Analysing the problems of reproducing the mineral resource base of scarce strategic minerals

- 1 — Ph.D., Dr.Sci. First Vice-Rector Empress Catherine II Saint Petersburg Mining University ▪ Orcid

- 2 — Ph.D. Chief Scientific Secretary Empress Catherine II Saint Petersburg Mining University ▪ Orcid

- 3 — Student Empress Catherine II Saint Petersburg Mining University ▪ Orcid

- 4 — Student Empress Catherine II Saint Petersburg Mining University ▪ Orcid

Abstract

The results of studying the scarcity of strategic minerals in the Russian Federation are presented, domestic consumption of which is largely provided by forced imports and/or stored reserves. Relevance of the work is due to aggravation of the geopolitical situation and a growing necessity to meet the demand of national economy for raw materials from own sources. Analysis of the state of mineral resource base of scarce minerals in the Russian Federation was accomplished, problems were identified and prospects for its development were outlined taking into account the domestic demand for scarce minerals, their application areas and the main consumers. Reducing the deficit through the import of foreign raw materials and the development of foreign deposits does not ensure the reproduction of the domestic mineral resource base, independence of the country from imported raw materials as well as additional competitive advantages, economic stability and security. It was ascertained that a major factor holding back the development of the mineral resource base is insufficient implementation of new technological solutions for the use of low-quality ore. Improving the technologies in the industry is relevant for all types of scarce minerals to solve the problem of reproducing their resource base. Taking into account the prospects for the development of the resource base for the minerals under consideration (manganese, uranium, chromium, fluorspar, zirconium, titanium, graphite) requires a set of legal and economic measures aimed at increasing the investment attractiveness of geological exploration for subsoil users at their own expense without attracting public funding. The proposed measures, taking into account the analysis of positive experience of foreign countries, include the development of junior businesses with expansion of the “declarative” principle, the venture capital market, various tax incentives, preferential loans as well as conditions for the development of infrastructure in remote regions. The proposed solution to the problem of scarcity of strategic minerals will make it possible in future to present measures to eliminate the scarcity of certain types of strategic minerals taking into account their specificity.

Introduction

The mineral resource base (MRB) of the Russian Federation is one of the largest in the world. In 2021, Russia held the leading position in reserves of many minerals (Table 1) possessing major mining and beneficiation capacities. Of 48 main types of mineral resources mined in the country, 22 are in the top ten. For comparison, 47 types of mineral raw materials are mined in China [1], 41 in the USA, 40 in Australia and Brazil, 36 in India, 35 in South Africa, and 34 in Canada.

Table 1

Mineral reserves in Russia

|

Mineral product |

Reserves |

Category of reserves |

Place of the RF MRB in the world |

|

Natural gas |

44 trillion m3 |

A + B1 + C1 |

1 |

|

Diamonds |

1,018.9 million carats |

A + B + C1 + C2 |

1 |

|

Gold |

15,453.5 t |

A + B + C1 + C2 |

1 |

|

Platinoids |

16.03 Kt |

A + B + C1 + C2 |

2 |

|

Iron ore |

58.11 billion t |

А + В + С1 |

3 |

|

Coal |

195.9 billion t |

А + В + С1 |

4 |

|

Liquid hydrocarbons |

19.3 billion t |

A + B1 + C1 |

5 |

Substantial reserves of mineral resources (MR) are the basis of national independence and sustainable development of the country, as they ensure the independence of national economy from foreign sources of raw materials and its competitiveness, guaranteeing a significant geopolitical advantage to the state [2-4]. Despite large reserves, Russia is forced to import some MR. According to the Order of the RF Government dated December 22, 2018, N 2914-r “On approval of the Strategy for development of the mineral resource base of the Russian Federation until 2035” (hereinafter, the Strategy), in-place reserves of the Russian mineral raw materials in terms of quantity and quality are divided into three groups.

The first group of MR has sufficient reserves to meet the needs of economy until 2035 under any scenario of its development.

Minerals of the second group at the achieved levels of their production are not sufficiently provided with reserves of developed deposits until 2035.

