and engineering projects is to substantiate the methodo-logy for formulating the fuel and energy complex strategy in cooperation with the chemical, metallurgical, electronic and electrical industries, transport engineering, and aerospace industry [14].

It is important to note that the fuel and energy complex strategy of the Russian Federation should be on the basis of a unified inter-industry technical policy in the fuel and energy complex, which allows technology consumers to set their priorities, manufacturers to predict potential demand for products and possible risks, science and engineering to plan current research and development programs. This requires solving a number of the following system tasks:

- To elaborate the main approaches to solving the problems of engineering development of the fuel and energy complex in the Russian Federation in the face of a decrease in imports of foreign technologies, equipment, and services.

- To determine priorities, objective prerequisites, and limitations for the engineering development of the fuel and energy sector based on system analysis.

- To develop and implement a methodology for calculating the digital maturity index for the fuel and energy sector.

- To substantiate the criteria for optimizing the interaction between the sectors of the fuel and energy complex and the defence industry complex (DIC) of Russia.

- To evaluate the results of the engineering development in the fuel and energy complex on the example of real projects.

- To determine the methods and level of state participation (tax incentives and loans, direct repayable and non-repayable subsidies) in the research and engineering development and infrastructure projects in the fuel and energy complex aimed at ensuring the technological sovereignty of the fuel and energy complex.

- To substantiate the main directions of personnel policy in the fuel and energy complex in the conditions of the fourth energy transition.

When conducting research, a systematic approach was used to study the problem of ensuring the technological sovereignty of the fuel and energy complex, including the analysis of data on the actual state of the oil and gas, coal, electric power and other related industries; methods for forecasting the prospects for the development of sectors, taking into account the dynamics of demand for the fuel and energy complex products; analysis of the state and changes in the resource base associated with the priority extraction of the most liquid reserves [15] and changes in the mining and geological conditions of their development, the challenges facing higher education in the training of experts; methods of digital processing of statistical data.

Geopolitical restrictions. At present, a ban on the supply of equipment for the fuel and energy complex from 48 unfriendly, but mainly industrialized countries – global suppliers of high-tech equipment and services is practically imposed. The work on the international hydrocarbon market of the vast majority of Russian energy companies is limited, financial restrictions are imposed on public and private companies in the fuel and energy complex.3

Domestic industrial companies, equipment manufacturers, service companies, and mineral developers themselves are experiencing difficulties due to disruptions in logistics supply chains, a significant increase in the cost of previously freely imported goods and services as part of a large number of projects of industrial collaboration, destruction of international industrial, engineering, and research cooperation.

It is indicative that Russia, which is one of the three largest world producers of energy resources, spends much less on research and development (R&D) than other industrialized countries. According to Rosstat, the volume of investments in R&D in the energy sector in the country for 2020 amounted to 140 billion roubles ($1.7 billion at the average exchange rate for 2020). On average, over the past 10 years, state spending on science has consistently amounted to about 1 % of GDP, which is several points lower than that of the first thirty countries in the Global Innovation Index 2021 [16]. The underfunding of domestic academic and, above all, applied science confirms the low percentage of Russia's contribution to R&D in terms of purchasing power parity, which lags behind the United States by more than 13 times, behind China by more than 12 times [17]. In this case, the calculations do not consider a large number of qualitative comparative indicators of science, providing access to research equipment and knowledge, basic schemes for the organization of science – bringing an idea to industrial implementation [18].

The solution to the problem of developing R&D in the fuel and energy sector in the future is possible through the qualitative and quantitative expansion of the research and technical area in the interstate association BRICS (Brazil, Russia, India, China, South Africa), which can transform solving problems in the R&D development of each of its member countries on parity mutually beneficial conditions with equal access to technologies due to their own significant production capacities and human resources [19, 20]: large sectors of oil and gas, power engineering, oilfield services in Russia, China, and Brazil, digital competencies of India, developed coal industry of South Africa, electric power industry and energy resources of Argentina, and technologies in the oil and gas processing and petrochemical industry of Iran [21].

Fig.2. Result of the 2021 survey “What impact will the introduction of new technologies have on your business?”

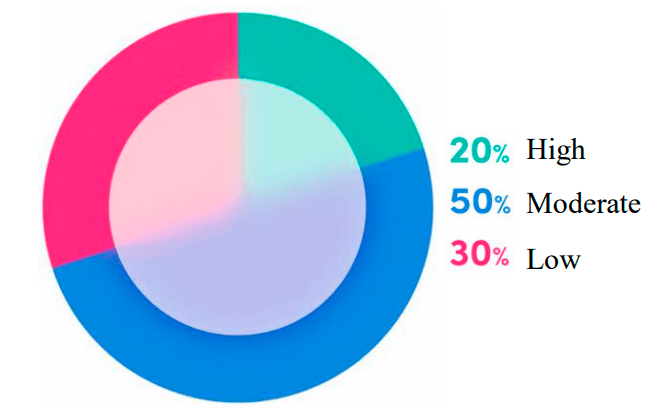

In 2021, the Competence Centre for Engineering Development of the Fuel and Energy Complex of the Federal State Budgetary Organization “Russian Energy Agency” of the Russian Ministry of Energy conducted industry surveys of 50 largest Russian fuel and energy companies from the oil and gas, electric power, and coal industries, designed to reflect the main engineering needs of each sector, as well as engineering development plans of enterprises until 2035, the possibility of import substitution in the major innovative areas and the readiness of enterprises for engineering cooperation. Companies were asked to evaluate 900 technologies in all traditional areas of the fuel and energy complex and choose the most relevant decarbonization technologies, including those in the field of hydrogen energy [22]. According to the survey, 80 % of fuel and energy companies do not consider technology as a necessary component of commercial success. The lack of economic motivation of corporations to innovate, a monopoly position in the relevant market segment does not require intensive investment in innovation (Fig.2).

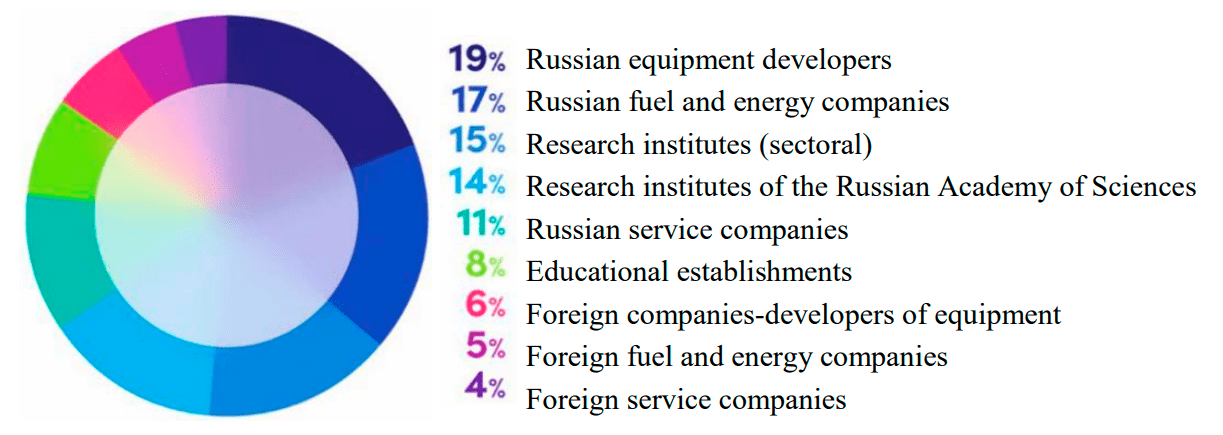

Moreover, almost 80 % of fuel and energy companies do not consider it possible to develop high-tech solutions together with Russian partners in academic institutions, universities, institutions that were originally designed to be at the forefront of engineering development, to generate, combine, and develop innovative engineering solutions. When developing new technologies, enterprises show the greatest interest in joint work directly with equipment developers – engineering and manufacturing companies within the framework of joint ventures or consortiums (Fig.3).

