Assessment of negative infrastructural externalities when determining the land value

- Ph.D. Saint Petersburg Mining University ▪ Orcid

Abstract

The work forms and substantiates the concept of land value, based on a new institutional theory. The infrastructural component of the cost of land in the presented concept determines, on the one hand, the efficiency of the use of natural resources, properties, demand for land on the market, on the other hand, the costs, which are determined not only by capital investments in construction of engineering infrastructure, but also by losses associated with restrictions on activities within zones with special conditions for territory use, creation of unfavorable conditions for economic activity, small contours, irregularities and others on a specific land plot, which are external negative infrastructural externalities that create losses of rights holders of land plots that are not compensated by the market, falling within the boundaries of these zones. Methods for assessing the impact of such negative infrastructural externalities on the cost of land encumbered by zones in different conditions of land market activity have been developed and tested, based on an expert-analytical approach (depressed market); the ratio of market values of land plots encumbered and unencumbered by a specific zone, and qualimetric modeling (inactive market); modeling by introducing into the model the factor of presence of zones with special conditions for territory use, based on the grouping of zones according to similar regulations for use, or by introducing the parameters of this factor (active market). Methods for taking into account spatial deficiencies and compensating for restrictions and prohibitions on activities on the territory of land plots with an individual market assessment are proposed.

Introduction. The problem of regulating externalities in the Russian land market is especially acute in relation to external effects caused by modernization and development of linear objects of engineering infrastructure, which determines the implementation of state policy in the field of strategic spatial development of the country, as provided for by the Decree of the President of the Russian Federation of January 16, 2017 N 13 “On approval of the Fundamentals of State Policy for Regional Development of the Russian Federation for the period up to 2025”. National projects for the development of infrastructure1, according to Vladimir Putin, are necessary to achieve maximum results in the development of a high-tech economy, thereby increasing labor productivity and, on this basis, the standard of living of citizens. In the conditions of scientific and technological progress, infrastructure is the connections for the transfer of products, energy, information in the conditions of spatial division of labor [20, 37], пtherefore, the problem associated with ensuring normal living conditions for the country population is reduced to security of the territory with the specified infrastructure. But security of the territory with infrastructure has an ambiguous character, on the one hand, increasing its investment attractiveness, and, accordingly, value, and on the other hand, having costs, which are determined both by capital investments in its construction and real damage caused by restriction of activities in zones with special conditions for territory use – use-restricted zone (URZ), creation of unfavorable conditions for economic activity, small contour, irregularity and others on a specific land plot. The latter are negative infrastructural externalities that create losses currently uncompensated by market for the owners of land plots that fall within the boundaries of the URZ.

The state, being a monopoly on the Russian land market, has levers to regulate land redistribution and intensify their turnover, one of which, according to the world scientific community [23, 28] and experience of some countries [36, 40], is internalization of negative infrastructural externalities. For example, A.Lafuite has shown positive results of internalization in the long term through the land tax [35]. While in Russia prerequisites for the implementation of methods for transforming externalities into internal ones have already been laid down by law, the methodological basis for their assessment has not been developed. The development of a mechanism for assessing negative infrastructural externalities in determining the value of encumbered land will ensure a civilized process of transactions in the land market, access to it for buyers and sellers with protection of their interests, and, as a result, the subject of bargaining, objectivity of land assessment for lending, compensation for losses in connection with the restriction of rights, socially fair land taxation.

Within the framework of the study, three main tasks were set: firstly, by studying the conceptual directions of value theories, to identify the patterns of a unified approach of science and practice in interpreting the content of land value and construction of negative infrastructural externalities in the system of modern land relations; secondly, to develop methods for assessing negative infrastructural externalities to determine the value of land encumbered by URZ in different conditions of land market activity; thirdly, to propose ways to take into account spatial deficiencies and compensate for restrictions and prohibitions on activities on the territory of land plots encumbered with URZ, with an individual market assessment.

Methods. The methodological studies of the modern paradigm of land value and pricing, as well as the concept of land value formation and construction of negative infrastructural externalities in the system of modern land relations, is based on the synthesis of general logical methods, including analysis, generalization, analogy, methods of deduction and induction, as well as methods of theoretical research in the form of formalization for the compilation of algorithms, hypothetical-deductive – for the approval of empirical facts

Justification of the need for a differentiated approach to assessing negative infrastructural externalities in the form of URZ is based on the evidence of the existence of land heterogeneity market activity in Russia, which was carried out not only through visual and geostatistical [26] data analysis, which gives an idea of the situation, but also methods of correlation analysis, principal components and k-average. Clustering was performed in the RStudio environment. As an object of analysis, the most widely represented and active segment of the market – land intended for gardening and truck farming, low-rise residential development, is considered. Initial data on the prices of purchase and sale transactions were obtained by downloading from the open automated information system “Monitoring of the real estate market” of the Federal Registration Service2.

The proposed methods for assessing negative infrastructural externalities in connection with the establishment of URZ in different conditions of land market activity are based on: expert-analytical approach (inactive (depressed) market); the method of correlating the market values of land plots, whether or not encumbered by a specific zone, and the method of qualimetric modeling (low-activity market); a modeling method based on the introduction of the factor “Availability of URZ” into the model by grouping zones according to similar regulations for the use of the territory or introducing the parameters of this factor (active market).