The third group consists of scarce minerals, the domestic consumption of which is largely ensured by forced imports and/or stored reserves. This group also includes types of MR whose MRB in Russia is characterized by predominantly low quality. The group consists of uranium, manganese, chromium, titanium, bauxites, molybdenum, tungsten, zirconium, beryllium, lithium, vanadium, niobium, tantalum, rare earth metals (except scandium and promethium), graphite, and fluorspar.

Order of the RF Government the dated August 30, 2022, N 2473-r “On approval of the list of the main types of strategic mineral raw materials” determined the list of strategic types of minerals. The main types of strategic mineral raw materials currently include oil, natural gas, helium, uranium, manganese, chromium, titanium, bauxites, copper, lead, antimony, tin, zinc, nickel, molybdenum, tungsten, cobalt, rare earth metals (lithium, rubidium, cesium, beryllium, scandium, rare earth metals (yttrium, lanthanum, cerium, praseodymium, neodymium, samarium, europium, gadolinium, terbium, dysprosium, holmium, erbium, thulium, ytterbium, lutetium), indium, gallium, germanium, zirconium, hafnium, vanadium, niobium, tantalum, rhenium), gold, silver, platinoids (ruthenium, rhodium, palladium, osmium, iridium, platinum), diamonds, graphite, phosphates (apatite ores), potassium salts , fluorspar, high pure quartz raw materials, and underground water.

The previous list of strategic mineral raw materials approved by Government Order N 50-r dated January 16, 1996, included only 29 items and remained in force for 26 years. Due to the fact that the list of strategic mineral raw materials is determined in accordance with the changing needs of national economy, a clause was added to Government Order N 2473-r on the necessity to update the list of types of strategic mineral raw materials at least once in three years.