Fig.3. Result of the survey “Who is your company ready to cooperate with in the technology development?”

The share of Russia in the world market of high-tech products is less than 0.3 %. This suggests that the current economic model needs a modern competitive mechanism that stimulates innovation in the industry on a large scale [23, 24].

Thus, according to the Global Innovation Index 2020, Russia is in the 45th place in the world and 29th in Europe. Switzerland, Sweden, and the USA are in the top three, followed by Asian countries: South Korea in 5th, Singapore in 8th, China in 12th, Japan in 13th place. In the top twenty there is one country from the Middle East, Israel (15th place). Large dynamic low- and middle-income economies lag behind, including Turkey (41st), India (46th), Mexico (55th), Brazil (57th), Iran (60th place), South Africa (61st place), Saudi Arabia (66th place), and Indonesia (87th place).

Now the main task of large fuel and energy companies within the framework of the built-up market model of the economy is the business processes based on quickly found or more often existing solutions, as well as the use of services of foreign service companies to carry out critical types of work. Each large fuel and energy company out of more than thirty in the oil and gas industry, electric power industry, and coal industry has its own full-fledged research and engineering block employing research personnel, often leading employees who transferred from the Russian Academy of Sciences, hardware and software developers, design engineers, and as a rule, there are experimental and serial production. These research and engineering centres of companies, each of which is comparable in staff number to some institutes of the Russian Academy of Sciences, do not interact with each other enough. Based on the examples of world and Russian (Soviet) practice, it can be concluded that it is impossible to ensure the solution of state multidisciplinary research and technical problems within a single company.

At the state level in Russia, the main efforts are focused on import substitution of already created and applied technologies, as well as on the provision of various tax benefits and preferences in the mineral resource sector of the economy due to the deterioration in the quality of the traditional resource base4. Import substitution contains a wide range of disparate, often unrelated between federal executive bodies, repeatedly duplicating each other state measures to support the research and engineering deve-lopment of individual industries.

The key goal of the Russian fuel and energy complex in cooperation with the chemical, metallurgical, electronic and electrical industries, transport engineering, and aerospace industry is the prompt provision of technological sovereignty through research and engineering development, improvement and expansion of production capabilities.

The innovative development of the traditional fuel and energy complex is and will be the basis for the set goal: oil and gas industry, electric power industry, and coal industry, together with the mining and processing industry, are the financial guarantors of the economy, the main customers for most industries and at the same time sources of energy resources and main providers of tax revenues to the budget. Achieving technological sovereignty in the fuel and energy complex will ensure the technological sovereignty of the entire country’s industry for the next few decades through the creation and widespread introduction of domestic innovative technologies based on relevant applied research and engineering developments and the results of fundamental research in the oil and gas industry, electric power industry, nuclear and coal industries, including the entire mining and processing industry. The gradual transformation of traditional technologies will be a key driver for the practical phased energy transition of the Russian economy for the period until 2060.

Oil production from a peak of 561.2 Mt in 2019 and 524.5 Mt in 2021 may drop to 490 Mt or lower, while consumption is growing. To maintain oil production, it is already necessary to form new oil and gas production centres in Eastern Siberia, the Far East, and the Arctic zone of the Russian Federation, which ensure the development of the continental shelf of the Russian Federation, as well as the involvement in the development of a significant amount of HRR. All this is possible and economically justified only due to new innovative types of equipment and technologies, which are not currently available [25].

Gas production in 2021 amounted to 762.8 billion m3. An analysis of gas demand in the world shows that it will grow by about 20 % by 2040. Under the current research and technical policy of the fuel and energy complex, gas production in Russia by 2035 will at best reach 850 billion m3, which is only 10 % higher than the current figure.

The decline in oil and gas production will entail the decline of the oilfield services market, which currently employs more than 300 thousand qualified experts. The total volume of coal production by open pit and underground mining in 2021 was 325 and 113 Mt, respectively, and is also expected to decrease by 5-10 %.

In the long term until 2035, the demand for electricity will grow annually. Positive dynamics is possible due to the development of renewable energy, modernization of existing coal and gas gene rating equipment with an increase in the unit capacity of power plants, construction of new power plants: thermal power plants, nuclear power plants, hydroelectric power plants.

Electricity production indicators for 2021: 1131 billion kWh, of which 54.7 % are thermal power plants, 19.1 % hydroelectric power plants, 19.7 % nuclear power plants, 6 % autonomous power units, and 0.5 % renewable energy sources. Domestic electricity consumption in the Russian Federation is 1109 billion kWh. Given the current free capacity and subject to increased consumption along with the growth of industrial production and the economy as a whole, innovative energy-efficient technical solutions are already required.

A large number of end-to-end innovative technologies should ensure the fulfilment of the set research and technical goals in the fuel and energy complex:

- in metallurgy – creation of austenitic steels, steels operating simultaneously at pressures above 40 MPa and temperatures above 600 °С, a wide range of low-temperature steels for the Arctic infrastructure, equipment operating down to –60 °С, projects for the production and transportation of liquefied natural gas;

- in the chemical industry – creation of basic components for drilling fluids, fluids for enhanced oil recovery, innovative paints for industrial equipment, adhesives and sealants for the electronics industry, equipment operated in mines and wells, under high voltage and at critically low temperatures;

- in precision engineering – production of a critically important electronic components based on relatively modern processes (28-65 nm) and power electronics components, on the basis of which domestic software logic controllers and inverters will be created, equipment for high-speed transmission of a large amount of process data in downhole and mine conditions, a full production cycle of high-precision laboratory equipment for industry [26];

- in medium mechanical engineering – creation from scratch of a bearing industry, including in response to the needs of the oil and gas and coal industries, electric power industry, mining and processing industry, shipbuilding, railway transport, partially motor transport, mass production of consumable components for machine tools, creation of processing robotic centres.

Key elements for achieving technological sovereignty of fuel and energy sectors

A unified intersectoral technical policy in the fuel and energy complex would allow technology consumers to form their priorities, manufacturers to understand the potential demand for their products and risks, science and engineering to plan research and development programs [27].

Only by becoming a direct participant in fuel and energy projects as a coordinator of research and engineering development with appropriate powers and a level of direct responsibility for the final research and engineering result, the Government will be able not only to ensure in the next five years the technological independence of the Russian fuel and energy complex5, which is acceptable in the new geopolitical realities, but also in the future in 10-15 years to determine the technical policy in a number of areas at the international level within the framework of friendly associations [28, 29].

Achieving the required level of response to challenges for the fuel and energy complex in the current conditions is possible only through the full implementation of the goal of technological sovereignty, which consists of a number of interrelated tasks.

First of all, it should be noted that in Russia there is no unified approach to assessing the level of localization of equipment for the needs of the fuel and energy complex; there is no clear understanding of how the share of imports is calculated, what methodology is used to calculate what is included in the import component [30].

In the Russian Federation, there are more than 100 government decrees, laws, regulations and even more protocols that in one way or another regulate the local policy. The main one is considered to be the Decree of the Government of the Russian Federation dated 17 July 2015 N 7196, confirming the production of certain types of products in Russia.

In the fuel and energy sector for 2022, there are different expert points of view on the calculating the localization level. The choice of methodology for the calculation remains with the company or the authorities, and approaches to the calculation of the import component vary greatly. As a result, in the corporate plans of fuel and energy companies, the vast majority of the achieved indicators of the import substitution level are consistently above 90 %, which often cannot be verified and is not consistent with reality.