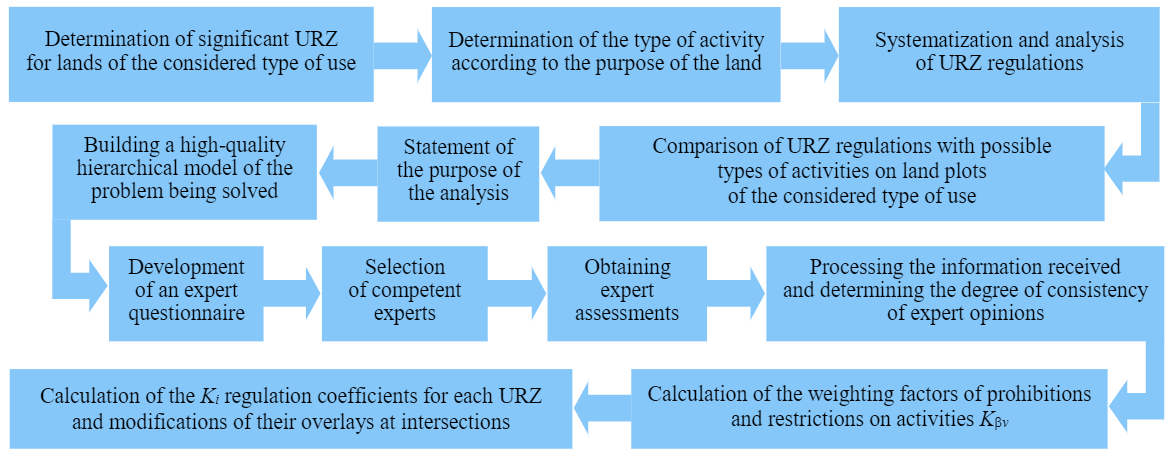

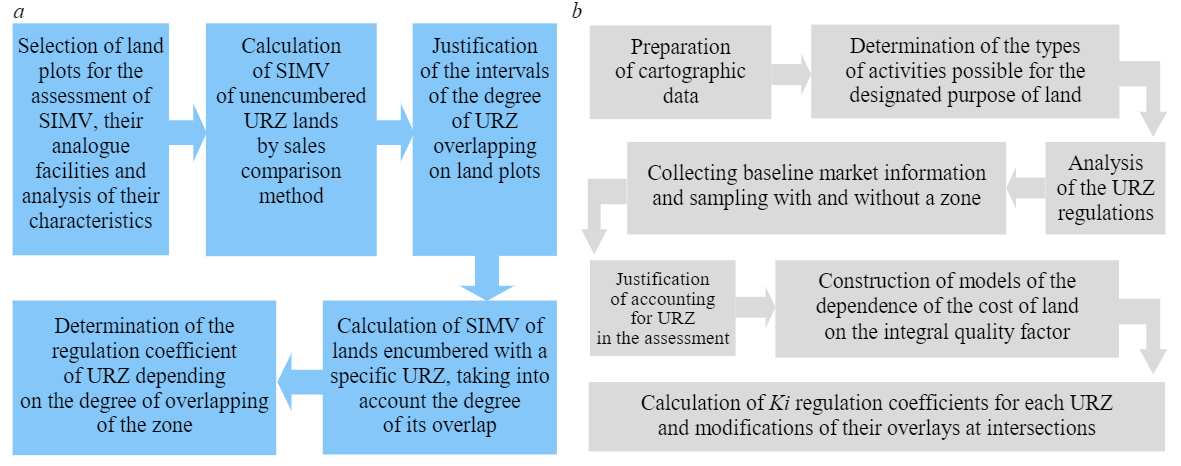

To determine the regulation coefficient Кi in a depressed land market using an expert-analytical approach, it is necessary to assess the impact of URZ on the efficiency of land use, transforming qualitative indicators (restrictions and prohibitions) into quantitative ones. The stages of Кi determination are shown in Fig.1.

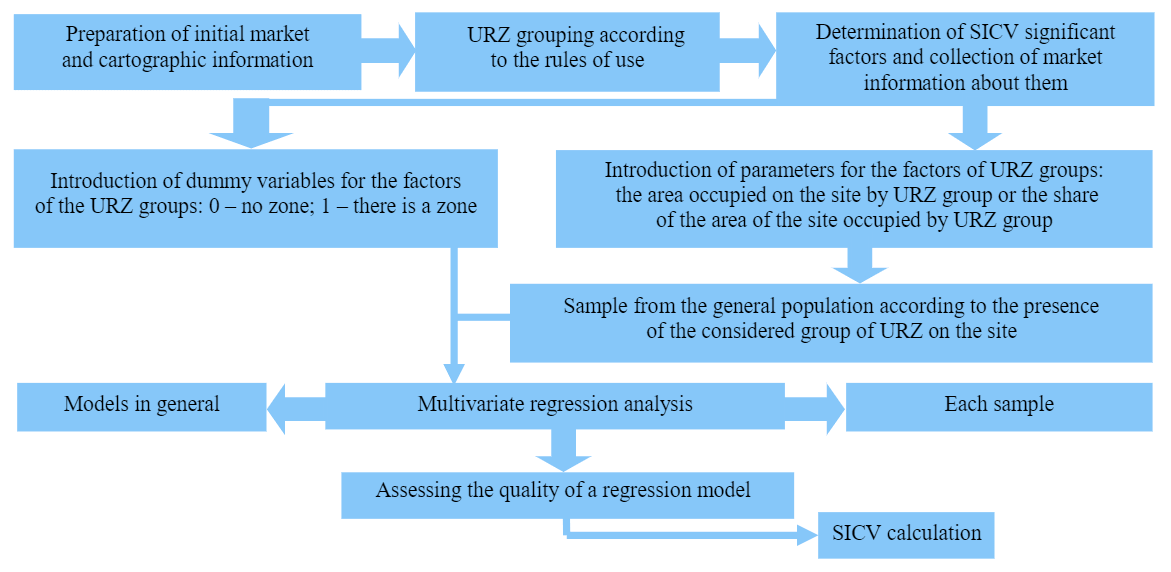

The sequence of calculating the regulation coefficients Кi in the conditions of inactive market by the two indicated methods is shown in Fig.2. According to the first method, Кi is determined by the ratio of the market value of the land plot encumbered with URZ and the plot free from such encumbrance, obtained by comparing the sales method, taking into account the degree of overlap of the zone on the land plot (Fig.2, a). The method of qualimetric modeling, modified by replacing the expert method for calculating the weights of factors with a mathematical one (Fig.2, b), is based on the use of both cartographic data and market information about analogue objects.

Depending on the degree of perfection of the active market, in order to take into account the influence of URZ on the value, it is proposed to introduce the factor “Availability of URZ” into the model of the specific indicator of cadastral value (SICV) or cadastral value (CV) based on the grouping of URZ according to similar regulations for the territory use and parameters factor URZ in the modeling of SICV or CV.

The stages of the methodology for modeling the SICV by including the factor “Availability of URZ” by grouping URZ according to similar regulations for the use of the territory are shown in Fig.3. Grouping URZ according to the rules of use.

Determination of spatial disadvantage ratios due to the presence of URZ on agricultural land plots was carried out using mathematical calculations, methods of analysis, k-average and adjustments.

Modeling processes were carried out in software products SPSS Statistics, Microsoft Excel and MassVal.

Results. Land value concept. The formation of the concept of land value in the author's interpretation is the result of the development of ideas about it in the process of evolution of economic theory. The main one in the context of the research is the new institutional theory, which includes analysis of the labor theory of value, methodological tools of the German historical school, as well as the principles and mathematical apparatus of neoclassicism.