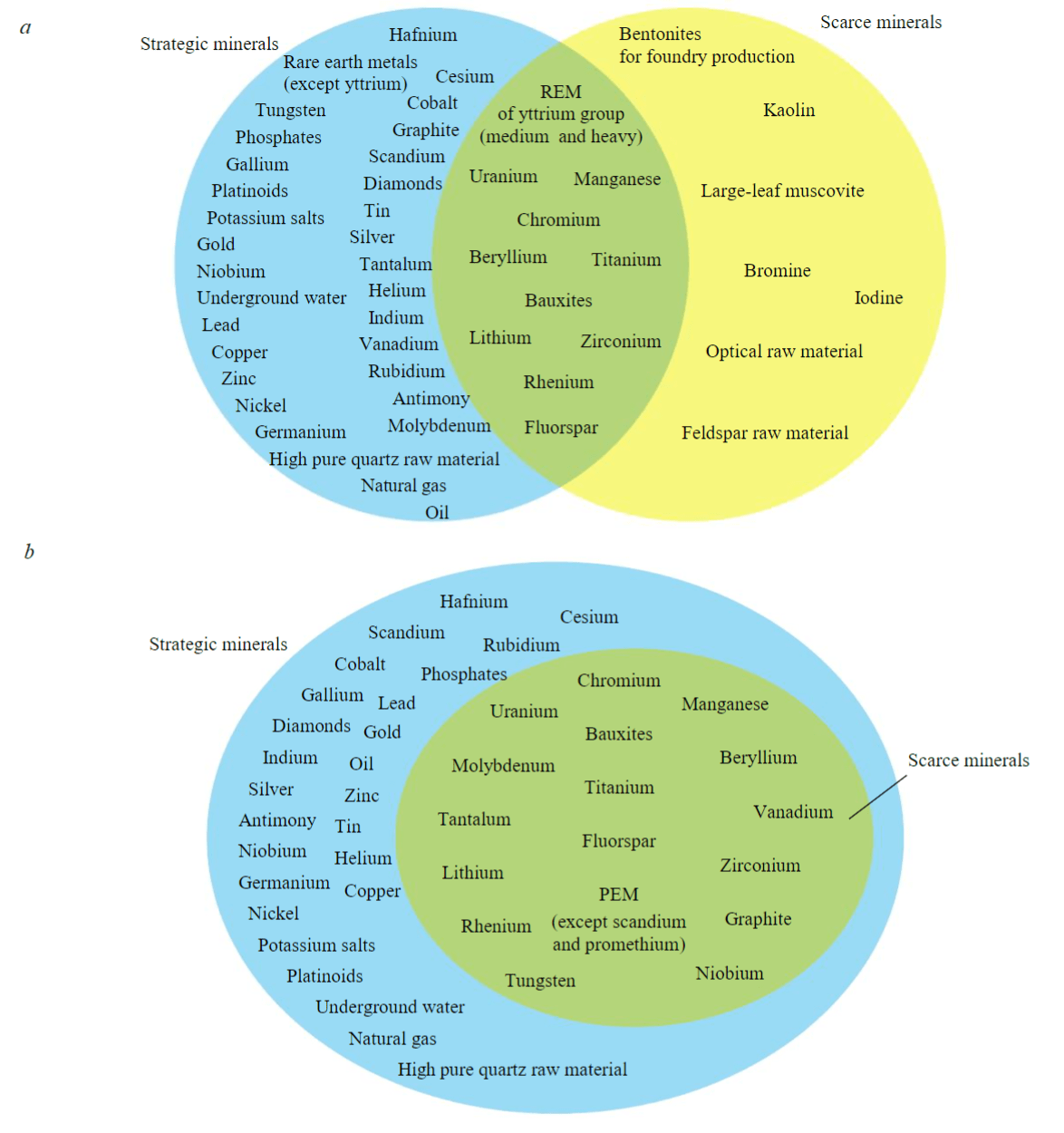

Fig.1. Strategic and scarce types of minerals before (a) and after (b) 26 April 2024

Figure 1 shows groups of scarce minerals (yellow zone) in effect until April 26, 2024, and strategic types of minerals (blue zone). Scarce strategic mineral resources (SSMR) (green zone) included: chromium, uranium, manganese, molybdenum, titanium, beryllium, tantalum, vanadium, bauxites, lithium, zirconium, rhenium, graphite, tungsten, fluorspar, niobium, rare earth metals (except scandium and promethium). On April 26, 2024, a new Order came into force according to which the SSMR include: uranium, manganese, chromium, molybdenum, beryllium, tantalum, vanadium, lithium, bauxites, zirconium, rhenium, graphite, tungsten, titanium, niobium, fluorspar and rare earth metals (except scandium and promethium). Currently, all types of scarce minerals are included in the group of strategic minerals.

The relevance of the study lies in the fact that the reproduction of scarce strategic minerals is essential owing to their critical importance in combination with an acute scarcity of high-quality reserves. The problem of reproduction of the MRB in the RF from the legal, economic and financial points of view is discussed in the works of V.S.Litvinenko, N.V.Pashkevich, V.P.Orlov, O.V.Petrov, S.Ya.Kaganovich, D.B.Burdin, L.V.Oganesyan, A.P.Albertyan, G.Yu.Boyarko, V.N.Voitenko, A.A.Fedchenko, L.I.Iseeva, N.P.Grigorev, V.I.Nazarov, Z.M.Nazarova, O.S.Krasnov, and A.A.Gert.

The purpose of the work is to determine the ways to overcome the scarcity of certain strategic minerals based on a comprehensive analysis of the state of their MRB and the problems of reproducing the reserves.

The object of the study are the strategic minerals of the Russian Federation, domestic consumption of which is largely provided by forced imports and/or stored reserves.

The subject of research are the problems of reproducing scarce strategic types of minerals.

Methods

The problem of reproducing the SSMR MRB is integrated and requires a systemic approach. Considering the needs of economy for the development of the MRB of a specific type of mineral, on the one hand, the reproduction of reserves implies intensification of geological exploration, which affects the licensing of subsoil users and their adequate financing from various sources (public and private); on the other hand, the supply of economy with raw materials depends on the development of technologies for extracting useful components from ores.