In particular, some companies that declare the use of 100 % domestic pipe products do not consider that the raw materials for smelting individual pipes (used in the Far North) are not produced in Russia. In the vast majority of cases, equipment that uses an electronic component base is only assembled in Russia. These indicators are achieved by performing the calculation in accordance with the requirements of Decree N 719, as well as the internal methods of companies. The indicated level of localization does not always include data on final contractors, who, when performing work, may use foreign personnel, technologies and equipment, foreign software, which may lead to biased assessment results.

Accordingly, as a basis for assessing an adequate level of localization, it is necessary to introduce a new unified universal methodology for calculating the level of localization of products, services, and software for the fuel and energy complex produced in the Russian Federation.

The proposed methodology, unlike the current methodology adopted in Decree N 719, is not based on a scoring system. The basic formula for calculating the level of product localization consists of calculations for each cost item involved in the value chain of products:

- basic raw materials, materials and components;

- overhead costs;

- services of contractors and individuals;

- depreciation of key assets;

- expenses for software, registration of the results of intellectual activity, licenses, patents, etc.;

- wages and deductions to the payroll fund;

- energy costs.

For a successfully implemented unified methodology for calculating the level of localization, it is necessary to have independent audit organizations both in the regions and at the federal level, which will be entitled to periodically monitor the calculation of the import substitution level.

The second significant systemic point for ensuring the basis for engineering development and technological sovereignty of the fuel and energy complex is that companies do not have either a single for the industry or an individual mechanism for developing plans to ensure business continuity, which the Government of Russia directly faced both in 2014 and in 2022, manually solving most of the tasks to prevent the shutdown of key industries and services [31].

The presence of proven plans for determining the risks of business continuity, together with the development of measures for prompt response within a single company, would allow companies in most cases in the current geopolitical environment to be ready for changes in established supply chains, disruption of financial transactions, unilateral denunciation of contractual relations, as well as for advance preparation of plans for the diversification of suppliers in a number of key areas to ensure the conduct of the core business (equipment, services, spare parts, etc.).

In the electric power industry, slightly more than a quarter of companies have implemented their own business continuity management systems, in the oil and gas industry, about 16 % [30, 31]. However, a large number of organizations are planning to build internal processes within three to five years, mainly because of the real danger of cyber threats. At present, the practical possibility of committing systemic sabotage has been added. Such low implementation rates are due, among other things, to the lack of uniform requirements from regulatory authorities. Due to the lack of a single mechanism and uniform requirements for the functioning of business continuity management systems used within most fuel and energy companies, the management of the company and the state can often form an incorrect idea of the current situation and development prospects in the context of rapidly changing world economic and political realities. The current GOST R ISO 22301-2014 “Business continuity management systems” does not meet the modern requirements of Russian business and is practically not used.

To solve this problem on a national level, it is necessary to create a mechanism and a modern regulatory framework to ensure an independent audit of the level of import dependence and stress testing of the continuous operation of fuel and energy companies, the vast majority of which operate hazardous production facilities and critical information infrastructure.

The third key task of providing the basis for engineering development and technological sovereignty of the fuel and energy complex is the consolidation of industry demand. Systematic automated work on collecting needs according to a single methodology, form, through a single federal window on the basis of the Coordination Centre under the Government of the Russian Federation will allow, simultaneously with the consolidation of industry demand, to unify the range of equipment, materials, components that are needed by the fuel and energy complex. Without the unification of the materials and components used, it is impossible to achieve a wide introduction of own developments in the fuel and energy complex in a single country.

The basis for solving the problem of consolidating industry demand should be a systematic analysis of the mineral resource base and the state of the energy infrastructure in the country. According to the assessment, if the state continues to work with the research, engineering, and industrial sectors of the fuel and energy complex within the framework of the existing format and procedures, maintaining the main indicators of the fuel and energy complex based on the results of 2021 by 2035 will be a difficult task.

The fourth task, the creation of any high-tech products in the fuel and energy complex, depends on the development and level of dependence on imports in related industries of basic end-to-end technologies: machine tool industry; precision engineering; secondary engineering; chemical industry, and power engineering.

The fifth target block is related to the standardization of production, which includes a number of tasks from industry-specific testing methods for equipment and technologies, along with ensuring mutual recognition of tests, creation and coordination of the work of distributed industry-specific testing centres, a metrological base, together with relevant institutions that ensure the functioning of federal and regional metrological centres of the fuel and energy complex, to the system of Russian standards harmonized with international ones.

One of the key priorities in the fifth block is the unification of the work of Rosstandart of Russia, Rostekhnadzor of Russia, the Customs Union of the Eurasian Economic Union, ANO “Institute for Oil and Gas Technological Initiatives” (INTI) in the oil and gas industry, electric power, coal and mining and metallurgical industries, as well as the development of agreements on the unification of national and supranational standards with the bodies responsible for standardization of the BRICS member countries. It is required to intensify the development of research and engineering cooperation, including a joint, end-to-end system of standardization and certification with the countries in the BRICS, the Middle East, Africa in the context of the gradual replacement or equal use of INTI and American Petroleum Institute (API) standards in most countries of the world with a developed fuel and energy complex.

Ultimately, implementation of the fifth block of tasks should result in a well-established unified procedure for the creation by Russian companies, along with foreign partners, of industry-specific testing methods for new equipment, services, materials, followed by testing at accredited test sites within the framework of the BRICS and acceptance of the work results by the interdepartmental industry commission, the conclusion of which will be accepted by all industry participants, both in Russia and in friendly countries [32]. A conditional developer, an innovative engineering company will be relieved of a large number of duplicating works, which will lead to a reduction in R&D time, an accelerated bringing a new engineering product to a wide market, and a reduction in the cost of development and creation of a pilot sample.

The sixth point is to eliminate the complexity of introducing domestic equipment into real production. It is important to note that for research, engineering, manufacturing, and service companies fulfilling orders for the needs of fuel and energy organizations, both with state participation and private companies, the priority task is to expand the practice of customers using a standard form of a contract for the supply of a future thing with fixed provisions on the need for relevant products for a period of up to 5 years, while ensuring the initially specified technical specifications and provided that there are no available analogues on the market. The contract of the future thing should allow companies entering the market with fundamentally new solutions to ensure the process of creating equipment/technology from an idea to the release of a serial sample under more loyal banking conditions.

As part of the contract for the supply of the future thing, the state should support for the risk insurance of developers when introducing new high-tech Russian solutions that do not have practical examples of implementation in production. It is also important to legally ensure the possibility of accelerated depreciation of operating foreign engineering solutions at domestic enterprises in order to attract additional funds to replace them before the expiration of the calendar time of service. It is also critical to link state support for the new innovative solutions in the fuel and energy complex with the introduction of Russian technical and engineering products. For example, benefits for the development of deposits with hard-to-recover reserves should be directly linked to the equipment, services, software for geological exploration, construction and development of wells, exploitation and transportation of hydrocarbons that are being introduced and used.

The seventh point concerns the importance of creating regional centres for engineering deve-lopment, import advancement along with federal structures – regional research and technical councils, which would promptly supplement the maps of industrial competencies of the regions and become an important link in creating systems of interregional cooperation between private and state innovative companies from start-ups to large holdings [33]. Detailed competency maps of each participant in innovation activity, small innovative enterprises at higher educational institutions of the Ministry of Education and Science of Russia, academic institutes of the Russian Academy of Sciences, sectoral private and public institutions, engineering companies, manufacturing and service enterprises should be promptly entered into the State Information System of Industry, GISP [34].