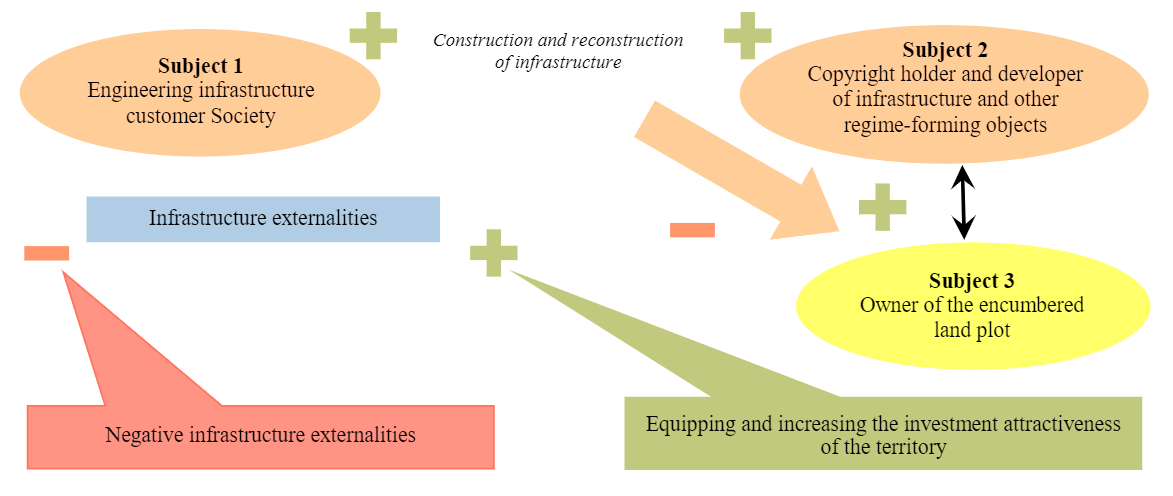

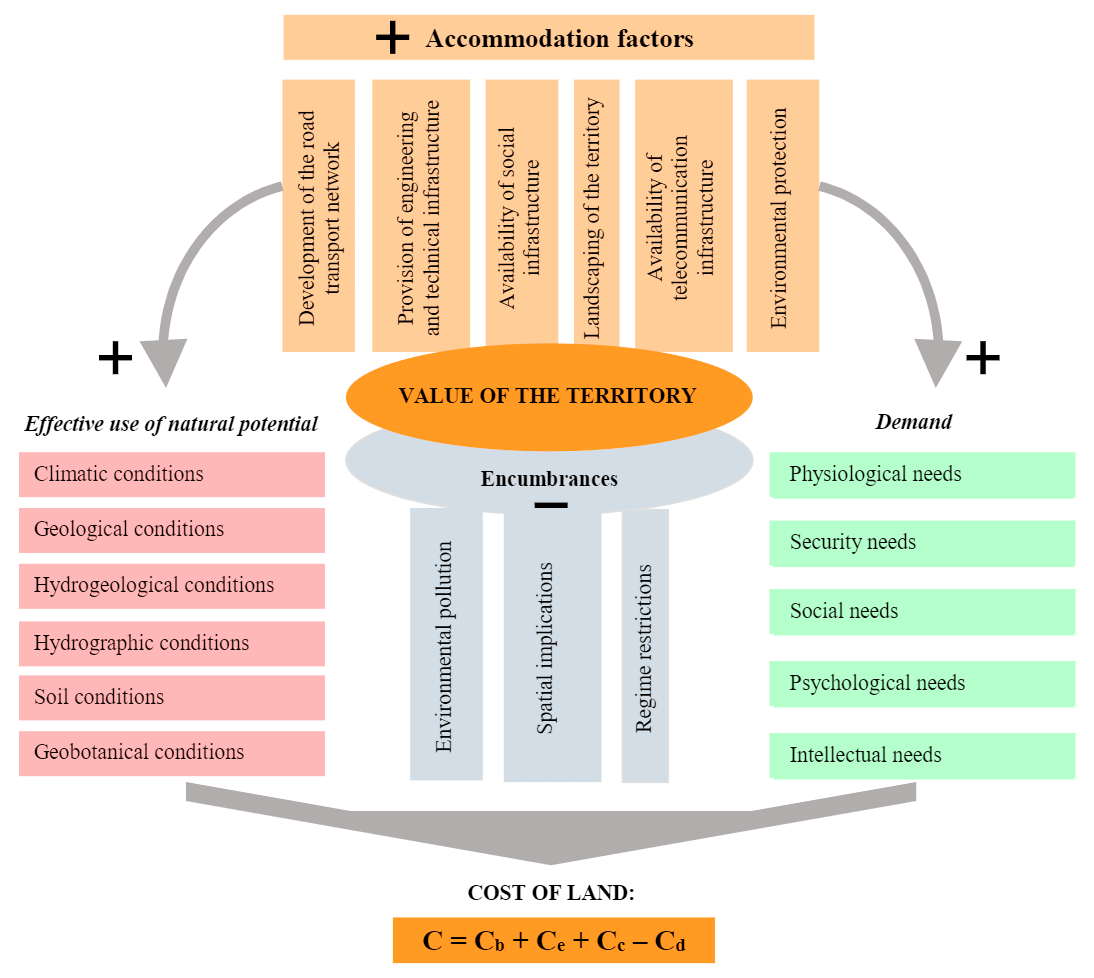

The presented concept is based on the fact that value of the territory at this stage of economic development is determined by elements, the main of which are not so much natural conditions as the costs of infrastructure development of the territory and the results of these costs, which determine the demand for land. In addition, among equally infrastructurally secured territories, factors of negative infrastructural externalities play a noticeable role, reducing the dignity of specific land plots (Fig.4).

The basic and cost parts of the land value can be interpreted in the context of the labor theory of value, although provisions on land as a product of labor do not fit into this theory. At the same time, a number of provisions of the positions of V.Petti, A.Smith, D.Ricardo, as well as K.Marx gave rise to the theory of rent and the theory of the land price, which is determined by labor costs [38]. Alternatively, interpreting the labor theory, which has been done recently in the light of modern problems around land relations quite often [29], рwe will consider it in relation to all the components presented in Fig.4. The cost of the productive (natural) potential of the land is shown in different contexts by modern researchers [17, 44], and not only in the economic direction [4, 43], but M.A.Sulin gives its formula, defining it as a combination of soil, geobotanical, geological, hydrological and other properties, including the cost of fixed assets and means of production, inextricably linked with the land [13]. In the author's interpretation of the study, the latter is included in the expenses part of the cost of the land, consolidating the costs of creating, reconstructing and repairing the infrastructure assigned to the land plot. This is not important, since in reality, from the moment a person invests labor and capital in land, including development of infrastructure, it is impossible to determine the base value. Engineering and transport infrastructure facilities, industrial, residential and other real estate objects, allowing to form a high-quality and favorable human environment and the production and economic potential of the territory, arise in the process of production on the ground [33] and placement of productive forces [12]. The most important thing in this is that they are the result of social labor [38], therefore, interpreting the labor theory of value, the land should be considered as a natural resource initially and as a result of labor – from the stage of creating infrastructure on it.