The research includes the following stages: analysis of the work on reproduction of the MRB in the RF in general and the SSMR MRB in particular; analysis of open data on the state of the SSMR MRB from reports taking into account the information on the current demand and needs of domestic economy for these types of raw materials; statistical processing of information using the method of grouping, tabulation, analysis, synthesis, and diagramming.

The research methodology is based on general scientific and special methods of obtaining knowledge: the use of results of industry expert assessments, analysis of domestic and foreign specialized literature, study of the Russian law on public management of mineral resources.

A significant part of the work is devoted to the study of global experience in operation of junior companies, the prospects for integrating this business practice into the Russian economy, taking into account industry-specific legal, financial, infrastructural, and natural climatic features.

Results

Considering the criteria for classifying minerals into one of three groups, provision of the state with mineral raw materials of a particular type on a long-term basis is determined by production levels and the corresponding reserves characterized by quantitative and qualitative indicators. Production volumes are affected by demand for the products of the industry, technical resources of the industry, existing technologies, available financing sources, and other factors. The size and quality of reserves, in turn, depend on the results of geological exploration (GE), the purpose of which is to identify mineral deposits and prepare them for commercial development. GE is aimed at studying the emplacement conditions, occurrence patterns, mineral composition and structural features of deposits (main and accompanying components), variability of the morphology of deposits, composition and properties of minerals for forecasting, prospecting, exploration, geological and economic evaluation and preparation of deposits for exploitation.

The main result of geological exploration is getting information for subsoil users. Geological information plays the key role not only in the development of already known deposits (recommended mining conditions, content of useful components in ore, etc.), but also forms a basis for the long-term period, provides subsoil users with information about potential sites [5].

An integrated approach to investigating the problem of the SSMR in this study involves the comparison of dynamics of production and import of reserves for the corresponding types of MR, identifying problems that do not allow satisfying the internal needs of the Russian economy and in future exporting raw materials as well as identifying possible ways to eliminate the current scarcity of strategic MR. The amount of reserves is influenced by production levels and reserves growth.

A necessary condition for the expanded reproduction of the MRB is the rate of geological exploration that exceeds the level of deposits development. However, actual data show that such rates are currently unattainable. From 1991, when the critical lower limit of reproduction was reached, not exceeding 150-170 % of production, a decrease in the reproduction of the MRB was recorded. This indicator, although limiting the manoeuvrability in industrial development, allowed maintaining the achieved level of production, and from the viewpoint of economists and politicians of modern times was even regarded as excessive [6]. Simple reproduction with a 1:1 ratio (production volume to reserve growth) is considered sufficient, which is currently unattainable for some SSMR.

The strategy for development of the mineral resource base of the Russian Federation until 2035 provides for an indicator of efficiency of the MRB development in terms of economic and energy security of the country RMRB which is calculated from values taken over 10 years to level out fluctuations in indicators associated with discovery of new deposits. The RMRB value for one year can be calculated as the ratio of an increment in MR reserves to their production. An actual reduction in reserves will lead to negative RMRB indicators, which contradicts the principles of sustainable development implying the use of resources without unsettling the well-being of future generations [7].

Depending on the general state of indicators of the quantity and quality of the MRB of reserves of certain types of MR, the target and maximum permissible values of РMRB are determined in accordance with the earlier discussed three groups and the maximum permissible value of РMRB in accordance with three groups considered earlier (Table 2).

Table 2

Maximum permissible and target values of РMRB, %

|

Group of MR |

Target value of РMRB |

Maximum permissible value of РМRB |

|

First |

50 |

Unidentified |

|

Second |

100 |

75 |

|

Third |

75 |

50 |

Some of the scarce MR in the Development Strategy belong to the first group (tungsten, tantalum, molybdenum and niobium), which currently contradicts the Order of the RF Government dated April 16, 2024, N 939-r, which came into force on April 26, 2024. The study did not evaluate the РMRB indicator for these types of SSMR. The elimination of contradictions in regulatory documents is expected with approval of the Development Strategy until 2050.