The state technical policy in the fuel and energy complex will allow technology consumers to form their priorities, manufacturers to understand the potential demand for their products and risks, science and engineering to plan research and development programs, as well as set tasks, in addition to all sectors of the fuel and energy complex, a large number of related industries in Russia, to combine all existing and targeted plans for import substitution, work plans for fundamental and applied science in the field of energy, oil and gas industry, and coal industry. The fuel and energy complex should become a base, a litmus indicator for the creation in the country of end-to-end high-tech industries for the production of components, materials, machinery, and equipment to ensure the smooth operation of energy companies and all industries without exception: bearings, magnets, semifinished metallurgical products, means of production, electronic equipment, specialized software for the needs of mechanical engineering (CAD7, CAE8, and CAO9 systems), chemical raw materials, rare and rare earth materials.

In order to practically ensure the technological independence of the fuel and energy complex, the state needs to return to direct participation in the research and engineering development of the fuel and energy complex, the key production sector in the Russian economy in terms of volume, given the breadth of coverage of related industries in the short term to ensure and potentially increase the planned pace growth of industrial production at a level of at least 2.4 % in 2023 and 2.2 % in 2024 in Russia as a whole.

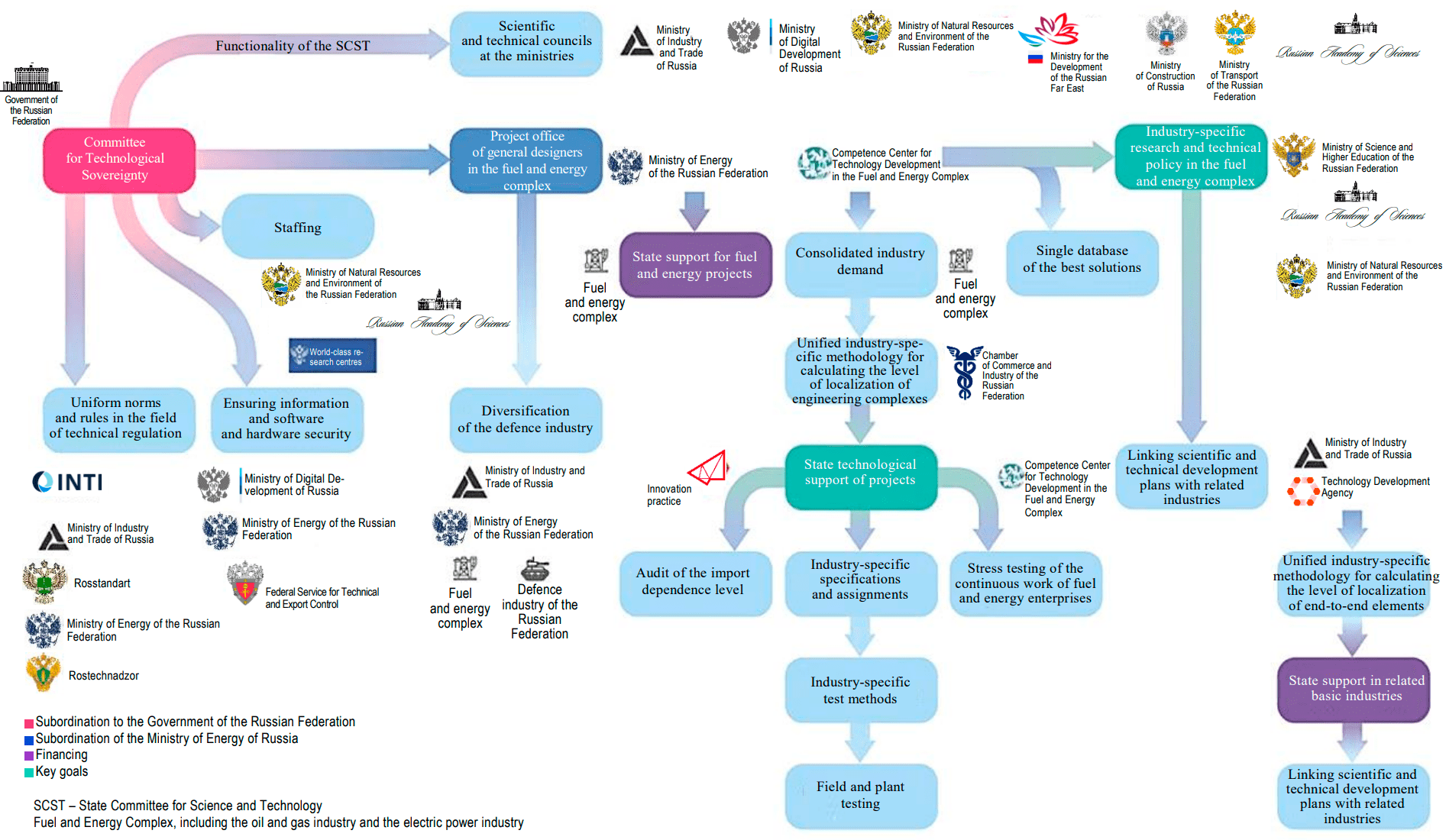

It is proposed to create a coordinating body under the Government of Russia (Fig. 4) to achieve the technological sovereignty of the industry and a project office of general designers in the fuel and energy complex under the Ministry of Energy of Russia to ensure import independence and import advancement in the oil and gas, electric power, coal industries, and a large number of related industrial sectors with the definition of appropriate powers and deadlines for the following tasks:

- Determination of detailed consolidated industry demand in high-tech products of the fuel and energy complex.

- Creation and implementation of a unified industry methodology for calculating the level of import dependence.

- Creation of an independent audit of the import dependence level and stress testing of the continuous functioning of the fuel and energy complex, state engineering support for projects for the creation of high-tech products.

- Development of industry-specific research and technical policy for the fuel and energy complex and matching plans for research and engineering development and import substitution with related sectoral documents.

- Preparation of generalized industry specifications, test methods for equipment and technologies.

- Conducting field and plant tests, the results of which will be recognized by all participants in the domestic fuel and energy market.

- Creation of a unified database of the best industry solutions.

- Practical diversification of production capacities in defence enterprises in the interests of fuel and energy companies.

- Systematic attraction of highly qualified research, technical, and production personnel on the side of state executive authorities to research and engineering development projects, infrastructure projects in the fuel and energy complex, with any level of state participation, from tax incentives and loans to direct repayable and non-repayable subsidies [8].

It should be noted separately that in order to solve administrative and financial problems when organizing a coordinating body under the Government of Russia to achieve the technological sove-reignty of the industry and the project office of general designers in the fuel and energy complex, there is a significant untapped potential to continue the restructuring of existing industrial development institutions, carried out at the end of 202010.

The joint work of the state, industry, business, and science should result in priority serial innovative solutions in engineering and technology to ensure technological sovereignty, rational, effective development of domestic mineral resource base, and implementation of a gradual complementary energy transition in general for the entire Russian economy, namely:

Fig.4. Organizational structure of development institutions to ensure technological sovereignty

- Technologies that increase energy efficiency – digital technologies for traditional complex energy-saturated systems used in the fuel and energy complex, including for the oil and gas complex: drilling rig 2.0 – a robotic drilling facilities [35], electricintroduction of permanent magnet motors in all engineering systems, technologies for the development of hard-to-recover reserves that have no analogues in the world, the widespread use of electric energy storage systems, coupled with the power supply of autonomous targets due to gas-piston generator sets, in combination with efficient industrial energy storage systems, the development and the use of LNG mini-plants for the reclamation of new areas.