Based on A.Marshal's two-criterion theory of value, both marginal costs and marginal utility are equivalent factors in the occurance of the value of a product (in our case, a land plot) [16], and value as a manifestation of estimation is considered in the course of an individual approach, taking into account the tastes and reactions of the buyer. L.Walras clarified the theory of value, assuming that production costs, incomes, valuation of goods on the market, supply, demand and others are determined jointly and simultaneously [45]. When projecting Walras's mind-conclusions on the land, it should be considered both as a commodity and as an engineered territory. The need for it as a commodity arises in connection with the demand for its properties, both natural and man-made. These include: fertility (when using land in agriculture), the presence of minerals deposits (in relation to industrial land), an advantageous location (during development), stocks of wood and non-forest values (forest lands) [34], landscape properties (when using land for recreational purposes), historical and cultural features (in relation to land under cultural heritage objects) [5], engineering provision (in all cases of use), etc. That is, the land should be assessed not only as a natural resource, but also as a battery of other, non-natural resources [14]. Non-natural resources are understood as useful properties of a territory created by man and allowing efficient use of natural properties and resources. This means that the basis is, for example, not natural fertility, but economic, not mineral deposits, but built mines, collieries.

It is clear that a functioning infrastructure increases the land value, but the presence of infrastructure created by generations also forms a negative component of the land value, caused by the establishment of encumbrances in the form of URZ. This component of the cost of Co (рис.4) Fig.4) is based on the Coase theorem [24], and the size of the cost reduction itself is negative infrastructural externalities. The concepts of externalities in the established meaning are considered by Russian [7-9] and foreign [22, 30] researchers in relation to various fields of application [15, 31]. The closest meaning of the term used is presented by N.V.Vasilenko (spatial-infrastructural externalities) [3] nd R.M.Melnikov (spatial externalities) [39]. However, in relation to the context of the study, it should be clarified that negative infrastructural externalities (NIE) are understood as losses of land rightholders associated with the presence of URZ on them, which are formed in connection with creation of regime-forming objects and cause regime restrictions on activities, the consequences of a spatial nature, environmental pollution, impacts on human health and reduced living comfort. To understand the design of the NIE occurrence, consider the diagram in Fig.5.

Fig.5. The construction of the emergence of negative infrastructural externalities [42], так и в рамках теоремы Р.Коуза [24, 32]. Это согласуется с мнением C.J.Dahlman в статье «Проблемы экстерналий» [25].

There are three subjects in the presented structure (Fig.5): subject 1 – the customer of the engineering infrastructure, which may be a private investor, government bodies, society as a whole; subject 2 – the owner of the infrastructure or other regime-forming objects that create encumbrances, and this can be the state, federal subjects or municipal authorities, or a developer; subject 3 – the right holder of the encumbered land plot. It should be noted that in some cases, subjects 1 and 2 can merge into one subject of land relations.

The occurance of externalities in this case is associated, firstly, with the benefit for all three entities, since the development of infrastructure is provision of favorable conditions for the life of population, efficiency of economic activity, and so on; secondly, with the damage inflicted on the copyright holder of encumbered land plot. The structure of the NIE includes three types of losses: losses caused by regime restrictions and prohibitions on the use of land plots for their intended purpose; caused by the consequences of spatial orientation, characterized by formation of rugged, impossible or difficult to use parts of the land plot in connection with the location of communications and their URZ; caused by environmental pollution, including in connection with the impact of linear engineering infrastructure facilities on human health and comfort of his residence (electromagnetic fields, noise, dust pollution, soil pollution [1], oil spills [18], gas emissions [19], etc.).

If the presence of infrastructure causes a negative effect in relation to subject 3, then the absence of such creates a negative effect not only in relation to subject 2, but also subjects 1 and 3. Since in this case there are interrelated problems, the question is, whether it is worth limiting subject 2 while protecting subject 3. Therefore, the task is to avoid more serious damage. The nature of the choice in this case is obvious: infrastructure or negative influence of the URZ from it on the use of land. The choice is also obvious, since getting rid of subject 3 from the negative effect creates a situation of deterioration in the well-being of subject 2 and society as a whole.

The party that should bear the costs (subject 3) must be determined by the law, and the basic rule: subject 2 is responsible for the damage caused to subject 3 (the principle of justice). The system of land relations copes with positive infrastructural externalities through the land market, while it cannot cope with negative ones. This is due to the imperfection and incompleteness of information in the USRN, underdetermination of rights, opportunism. The vagueness of rights increases transaction costs [11] and generates externalities, a particular case of which is NIE.

Within the framework of the institutional mechanism, a promising direction of NIE management is the improvement of relationship of property rights to land and their restrictions by means of land redistribution, including market and government regulation [27].