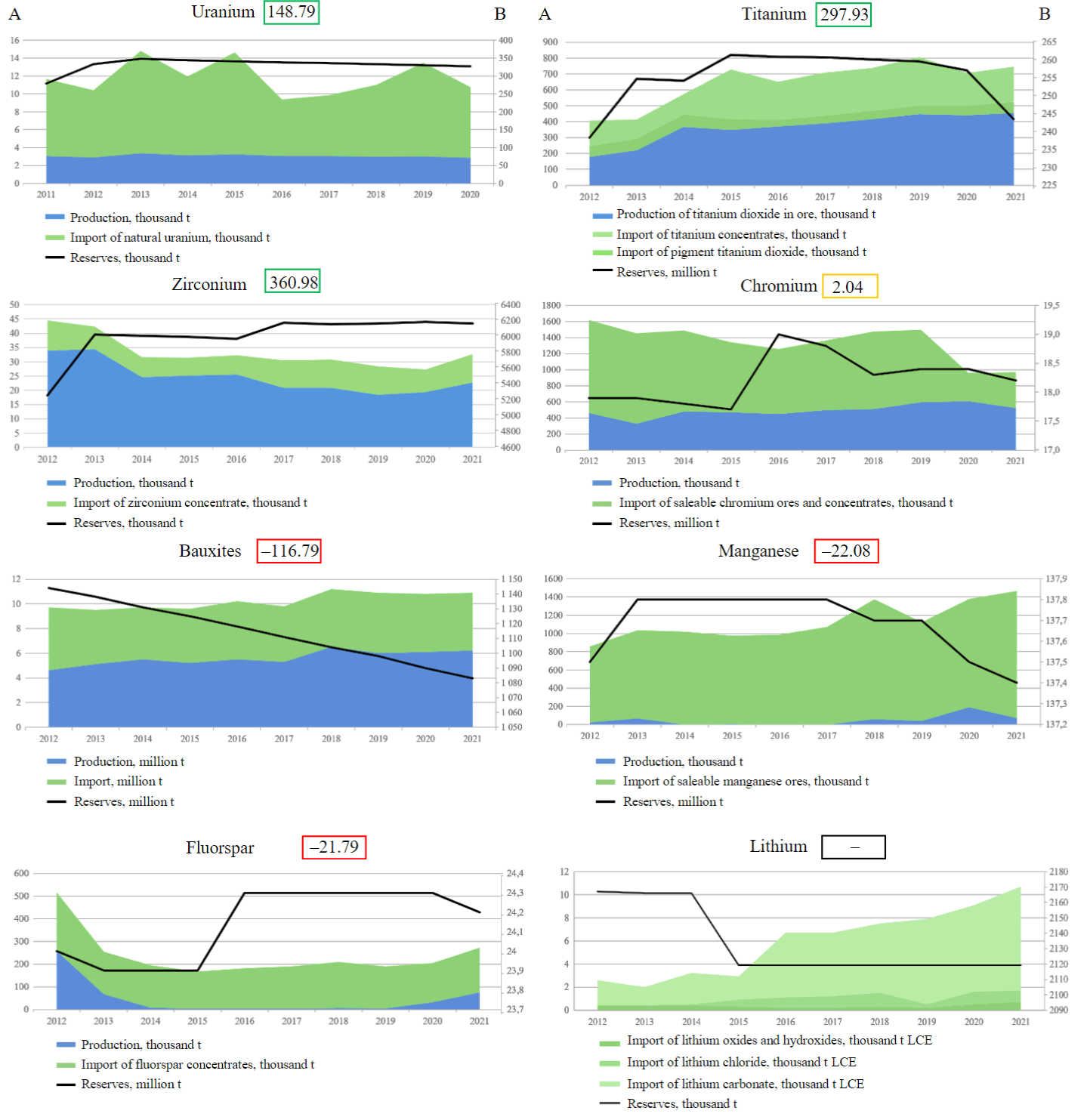

For comparability of the considered indicators, each graph in Fig.2 shows the dynamics of demand for each type of SSMR and the dynamics of their reserves. The demand indicator is introduced, which is the sum of production and import volumes. Levels of mineral raw materials extraction by the Russian companies demonstrate the part of the demand volume covered from own sources.