- The use of energy-efficient robotic and digital engineering systems in drilling, along with the introduction of new hydrocarbon production technologies, should ensure the fulfilment of the tasks set in the Energy Strategy of the Russian Federation until 2035 to maintain the current high levels of oil production in the Russian Federation for the long term. This should be achieved by increasing the oil recovery factor (ORF) at operating oil fields up to 40 % within 15 years, starting a wide industrial development of low-yield fields and ensuring cost-effective production of hard-to-recover heavy oil from low-permeability formations, from great depths, on the shelf of the Arctic seas [36].

- Specialized software plays an increasingly significant role in the transformation of the oil and gas industry. Without it, it is impossible to solve the problems of producing hydrocarbon raw materials and implementing import substitution plans [37]. Modules with elements of artificial intelligence are beginning to be used in modern software [38], in particular, to optimize the prospecting and exploration of deposits, determine the reservoir properties, plan well designs, optimize the drilling process, simulate hydraulic fracturing, optimize oil production, analyse risks in development design.

- One of the directions of the world economy decarbonization is hydrogen energy technologies, which received an additional impetus for development in connection with the climate agenda and the desire of the countries of the world to move to a low-carbon economy [39, 40]11. By 2050, according to various estimates, the share of hydrogen in the global energy balance can increase many times and reach from 4 to 24 % of final energy consumption12. For Russia, in addition to hydrogen energy technologies within the framework of decarbonization, it is worth separately highlighting the prospects for petroenergy, primarily due to high competencies in the field of well construction [41].

- The predicted long-term preservation of a significant role in the energy and chemical industries of fossil carbonaceous raw materials makes the technologies for capturing, storing, and using carbon dioxide one of the most important ways to reduce emissions [42]. Traditionally, CO2 storage techno-logies included injecting it into various types of geological reservoirs, such as salt storage, exhausted formations after oil recovery, coal seam storage, etc. There are many geological systems that naturally capture CO2 and store it for thousands of years. In addition, the oil and gas industry has long used CO2 to enhance oil recovery.

In order to ensure personnel training as the basis of any research and engineering development, including teacher training, updating training programs and tools, including the use of production equipment, it is necessary to determine and regulate the participation of energy companies and all subsoil users without exception in the financing of research and engineering solutions and developments, from fundamental scientific research to the training of innovative engineering and technical personnel, production of new types of machinery and equipment at domestic enterprises, increasing the expert role of state research institutions in the real sectors of the economy.

Approbation of individual elements of the methodology for ensuring technological sovereignty

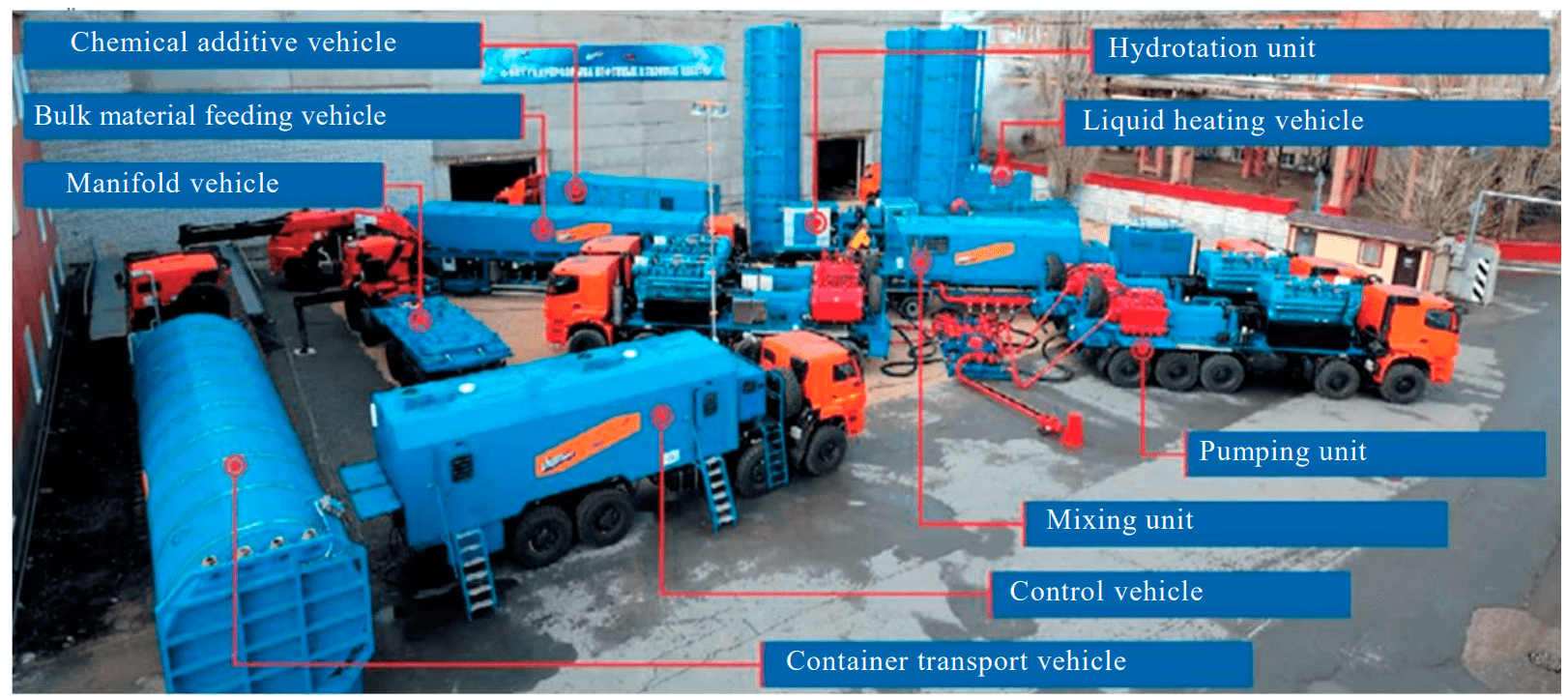

In 2019, with the support of the Government of Russia14, a project was launched to create a domestic fleet for hydraulic fracturing. Considering the industry specification, the architecture of the hydraulic fracturing fleet was developed, with respect to the climatic and geographical features of operation [43]. The hydraulic fracturing fleet being developed is intended for work on continental oil and gas fields, including in Arctic conditions. Self-propelled fleet pumping units designed on a special chassis are unique. It is traditional to place pumping units with a capacity of 2000 kW on an automobile trawl, which significantly reduces the cross-country performance of the fleet, especially in spring and autumn thaw conditions. The self-propelled execution of all units of hydraulic fracturing fleet equipment makes it possible to increase the efficiency of using the fleet by reducing the time for mobilizing equipment to wells, and the efficiency of movement along field roads. The expected increase in production in the fleet is up to 30 % (on average, from 10 to 13-15 operations per month).

In 2020-2021 a prototype of the hydraulic fracturing fleet was produced (Fig.5). More than 1,000 domestic enterprises, including those of the defence industrial complex, joined the fleet creation cooperation. A specialized software and hardware complex was developed to manage the fleet from a single command centre. The level of fleet localization exceeds 80 %.

For a comprehensive test of a prototype hydraulic fracturing fleet in 2021, an industry test methodology was developed and approved by oilfield service companies, aimed at testing all functions and operating modes of the complex. In 2022, bench tests of the hydraulic fracturing fleet are being completed at the first domestic unique test bench for full-scale testing of hydraulic fracturing equipment samples, as well as bench tests of the hydraulic fracturing fleet in Volgograd at the production site of AO Federal Research and Production Centre “Titan-Barrikada”.