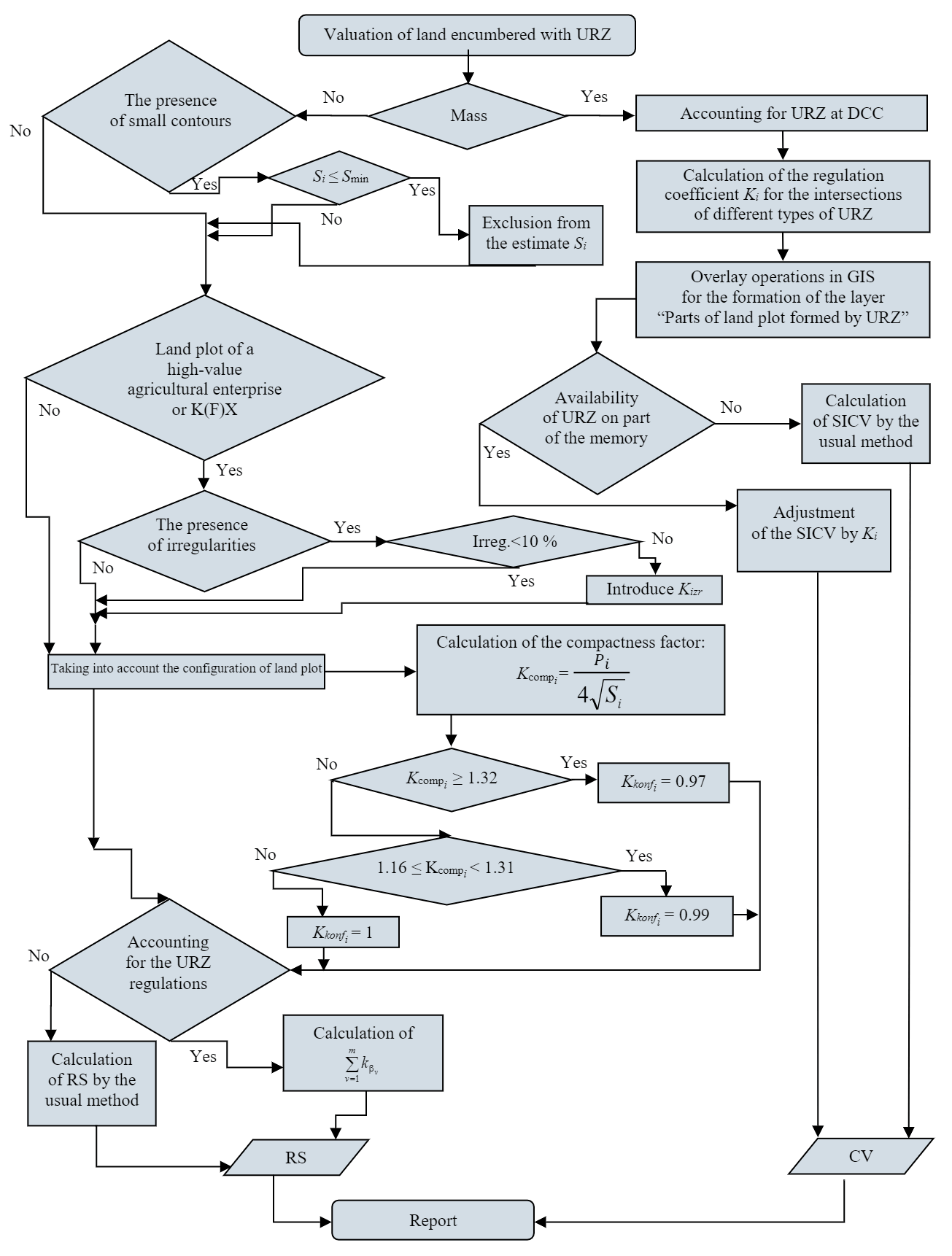

As the main method of state regulation of the market turnover of land in conditions of an imperfect market, the method of NIE internalization is singled out, which makes it possible to include external costs in the costs of those subjects that cause them. This is possible through redistribution of the tax burden between the rightholders of land and regime-forming objects, as well as state regulation of the process of land redistribution in the market. Discussion of such factors as NIE can also become a subject of bargaining in the course of transactions, but only if the negative side of them is understood by participants in the transactions. Therefore, a quantitative assessment of the impact of such NIEs in the form of URZ will become a mechanism for market regulation. To implement the apparatus for assessing land with encumbrances in use, an algorithm, shown in Fig.6, is proposed.

Methods for assessing negative infrastructural externalities. In Russia, the presence of varying degrees of activity of the land market (depressed, inactive and active) has been proven, which predetermined the need to differentiate the proposed methods for assessing the impact of NIE on the land value.

Method for assessing the impact of URZ in a depressed market. It is proposed to modify the calculation of the cadastral value of land by introducing a regulation coefficient (activity restrictions) into it in connection with the presence of URZ:

where UICV is the specific indicator of the cadastral value of land; SZWSCUTi – the area of the ith part of the land plot formed by URZ and/or their imposition at the intersection, and having restrictions and prohibitions on use; S– the area of the unencumbered part of the land plot; Ki –regulations coefficient (restrictions on economic activity) in the URZ, showing the residual efficiency of using the i-th encumbered part of the land plot; n is the number of encumbered parts of the land plot formed by the URZ, including their imposition at the intersection.

Implementation of the method for assessing the impact of URZ in a depressed market (see Fig.1) is carried out on the example of agricultural land, including for areas of high-value agricultural enterprises and garden and vegetable garden plots. The main stage is the construction of a qualitative model of the problem to be solved in the form of a three-level hierarchy, including the goal (assessment of the impact of URZ on the efficiency of agricultural land use) and criteria of two levels, the first of which represents prohibited or limited types of activities provided by the intended purpose, the second – the restrictions themselves and prohibitions. This structure makes it possible to consis-tently compare the factors under study in terms of significance by calculating the coefficients of the influence of specific restrictions and prohibitions on the efficiency of land use (Table 1). The final regulations coefficient Ki is the difference of the 1 and the sum of the weighting coefficients of the types of activities prohibited and/or limited in the i-th part of the land plot \((K_i=1-\sum^n_{i=1}k_{\beta_{v}})\) [2].

Table 1

Coefficients of the influence of restrictions and prohibitions of types of activities for lands of agricultural enterprises and farms (copy)

| Prohibitions and restrictions on agricultural activities | \(k_{\beta_{v}}\) |

| Construction of monumental flower beds | 0,010 |

| Cutting down trees | 0,049 |

| Earthworks at a depth of more than 0.3 m (on arable land 0.45 m) | 0,016 |

| Ground leveling (reclamation) | 0,016 |

| Sod removal | 0,090 |

| Land plowing (placement of summer cottages and garden plots) | 0,106 |

| Temporary flooding | 0,021 |

| Watering with a stream of water above 3 m | 0,012 |

| Construction of irrigation and drainage systems and canals | 0,117 |

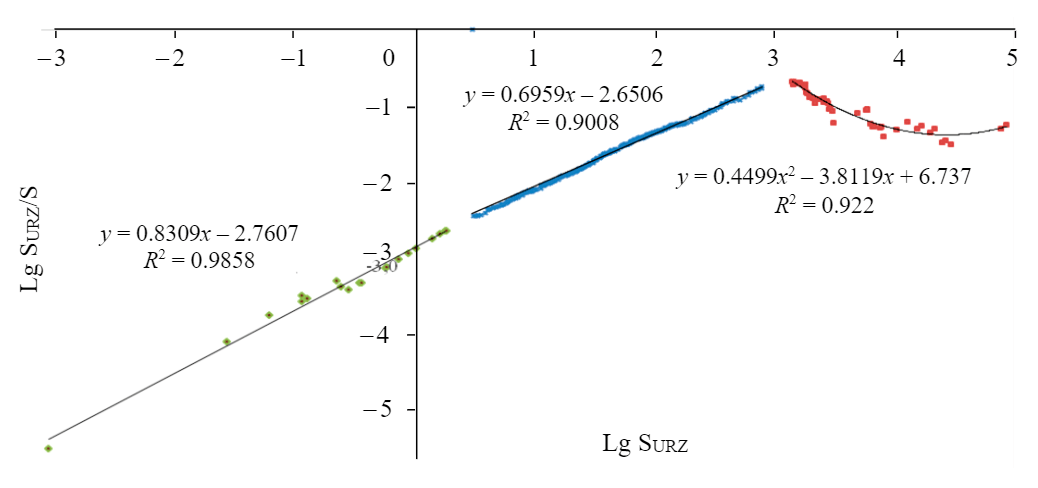

Method for assessing the impact of URZ in a low-activity market. The method is implemented (see Fig.2, a) on the example of garden and vegetable garden plots, analysis of the influence of the overlap degree of the URZ, which is significant in the mass assessment, therefore, the degree of overlap affects the Ki value. By means of a gradual increase in the intervals of values of the degree of URZ coverage in percentage terms and assessing the quality of the SICV models, three groups of the degree of coverage of a land plot by zones were identified. The calculation of the regulation coefficient for each group was determined by the ratio of SIMV taking into account URZ to SIMV without taking it into account. The calculation results for the security zone (SZ) of the power transmission line are presented in Table 2.