Comparison of volumes mined from the Russian ore deposits and of imported commercial ores and concentrates is a deliberate assumption to demonstrate the extent of dependence of domestic economy on imported mineral raw materials. For any other purpose, the combination of concentrates, imported commercial ores and raw materials mined in the territory of the RF is unacceptable due to different average concentrations of useful components in them.

Calculation of the РMRB parameter for the considered period showed that a reduction in reserves is not characteristic of all SSMR: bauxites – 116.79; uranium 148.79; manganese 22.08; chromium 2.04; titanium 297.93; zirconium 360.98; lithium 0; fluorspar 1.79 %. In Fig.2, the РMRB values are given for comparison with actual trends in development of the SSMR MRB – the dynamics of reserves and changes in demand structure over time.

The obtained values for individual types of SSMR are extremely high, which is explained by the low base effect: a slight increment in the MRB is attributed to high production levels. For example, the indicator calculated for coal and gold is about 37 and 25 %, respectively.

High values of the RMRB indicator do not specify that the problem of scarcity of the considered types of raw materials was overcome, which is a major disadvantage of the RMRB. A comprehensive evaluation requires a detailed analysis of the qualitative structure of reserves increment and an assessment of the possibility of production in the near future.

Fig.2. Reproduction and use indicators of MRB SSMP

A – demand axis; B – reserves axis

State report “On condition and use of mineral resources of the Russian Federation in 2019”. Moscow, 2020, p. 494.

The RMRB indicator calculated for uranium, titanium and zirconium far exceeded the maximum permissible and target values amounting to 148.79, 297.93 and 360.98 %, respectively, which is explained by the low base effect (relevant for the SSMR MRB) and low production volumes of the considered MR.

Value of the RMRB indicator for chromium was positive but was much lower than the limit values – 2.04 % with the marginal value 50 %. This is due to the fact that in 2012-2021 positive exploration and revaluation results did not compensate for the volumes of chromium ore production.

The indicators for bauxite, manganese and fluorspar are negative: –116.79, –22.08 and –21.79 %, respectively.

The most difficult situation is with lithium, since in the years under review its economic development was not carried out in Russia, therefore, the indicator cannot be calculated (denominator of the formula is zero).

Table 3 presents a characteristic of the state of the MRB of scarce strategic types of minerals, problems and prospects for its development.

The main factor hindering the development of the available SSMR MRB in the RF is the lack of industrial technologies that would allow the use of low-quality ores at an optimal level of profitability. New technological solutions could help significantly reduce the deficit without additional geological exploration, which is especially important for the SSMR types with no prospects for increasing the reserves.

Table 4 shows data on domestic demand for the SSMR taking into account the application areas and the list of the main consumers.

The dependence of Russian manufacturers on imports threatens the stability of development and the security of economy, since in modern geopolitical conditions of breakage of supply chains and refusal to cooperate can lead to downtime of production facilities and a major growth of production costs. Industrial enterprises should be uninterruptedly provided with the necessary materials, technologies, and components of appropriate quality despite changes in the industry caused by the sanctions pressure [8, 9].

Considering the current state of the SSMR MRB (see Table 3), solving the scarcity problem is possible by importing foreign raw materials, developing foreign deposits, conducting geological exploration in the Russian Federation (uranium, manganese, chromium, titanium, graphite), improving the technologies in the industry (all types of SSMR). Import of raw materials and development of foreign deposits do not ensure the strategic advantages at the geopolitical level, and do not offer a complete solution, since they do not resolve the problem of reproducing the domestic mineral resource base.

Solving the problem of the SSMR scarcity (especially for the SSMR with considerable increment prospects (Table 3) is primarily associated with active geological exploration. Since most of the SSMR consumers (Table 4) are subsoil users carrying out the full cycle: from geological exploration to the production of the final product shipped to the final buyer, the solution to the problem of reproducing the SSMR MRB can be associated with development of a set of measures to motivate businesses to prospecting and discovery of new deposits for increasing the available reserves (for example, tax incentives for the companies).