In 2023, it is planned to conduct field tests of an experimental hydraulic fracturing fleet at oil and gas fields in the Khanty-Mansiysk Autonomous Okrug at the Yuzhno-Priobskoye field. To this end, cooperation was established between an oilfield service company and a vertically integrated oil company, candidate wells are being identified, design work is underway to prepare hydraulic fracturing injection programs.

The timely launch of the production of domestic hydraulic fracturing fleets will fully satisfy the need of the domestic oilfield service in new complexes for the development of continental oil and gas fields. The total market for new hydraulic fracturing fleets by 2030 will be 40 fleets (50 billion roubles). The commissioning of highly mobile hydraulic fracturing complexes will make it possible to accelerate the commissioning of new wells with planned flow rates, to carry out the timely development of hard-to-recover reserves, and to achieve the goals for oil and gas production enshrined in the Energy Strategy of the Russian Federation.14

Fig.5. Units of a prototype hydraulic fracturing fleet

Another example of a particular application of the methodology for ensuring technological so vereignty is the ongoing project on carbide cutters for rock cutting tools (bits, calibrators, etc.), which is mainly used in drilling exploration and production wells for oil and gas. The bit service market in the Russian Federation (including the production of new bits) is about 50 billion roubles per year, about 20 % of the new well stock. Considering the growth of wells with horizontal completion in the total number of wells under construction per year and the intensive development of HRR, the market is expected to grow by 60-70 % by 2030, up to 80 billion roubles. Bit armament – bit cutters are partially produced in Russia. The import dependence of the Russian industry for the production of bits for premium cutters with high mechanical, strength, and rock-cutting properties is 100 %.

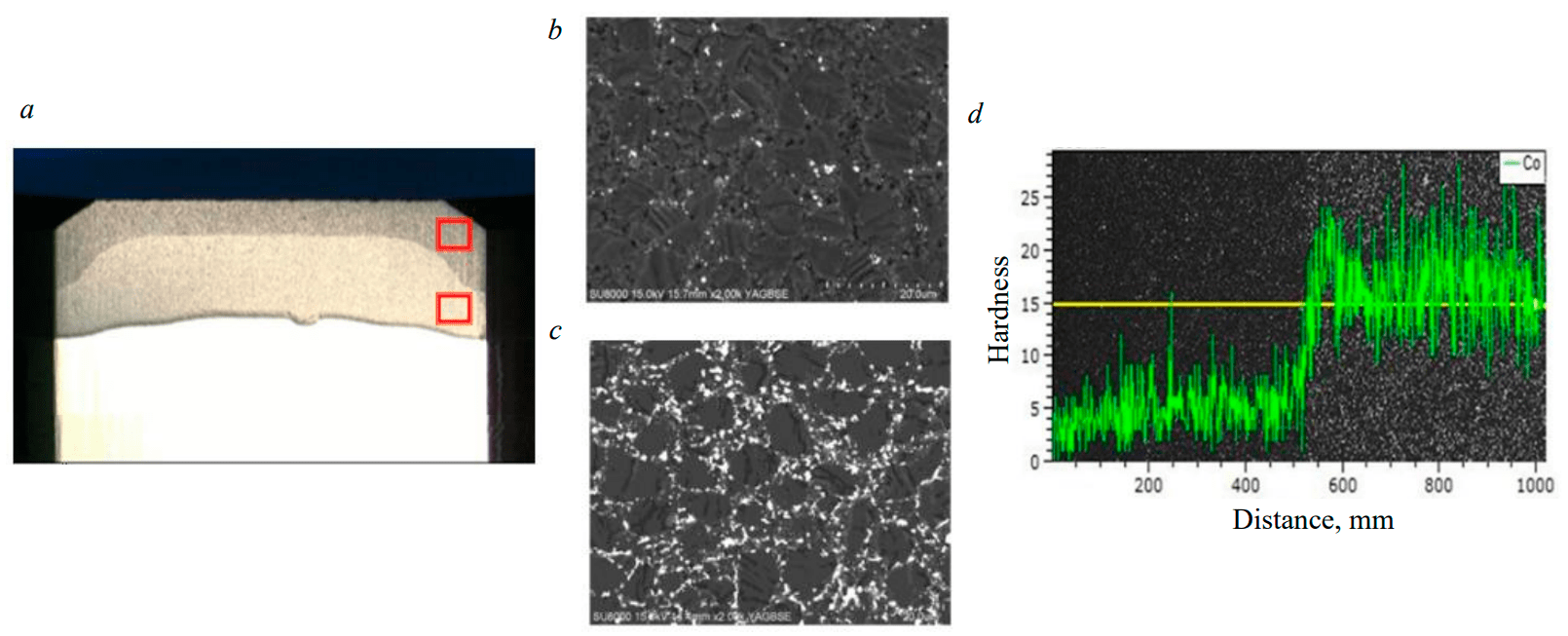

In 2020, in order to solve the problem of launching the production of premium PDC cutters, with the support of the Russian Government, a consortium of interested enterprises was created, which included an enterprise of the defence industrial complex from the Kurgan Region and a leading federal research institute.

Together with leading domestic bit companies, we developed industry-specific technical requirements. In 2020-2021 the fundamental principles for the chemical processing of hard alloys were worked out, the modes of sintering mixtures, and the requirements for raw materials were confirmed. A pilot laboratory process was developed for the production of pilot batches and confirmation of product properties. In 2021, an experimental site was created for the production of pilot batches of cutters, which provides a full range of development work to enter a serial product. A fundamentally new for domestic production stage for the manufacture of hard-alloy plates was introduced – chemical processing of hard-alloy plates by leaching under certain conditions (Fig. 6); leaching removes cobalt inclusions between the synthesized diamond grains.

In 2022, PDC cutters were obtained with the following characteristics: geometric dimensions Æ 13.44´δ8 mm and Æ 15.88´δ8 mm; thickness of the diamond layer 0.5-2.5 mm; wear resistance 0.30 mg/kg; hardness of the diamond layer 100 GPa; compressive strength 1.4 GPa; bending strength 1.25-1.3 GPa; crack resistance 6.0 MPa m1/2; cost price is 25-30 % lower than foreign analogues.

Carbide cutters were tested in accordance with the world's leading ASTM and API methods. In 2022, pilot tests of premium domestic PDC cutters were carried out at two wells in the Yamalo-Nenets Autonomous District. A project for mass production of PDC cutters was developed to cover 75 % of the market by 2024 with a planned reduction in the cost of cutters production by 25-30 % when entering mass production. With a market share in the Russian Federation of 75 %, the expected effect for bit service enterprises will be over 500 million roubles in year.

Fig.6. Process of improving the thermal stability of the cutting insert by leaching: a – general view of the cutter; b – area without etching; c – area after etching; d – change in hardness after treatment by leaching

Conclusion

The Russian fuel and energy complex is faced with the task of maintaining the volume of oil and gas condensate production at a level of at least 490 Mt until 2035, achieving the volume of production of liquefied natural gas of at least 80 Mt, and reducing the index of the average duration of outages in the power supply system to 2.23 h, the development of new sectors, including hydrogen energy and others, which together should become the basis for the stable growth of the entire Russian economy. Without engineering development within the country, the practical participation of federal executive authorities in industrial projects at the level of highly qualified engineering and technical production experts, ranging from fundamental, applied science to the extraction and processing of proper valuable raw materials and the production of end-to-end high-tech elements, these indicators in the conditions of the current world state of affairs are unattainable [44].

By the end of 2022, the following results were achieved, the expansion, replication, and implementation of which in the domestic fuel and energy complex and end-to-end industries will ensure by 2035 technological sovereignty in the energy sector of the Russian Federation from the prospecting and exploration of energy resources, rational development, and their application to the sale of products on their base around the world:

- The methodology for the formation of the strategy in the fuel and energy complex of the Russian Federation is substantiated when creating, in cooperation with the basic sectors, of Russian technologies and equipment sufficient to ensure the technological independence of the Russian Federation from foreign developments in critical areas.