Table 2

Values of the coefficients of the SZ power lines

| Coverage, % | SIMV taking into account SZ | SIMV without SZ | Regulation coefficient Кi |

| Менее 30 | 1655,84 | 1669,86 | 0,99 |

| 30-50 | 2139,51 | 2398,28 | 0,89 |

| Более 50 | 1351,43 | 1591,97 | 0,85 |

Also, determination of the regulation coefficient in the conditions of an inactive land market implies the use of qualimetric modeling method (see Fig.2, b), but at the same time the expert method in calculating the weights of factors is replaced by a mathematical method. This canceled the subjectivity of assessing the market situation due to objectivity of the results.

Considering the proposed methodology on the example of water bodies zones, it should be borne in mind that they can affect both an increase in the price (proximity increases the recreational attractiveness of the site) and its decrease (mode of use). Therefore, the use of statistical analysis methods allows, in contrast to expert assessment [41], to reveal such ambiguity by obtaining a value compensated by the influence of market conditions (the ratio of supply and demand for land plots). The buyer can pay more for proximity to the water source, knowing about the restriction of the mode of use of the land, if the offer for such plots is limited. In a different situation, he will try to reduce the price due to the availability of URZ, if the demand for such plots is low, and there is a lot of supply.

For modeling, objects-analogues in the amount of 27 land plots were used. The main factors for assessing the two models of land value (with and without taking into account the zones of water bodies) were identical, except for the investigated factors “The presence of a water protection zone at the site” and “The presence of a coastal protective strip at the site”. The factor “Proximity to water sources” was not used due to its inconsistency with the subject. The market data correction was only entered for the terms of sale (offer discount). The values of the factors were assigned by determining the rank values of the qualitative characteristics. After receiving the ranked indicators, they were reduced to a single form of relative quality indicators. To determine the weighted quality indicators, the weighting coefficients of each cost factor are established.

Table 3

Calculation of the regulation coefficient of the water protection zone

| Indicators | Model 1 (excluding WPZ) | Model 2 (including WPZ) |

| Dependencies* | Yexc WPZ = 265,48 + 4062,54х | Yinc WPZ = –46,71 + 4264,98х |

| Determination coefficient R2 | 0,64 | 0,77 |

| Significance level | ||

| Fрасч | 45,19 | 83,45 |

| F | 4,80E–07 | 1,92E–09 |

| Fкрит | 4,24 | 4,24 |

| Cost, rub./m2 | 1346,59 | 1233,07 |

| Area, m2 | 1034,8 | 1034,8 |

| Cost, rub. | 1393454,73 | 1275977,09 |

| Water protection zone regulation coefficient Ki = Yexc URZ/Yinc URZ | – | 0,916 |

*Y – specific indicator of the cadastral value; x – integral quality factor.

By a similar method, the regulation coefficients were obtained for the coastal protection zone (1.0), the protection zone of the power transmission line (0.896) and the zone of regulation of development and economic activity (0.623).

A method for assessing the impact of URZ in an active market. Modeling of the cadastral value (see Fig.3) was carried out on the basis of a grouping of zones within which the regulations for the use of the territory for the considered type of land plots are similar (Table 4). Five factors have been added to the model for calculating the cadastral value, which correspond to the indicated groups of URZ. Factors are introduced as dummy variables (presence or absence). The dependent variable is the specific indicator of the market price of the land plot, which is used after the functional transformation using the logarithmic function. It is necessary to logarithm the function, since distribution of the dependent variable most often does not have the character of a normal distribution, and there is a risk of distortion of regression results. The results of multivariate regression analysis for garden and vegetable gardens are presented in Table 4.

Table 4

Indicators of the quality of the regression model taking into account URZ groups

| Factor | Regression coefficients | RMS coefficients | t-statistics | Significance level |

| Base rate | 8,17 | 0,14 | 59,88 | 0,99 |

| Land plot area | 0,18 | 0,03 | 6,27 | 0,99 |

| Base of land plots evaluations | –0,46 | 0,04 | 12,75 | 0,99 |

| Trading results | –0,71 | 0,09 | 8,28 | 0,99 |

| Provision of engineering infrastructure | –0,15 | 0,03 | 4,74 | 0,99 |

| Availability and type of entry | –0,12 | 0,11 | 1,10 | 0,7 |

| The presence of an entrance by rail | –0,10 | 0,03 | 3,65 | 0,99 |

| City center influence | 0,20 | 0,05 | 3,94 | 0,99 |

| Influence of local centers | 0,14 | 0,02 | 6,60 | 0,99 |

| Impact of highways | 0,04 | 0,02 | 1,56 | 0,8 |

| Territorial zone number: | ||||

| 1 | 0,16 | 0,16 | 1,00 | 0,6 |

| 2 | 0,04 | 0,09 | 0,38 | 0,2 |

| 4 | –0,17 | 0,08 | 2,05 | 0,95 |

| 5 | –0,27 | 0,09 | 2,90 | 0,99 |

| 6 | –0,38 | 0,11 | 3,42 | 0,99 |

| Protected zones of engineering networks (PZEN) | –0,08 | 0,033 | 2,32 | 0,97 |

| Water body zones (WBZ) | 0,08 | 0,05 | 1,69 | 0,9 |

| Protected zones of cultural heritage sites (PZCHS) | –0,16 | 0,09 | 1,76 | 0,91 |

| Zones of regulation of development and economic activity (ZRDEA) | 0,04 | 0,03 | 1,40 | 0,8 |

| Protected zone of overhead power lines (PZOPL) | –0,04 | 0,04 | 1,02 | 0,6 |

The level of factors significance of the URZ groups varies in the range of 0.8-0.99, which indicates reliability of the regression performed. The PZOPL factor has a significance level of 0.6 (insufficient reliability), which suggests that it should be removed from the model, but as a result its quality will deteriorate, so it was decided to leave this factor. Quality indicators of the resulting model: R2 – 0,782; R2корр – 0,768; F(статистика) – 55,465; Fкрит – 1,639; СКО – 0,233; СКО, % – 3,124; средняя ошибка аппроксимации А, % – 2,424.

To implement the second method of accounting for URZ in the conditions of active land market, it is necessary to enter into the model such a parameter as the area of a part of the site occupied by URZ, or the share of the area occupied by URZ. In this case, as in the previous method, URZ groups can act as assessment factors.

Modeling was carried out for industrial and warehouse land. Factors that were taken into account earlier were excluded from the models, which is associated either with a small influence on the modeling results, or with a low level of significance [6]. The simulation results are presented in Table 5. In connection with the still developing reaction of the market for industrial and warehouse land to factors such as URZ a satisfactory level of significance of the factors of the regression model should be set equal to 0.5.

The first model. The obtained values show that the factor “PZEN area on the site” is significant (significance level 0.8), but at the same time the market compensates for the negative impact of the presence of PZEN, limiting the use of land, with the positive effect of providing the site with utilities. This is objective, since the costs of supplying gas, water supply and other communications may exceed the losses of the copyright holder due to the restriction of the territory regulations.

The second model (with the inclusion of the factor “WBZ area on the site”). The significance level of the factor corresponds to 0.6, which for the given conditions indicates its significance, and the regression coefficient indicates a decrease in the cadastral value, albeit insignificant. The decrease in cost is associated with compensation for the influence of proximity to water sources, which is objective in conditions of limited supply for such lands with good demand.

Table 5

Model quality indicators byURZ groups

| Indicators / Model Numbers | Base rate | Land area | Provision of engineering infrastructure | Availability and type of entry | The presence of an entrance by railway transport | City center influence | Influence of local centers | Impact of highways | Territorial zone number | Territorial zone number (1) | WPZ area on the site (2) | ZRDEA area on site (4) | PZOPL area on site (5) | ||||

| 1 | 4 | 5 | 6 | ||||||||||||||

| Regression coefficient | 1 | 8,13 | 0,11 | 0,02 | –0,1 | 0,23 | 0,15 | 0,04 | –0,43 | –0,45 | –0,54 | –0,52 | 1,45Е-06 | ||||

| 2 | 7,99 | –0,21 | –0,88 | –0,28 | –0,44 | 0,34 | –0,19 | –0,12 | –0,31 | –0,12 | –9,72Е-07 | ||||||

| 3 | 7,97 | 0,16 | –0,03 | 0,01 | –0,13 | 0,45 | 0,13 | –8,49Е-04 | –0,33 | –0,04 | –0,06 | –0,2 | 7,62Е-07 | ||||

| 4 | 6,98 | 0,16 | –0,15 | 0,4 | –0,02 | 0,47 | 0,12 | –0,02 | 0,54 | 0,45 | 0,4 | –7,94Е-07 | |||||

| RMS | 1 | 0,23 | 0,06 | 0,23 | 0,05 | 0,09 | 0,04 | 0,04 | 0,24 | 0,13 | 0,15 | 0,22 | 9,75Е-06 | ||||

| 2 | 0,32 | 0,08 | 0,14 | 0,23 | 0,09 | 0,11 | 0,06 | 0,08 | 0,21 | 0,22 | 9,25Е-07 | ||||||

| 3 | 0,18 | 0,04 | 0,04 | 0,18 | 0,04 | 0,08 | 0,03 | 0,04 | 0,19 | 0,12 | 0,13 | 0,17 | 3,18Е-07 | ||||

| 4 | 0,42 | 0,07 | 0,07 | 0,25 | 0,12 | 0,12 | 0,08 | 0,08 | 0,3 | 0,31 | 0,34 | 1,05Е-06 | |||||

| t-statistics | 1 | 35,7 | 1,78 | 0,07 | 2,11 | 2,54 | 4,12 | 1,05 | 1,77 | 3,58 | 3,63 | 2,37 | 1,48 | ||||

| 2 | 24,82 | 2,62 | 6,44 | 1,23 | 4,88 | 3,14 | 3,13 | 1,56 | 1,49 | 0,56 | 1,05 | ||||||

| 3 | 43,12 | 3,64 | 0,6 | 0,05 | 3,04 | 5,57 | 4,53 | 0,02 | 1,77 | 0,31 | 0,45 | 1,22 | 0,24 | ||||

| 4 | 16,46 | 2,24 | 2,2 | 1,6 | 0,21 | 3,78 | 1,48 | 0,3 | 1,84 | 1,46 | 1,16 | 0,75 | |||||

| Significance level | 1 | 0,99 | 0,92 | 0,1 | 0,96 | 0,98 | 0,99 | 0,7 | 0,92 | 0,99 | 0,99 | 0,98 | 0,8 | ||||

| 2 | 0,99 | 0,98 | 0,99 | 0,7 | 0,99 | 0,99 | 0,99 | 0,8 | 0,8 | 0,4 | 0,6 | ||||||

| 3 | 0,99 | 0,99 | 0,4 | 0,1 | 0,99 | 0,99 | 0,99 | 0,1 | 0,92 | 0,2 | 0,3 | 0,7 | 0,1 | ||||

| 4 | 0,99 | 0,97 | 0,96 | 0,8 | 0,1 | 0,99 | 0,8 | 0,2 | 0,92 | 0,8 | 0,7 | 0,5 | |||||

The third model (with the inclusion of the factor “ZRDEA area on the site”) showed no influence (significance level 0.1), which indicates either the absence of serious restrictions and prohibitions on the implementation of activities in this zone for the considered type of land use, or the lack of reaction market for this factor.

The fourth model (with the inclusion of the factor “Area of PZOPL on the site”). Its significance (0.5 < 0.6) indicates the lack of market reaction to the presence of restrictions in the security zones of power transmission lines. But the market trend is such that even a slight increase in the amount of information in the USRN about the protection zones of power transmission lines can lead to an increase in the level of significance by 0.1. The regression coefficient of this factor also shows a downward trend in value, albeit insignificant.

The fifth model.. The selection of land plots for inclusion in the model of the factor “PZCHS on the site” showed an insufficient sample for modeling (there were seven sites left).

Methods for accounting for spatial deficiencies in individual market valuation. In an individual assessment of land plots encumbered with URZ, in contrast to the mass one, one should take into account possibility of the appearance of small contours and irregularities, since the right holder, for example, of an agricultural land plot, therefore, does not receive a part of net income. This is due to the non-use of parts of the land or their use, subject to an increase in the cost of agricultural products in unfavorable conditions of mechanized field work.