- The priorities, objective prerequisites, and limitations of the engineering development in the sectors of the fuel and energy complex of the Russian Federation are determined.

- The methods and degree of state participation in the projects of research and engineering development of the fuel and energy complex aimed at ensuring the technological sovereignty of the fuel and energy complex of the Russian Federation are substantiated.

- Comprehensive work was carried out to create an industry-specific technical policy for the fuel and energy complex, a fundamental system document as a detailed continuation of the Energy Policy of the Russian Federation until 2035. Key technologies that will be in demand in the long term are described with a detailed disclosure of trends in global and domestic fuel and energy complexes (transition to Industry 4.0, decarbonization, energy efficiency, etc.).

- Several dozen industry technical requirements and tasks were prepared, some of which have already fundamentally influenced or continue to influence the criteria for the engineering development of the fuel and energy complex in the field of construction and completion of wells, development and operation of fields, development of the Arctic shelf, oil refining, power and microelectronics, specialized software for the fuel and energy complex, hydrogen energy, systems for the Earth remote sensing in the interests of the fuel and energy complex.

- Industry-specific feasibility criteria were established for a number of projects. Technical specifications were prepared, new technical solutions were implemented, equipment and technology testing procedures were prepared, field and factory tests were carried out: non-magnetic steel for the needs of the oil and gas industry, hydraulic fracturing fleet, electric energy storage system, downhole accelerometer, project of a smart plant producing components for centrifugal pumps, hardware complex for monitoring the level of organochlorine compounds, specialized IGBT module for power electronics.

- As part of the systematic work to diversify the production capacities of defence enterprises in the interests of electric power, oil and gas, oilfield services and coal companies, an algorithm for holding field events at production facilities was developed and implemented to put into operation joint projects of fuel and energy companies and defence enterprises.

1 Central Dispatch Department of Fuel and Energy Complex (CDU TEK). URL (accessed 01.12.2022).

2 Decree of the Government of the Russian Federation of 09.06.2020 N 1523-r (on approval of the Energy Strategy of Russia until 2035).

3 Guide to sanctions and restrictions against the Russian Federation (after 22 February 2022). URL (accessed 01.12.2022).

4 Minutes of the meeting of the Project Committee of the Federal Project dated 22 September 2021 N 1 chaired by the Deputy Prime Minister of the Russian Federation A.V.Novak.

5 Litvinenko V.S. The state as a customer for the achievement of technological sovereignty. Vedomosti, 30.11.2022 URL (accessed 01.12.2022).

6 Decree of the Government of the Russian Federation of 17 July 2015 N 719 “On confirmation of the production of industrial products in the Russian Federation”.

7 CAD (Computer Aided Design) – computer-aided design systems.

8 CAE (Computer Aided Engineering) – systems for automated engineering calculations.

9 CAO (Computer Aided Optimization) – systems for designing optimization technologies.

10 Decree of the Government of the Russian Federation of 31 December 2020 N 3710-r (as amended on 24 March 2022) “On development institutions”.

11 Decree of the Government of the Russian Federation of 12 October 2020 N 2634-r on the approval of the Action Plan “Development of hydrogen energy in the Russian Federation until 2024”.

12 Hydrogen Economy Outlook, Key Messages, March 30, 2020. BloombergNEF. URL (assessed 01.12.2022).

13 Decree of the Government of the Russian Federation dated 2 November 2020 N 2861-r.

14 Minutes of the meeting of the Project Committee of the Federal Project dated 22 September 2021 N 1 chaired by the Deputy Prime Minister of the Russian Federation A.V.Novak.

The author expresses his gratitude to D.S.Zavalov for his help in preparing the article.

References

- Zhdaneev O., Zuev S. Development of Renewable Energy of a New Energy Policy in Russia. Energy Policy. 202. N 2 (144), p. 84-95 (in Russian). DOI: 10.46920/2409-5516_2020_2144_84

- Long-term research and engineering development of Russia. Potentsialnye vozmozhnosti rosta rossiiskoi ekonomiki: analiz i prognoz: Nauchnyi doklad. Moscow: Artik Print, 2022, p. 170-199 (in Russian). DOI: 10.47711/sr2-2022

- Shcherbakov M.V., Glotov A.V., Cheremisinov S.V. Proactive and Predictive Maintenance of Cyber-Physical Systems. Cyber-Physical Systems: Advances in Design & Modelling. Studies in Systems, Decision and Control. Cham: Springer, 2020. Vol. 259, p. 263-278. DOI: 10.1007/978-3-030-32579-4_21

- Xiaoyong Dai, Chapman G. R&D tax incentives and innovation: Examining the role of programme design in China. Technovation. 2022. Vol. 113. N 12707. DOI: 10.1016/j.technovation.2021.102419

- Zhdaneev O., Сhuboksarov V. Technical Policy of the Oil and Gas Industry in Russia: Tasks and Priorities. Energy Policy. 2020. N 5 (147), p. 76-91 (in Russian). DOI: 10.46920/2409-5516_2020_5147_76

- Zhdaneev O.V., Zaitsev A.V., Kolesnikov S.V., Soshnikov A.I. Development of the production of Russian bearings for the fuel and energy complex. Journal of Machinery Manufacture and Reliability. 2022. Vol. 51. N 7, p. 86-94. DOI: 10.3103/S1052618822070196

- Litvinenko V. The Role of Hydrocarbons in the Global Energy Agenda: The Focus on Liquefied Natural Gas. Resources. 2020. Vol. 9. N 5. N 181. DOI: 10.3390/resources9050059

- Zhdaneev O.V., Bravkov P.V., Frolov K.N. et al. Issues of technical policy in the fuel and energy complex of Russia. Moscow: Nauka, 2020, p. 304 (in Russian). DOI: 10.7868/9785020408241

- Rozhkov A.A. Structural analysis of import substitution in the Russian coal industry: reality and forecast. Gornaya promyshlennost. 2017. N 6 (136), p. 4-13 (in Russian).

- Belousov D.R., Mikhailenko K.V., Sabelnikova E.M., Solntsev O.G. The Role of Digitalization in the Target Scenario of Russian Economic Development. Studies on Russian Economic Development. 2021. Vol. 32. N 4, p. 374-382 (in Russian). DOI: 10.1134/S1075700721040055

- Agamirzyan I., Belousov D., Kuznetsov E. et al. Challenge 2035. Мoscow: Olimp-Biznes, 2016, p. 240 (in Russian).