НAt the first stage, it is necessary to determine the presence of small-contour parts of the land plot. To do this, it is necessary to justify the minimum area suitable for processing, formed by the regime-forming objects, their URZ, as well as overlapping when they intersect between themselves. This will allow excluding from the estimate the total area of unsuitable for cultivation land, determining its market value equal to 0.

Research by V.A.Rudi [10] allows us to consider as an estimated parameter for the formed elongated contours, not the area, but the width, which is impossible for processing with agricultural machinery (less than 5 m). In addition to elongated parts of the land plot, parts that are compact in configuration, but of a small area, can also be formed. In the scientific literature on economics of land management, the concept of “small contour plot” is quite often encountered, but its area is not indicated. The size of the small-contour parts of the site differs depending on the type of land use, in addition, it may differ by constituent entities of the Russian Federation2. Justification of the size of such parts for the lands of agricultural enterprises and farms was carried out on the basis of the standards for the needs of the agro-industrial complex (0.015 hectares), and for orchards and vegetable gardens (2.36 m2) through clustering by the k-average method (3 clusters were visually identified) (Fig.7).

The formula for calculating the market value of a land plot for agricultural use for an agricultural enterprise or farm is as follows:

where Vmarket – is the market value of that part of the land plot that is not encumbered by the URZ, rubles; Siis the area of the i-th part of the land plot encumbered with URZ (formed by URZ and their overlay), m2; UIVmarket – is a specific indicator of the market value of a land plot unencumbered by URZ, rubles / m2; \(\sum^m_{v=1}k_{\beta_{v}}\) – the sum of the weight coefficients of prohibited and restricted types of activities, provided for by the designated purpose of the land, in connection with the establishment of regulations for use on the i-th part of the land plot encumbered with URZ; v– prohibited or restricted type of activity; m is the number of prohibited and restricted activities; i is the number of the part of the land plot formed by the URZ and/or their imposition at the intersection; n is the number of parts of the land plot encumbered with URZ taking into account their overlaps when crossing; Kizr is a coefficient that takes into account the area and irregularity of the land plot by obstacles [2].

The ruggedness of the land plot territory of the is proposed to be taken into account by the coefficient o rupture by obstacles, which in this case are power lines, pipelines and other regime-forming objects, not only establishing a special regime for the use of land in URZ, but also dismembering the territory, creating disadvantages of land use. Correction factors have been calculated taking into account the area and irregularity of the land plot by obstacles; for plowing, sowing, planting and processing: 10 % – 0.91, 20 % – 0.85, 30 % – 0.8, 40 % – 0.76, 50 % – 0.723. If the section is cut by obstacles by less than 10 %, then the coefficient of irregularity should be taken equal to 1, i.e. the ruggedness is insignificant and does not affect the cost. If the site is indented by more than 50 %, the question should be raised about the effectiveness of its use as before for its intended purpose.

When determining the market value of garden and vegetable garden plots, it is proposed to use configuration correction factors for each part of the land plot formed by regime-forming objects, their URZ, as well as their superposition when crossing each other, taking into account the parts that remain unencumbered:

where Kkonfi – is the configuration coefficient of the i-th part of the land plot formed by regime-forming objects, their URZ, as well as their superposition at the intersection of one and the other and with each other; when determining the regulation coefficient by statistical methods, the component \(1-\sum^m_{v=1}k_{\beta_{v}}\) will match Ki [2].

Configuration factors for different configurations of the formed parts of the land plot described by the compactness factor are presented in Table 6.

Table 6

The scale for assessing the configuration of parts of the land plot formed by URZ [2]

| Indicators | Configuration categories | ||

| Complex, non-functional | Complex, functional | Correct or close to correct, functional | |

| Compactness factor intervals | Более 1,32 | 1,16-1,31 | 1-1,15 |

| Cost adjustment, %4 | 2,98 | 1,25 | 0 |

| Configuration factor | 0,97 | 0,99 | 1 |

Conclusion. As a result of the study, the following scientific and practical results were achieved:

1. The concept of land value was formed and substantiated, it is based on a new institutional theory, the fundamental basis of which is the infrastructural component of the territory, which determines the efficiency of the use of natural properties and resources and demand for land on the market.

2. As the main method of state regulation of land market turnover in the conditions of an imperfect market, the method of internalization of NIE is singled out, that is, inclusion of external costs in the costs of entities whose activities cause these losses through state regulation of the process of land redistribution in the market and redistribution of the tax burden between the land owners and regime-forming objects. It is the discussion of such factors that can become a subject of bargaining when concluding transactions with land plots.

3. As the main method of state regulation of land market turnover in the conditions of an imperfect market, the method of internalization of NIE is singled out, that is, inclusion of external costs in the costs of entities whose activities cause these losses through state regulation of the process of land redistribution in the market and redistribution of the tax burden between the land owners and regime-forming objects. It is the discussion of such factors that can become a subject of bargaining when concluding transactions with land plots.

4. Methods for assessing the impact of NIE on the value of land encumbered with URZ have been developed and tested during mass appraisal in different conditions of land market activity.

5. Formulas for calculating the market value of agricultural land plots based on assessment of NIEs arising in connection with establishment of URZ, which differ depending on the type of use by introduced coefficients for prohibitions or restrictions on activities, for area of the plot and for irregularity of obstacles, at stake – the configuration of the parts formed by regime-forming objects and their URZ are proposed.

6. Methods for taking into account spatial deficiencies and compensating for restrictions and prohibitions on activities on land plots in the event of consequences of URZ establishment are proposed.

7. Coefficients that take into account the area and irregularity of the land plot by obstacles in the form of regime-forming objects and their URZ, which are applicable to lands assessment of agricultural enterprises and farms, have been calculated.

8. A method for determining the configuration factor for garden and vegetable plots, based on assigning a part of the plot to configuration category, the scale of which is obtained by calculating compactness factors for various figures of different elongation (from 1:1 to 1:4), and then determining the cost reduction by the amount of percentage adjustment, is proposed.

1 Decree of the President of Russia dated May 7, 2018 N 204 “On national goals and strategic objectives of the development of the Russian Federation for the period up to 2024”. URL (date of access 09.02.2021).

2 Federal Service for State Registration, Cadastre and Cartography: Monitoring of the real estate market. URL (date of access 09.02.2021).

3 Order of the Ministry of Health and Social Development of the Russian Federation of 26.04.2006 N 317 “On the approval of Inter-industry standard production standards for silvicultural work performed in flat conditions”. URL (date of access 09.02.2021).

4 Center for Economic Analysis and Expertise. URL (date of access 09.02.2021).

References