- Chupin E., Frolov К., Korzhavin M., Zhdaneev O. Energy storage systems for drilling rigs. Journal of Petroleum Exploration and Production Technology. 2021. Vol. 12, p. 341-350. DOI: 10.1007/s13202-021-01248-5

- Melnikov V.P., Osipov V.I., Brushkov A.V. et al. Reducing the stability of the Russian fuel and energy complex infrastructure in the Arctic as a result of an increase in the average annual temperature in the near-surface layer of the permafrost zone. Vestnik RAN. 2022. Vol. 92. N 4, p. 303-314 (in Russian). DOI: 10.31857/S0869587322040053

- Zhdaneev O.V. Russian Fuel and Energy Complex Technology Policy at the state of Energy Transition. Eurasia mining. 2022. N 1, p. 13-19. DOI: 10.7580/em.2022.01.03

- Zubov V.P. Applied technologies and current problems of resource-saving in underground mining of stratified deposits. Gornyi zhurnal. 2018. N 6, p. 77-83 (in Russian). DOI: 10.17580/gzh.2018.06

- Dutta S., Lanvin B., Leon S.R. et al. Global innovation index 2021: tracking innovation through the covid-19 crisis. Geneva: WIPO, 2021, p. 205. DOI: 10.34667/tind.44315

- Dobni C.B., Klassen M., Nelson W.T. Innovation strategy in the US: top executives offer their views. Journal of Business Strategy. 2015. Vol. 36. N 1, p. 3-13. DOI: 10.1108/JBS-12-2013-0115

- Gokhberg L.M., Ditkovskii K.A., Kotsemir M.N. et al. Science indicators 2022: statistical compilation. Moscow: Vysshaya shkola ekonomiki, 2022, p. 400 (in Russian). DOI: 10.17323/978-5-7598-2647-7

- Zhdaneev O.V., Seregina A.A. Staffing of the fuel and energy complex of the Russian Federation in the context of the energy transition: Monografiya. Moscow: INFRA-M, 2022, p. 269 (in Russian). DOI: 10.12737/1865411

- Boschma R. Global value chains from an evolutionary economic geography perspective: a research agenda. Area Development and Policy. 2022. Vol. 7. Iss. 2, p. 123-146. DOI: 10.1080/23792949.2022.2040371

- Zhdaneev O.V., Seregina A.A. Vectors of BRICS Technological Cooperation in the Fuel and Energy Sector. International Technical and Economic Journal. Part 1. 2021. N 1, p. 7-17 (in Russian). DOI: 10.34286/1995-4646-2021-76-1-7-17; Part 2. 2021. N 2, p. 7-22 (in Russian). DOI: 10.34286/1995-4646-2021-77-2-7-22

- Chulok A.A. Foresight as a tool for creating and managing a company’s ecosystem. Voprosy ekonomiki. 2022. N 3, p. 52-76 (in Russian). DOI: 10.32609/0042-8736-2022-3-52-76

- Litvinenko V.S., Sergeev I.B. Innovations as a Factor in the Development of the Natural Resources. Studies on Russian Economic Development. 2019. Vol. 30, p. 637-645 (in Russian). DOI: 10.1134/S107570071906011X

- Frolov I.E. Assessment of the development of the Russian high-tech complex in conditions of low inflation and limited state support. Problemy prognozirovaniya. 2019. N 4 (175), p. 3-15 (in Russian).

- Zhdaneev O.V., Frolov K.N., Konygin A.E., Gekhaev M.R. Exploration drilling on the Russian Arctic and Far East shelf. Arctic: Ecology and Economy. 2020. N 3 (39), p. 112-125 (in Russian). DOI: 10.25283/2223-4594-2020-3-112-125

- Argastsev A., Zhdaneev O., Stavtsev A. et al. Inverters for Technological Development of Russia’s Energy Sector and Industry. Elektricheskie stantsii. 2022. N 2 (1087), p. 45-56 (in Russian). DOI: 10.34831/EP.2022.1087.2.008

- Kryukov V.A. On the relationship and interaction of economic, industrial, research, and engineering policies. Upravlenie naukoi: teoriya i praktika. 2020. Vol. 2. N 2, p.15-46 (in Russian). DOI: 10.19181/smtp.2020.2.2.1

- Engen O.A., Simensen E.O., Thune T. The evolving sectoral innovation system for upstream oil and gas in Norway. Routledge, Petroleum Industry Transformations. Taylor & Francis Online, 2018, p. 17. DOI: 10.4324/9781315142456-2

- Kryukov V.A. Subsoil Knowledge Economy in Time and in Space. Science Management: Theory and Practice. 2020. Vol. 2. N 4, p. 71-117 (in Russian). DOI: 10.19181/smtp.2020.2.4.4

- Zhdaneev O.V. Assessment of Product Localization during the Import Substitution in the Fuel and Energy Sector. Economy of regions. 2022. Vol. 18. N. 3, p. 770-786 (in Russian). DOI: 10.17059/ekon.reg.2022-3-11

- Bravkov P., Zhdaneev O., Chuboksarov V. Revisiting business continuity of oil and gas enterprises in Russia. Standards and Quality. Part 1. 2020. N 8, p. 88-94; Part 2. 2020. N 9, p. 70-74 (in Russian).

- Zhdaneev O.V., Zaitsev A.V., Lobankov V.M., Frolov K.N. The Concept of Testing Downhole Equipment. Nedropolzovanie XXI vek. 2021. N 1-2 (90), p. 4-15 (in Russian).

- Kryukov V.A., Seliverstov V.E. Strategic planning of the spatial development of Russia and its macro-regions: Captured to old illusions. Russian Economic Journal. 2022. N 5, p. 22-40 (in Russian). DOI: 10.33983/0130-9757-2022-5-22-40

- Koshovets O.B., Ganichev N.A. Global Digital Transformation and I ts Goals: Declarations, Reality and the New Growth Mechanism. Economics of Contemporary Russia. 2018. N 4, p. 126-143. (In Russian).

- Zhdaneev O., Frolov K., Petrakov Y. Predictive Systems for the Well Drilling Operations. Springer: Cyber-Physical Systems: Design and Application for Industry 4.0. Cham: Springer, 2021, p. 347-368. DOI: 10.1007/978-3-030-66081-9_28

- Karev V., Kovalenko Y., Ustinov K. Mechanical and Mathematical, and Experimental Modeling of Oil and Gas Well Stability. Geomechanics of Oil and Gas Wells. Advances in Oil and Gas Exploration & Production. Cham: Springer, 2020, p. 35-60. DOI: 10.1007/978-3-030-26608-0_9

- Zhdaneev O., Chuboksarov V. Prospects for Industry 4.0 Technologies in the Fuel and Energy Complex of Russia Coal. Energy Policy. 2020. N 7, p. 16-33 (in Russian). DOI: 10.46920/2409-5516_2020_7149_16

- Shah M. Big Data and the Internet of Things. Big Data Analysis: New Algorithms for a New Society. Studies in Big Data, Cham: Springer, 2020. Vol. 16, p. 207-237. DOI: 10.1007/978-3-319-26989-4_9

- Galitskaya E.A., Zhdaneev O.V. Development of electrolysis technologies for hydrogen production: A case study of green steel manufacturing in the Russian Federation. Environmental Technology and Innovation. 2022. Vol. 27. N 102517. DOI: 10.1016/j.eti.2022.102517

- Bazhenov S., Dobrovolsky Y., Maximov A., Zhdaneev O. Key challenges for the development of the hydrogen industry in the Russian Federation. Sustainable Energy Technologies and Assessments. 2022. Vol. 54. N 102867. DOI: 10.1016/j.seta.2022.102867

- van Oort E., Chen D., Ashok P., Fallah A. Constructing deep closed-loop geothermal wells for globally scalable energy production by leveraging oil and gas ERD and HPHT well construction expertise. SPE/IADC International Drilling Conference and Exhibition, 8-12 March 2021, Virtual. OnePetro, 2021. SPE-204097-MS. DOI: 10.2118/204097-MS

- Raising energy efficiency and reducing greenhouse gas emissions: an analysis of publicly funded petroleum research 2015-2018. The research council of Norway, 2018, p. 52.

- Baidyukov K.O., Bravkov P.V., Zhdaneev O.V., Kononenko V.A. On priority areas for the development of hydraulic fracturing technologies in Russia. Razvedka i okhrana nedr. 2020. N 11, p. 49-57.

- Litvinenko V.S., Petrov E.I., Vasilevskaya D.V. et al. Assessment of the role of the state in the management of mineral resources. Journal of Mining Institute. 2022, p. 1-17 (Online first). DOI: 10.31897/PMI.2022.100