Table 3

Analysis of development prospects for the SSMR MRB

|

Type of SSMR |

Characteristic |

Development prospects |

Specific features |

|

Uranium |

Most of ores are of low quality, which hinders their mining; 29.8 % of in-place reserves are in the unallocated subsoil reserve fund; the development degree is relatively high |

Significant increment prospects – C2cond indicator is 30 % of the current in-place reserves. Increasing amount of reserves (RMRB = 148.79 %) is accompanied by decreasing production volumes |

Lack of cost-effective industrial technology for beneficiation of complex ores, uranium ores of the Elkon group deposits |

|

Tungsten |

A small number of profitable sites for ore mining, while Russia has one of the largest raw material bases for this MR. A major reduction in production over the last 10 years (–40 %) due to deterioration of the technological quality of processed raw materials accompanied by a decrease in its extraction into concentrates |

A high share of deposits prepared for development and explored (64.2 %), the exploitation of which is expected to cover most of the need for raw materials |

High production costs along with strong tax pressure on the industry; competition with Chinese producers and a growing sanctions pressure. The need for additional public support |

|

Graphite |

Low development degree of domestic raw material base: about 86 % of reserves are in the unallocated subsoil reserve fund; in development status – only 1.5 million t (1.5 % of reserves) |

Prospects for a major increase in reserves of crystalline graphite: C2cond indicator is comparable to in-place reserves. The prospect of a multiple increase in production due to development of the Topolikhinskii site of the Soyuznoe deposit in the Jewish Autonomous District |

Logistics and infrastructure difficulties relevant for individual sites; low utilization degree of the available MRB |

|

Molybdenum |

High formal degree of development with a low actual level of reserves developed – actual share of developed reserves is about 4 % |

C2cond indicator is approximately 16 % of in-place reserves; at the same time, the quality of prognostic reserve fund ores is comparable to in-place reserves of similar deposits |

High sensitivity to world prices for raw materials; low domestic demand for molybdenum products |

|

Tantalum |

Taken into account in ores of the Ulug-Tanzekskoe deposit, deposits of the Lovozerskii GOK and other deposits of complex ores |

Due to the rarity of MR (valid for the whole world), the optimal development trend for the available MRB is the development and implementation of missing technologies, restoration of the chain “from ore to final products” |

The need to organize tantalum powder production in Russia with subsequent introduction into domestic industry |

|

Vanadium |

Most of ores sufficient for industrial use are contained in the depths of iron ore mines. deposits of the Ural Federal District (Gusevogorskoe and Sobstvenno-Kachanarskoe); considered as the main component at the Srednyaya Padma deposit (Republic of Karelia) |

Russia has a great potential for extracting vanadium from complex ores; at the same time, it is possible to develop zero-waste mining which involves vanadium production from oils and various types of industrial waste |

Development of technologies of vanadium extraction from spent catalysts and other industrial waste containing vanadium |

|

Niobium |

Contained as an associated component in ores of the Afrikandovskoe deposit; in ores of the Ulug-Tanzekskoe deposit and the Zashikhinskoe deposit tantalum and niobium are the main components; found in commercial quantities in ores of the Lovozero deposit, etc. |

The start of production at the prepared deposits will to a major extent satisfy the needs of economy |

Search for additional investments for the development of potential sites |

|

Manganese |

Manganese base as a whole does not meet the requirements of industry: low-quality ores with harmful impurities; low actual degree of development – about 0.5 % of reserves are developed; subsoil user, who had 93 % of allocated in-place reserves and part of allocated subsoil reserve fund, was declared bankrupt in January 2018 |

Prospects for a major increase: C2cond indicator is about 50% of in-place reserves; reduction in the amount of reserves (PMRB = –22.02 %) accompanied by resumption of production in the RF |

Lack of infrastructure near major sites |

|

Chromium |

Low quality of raw materials (low-grade and lean ores); low degree of development: 11.3 % of reserves are developed; 7.9 % are at the stage of preparation for development and exploration; 80.7 % – unallocated subsoil reserve fund |

Prospects for a major increment: C2cond indicator is twice the value of in-place reserves; increasing reserves (PMRB = 2.04 %) accompanied by growing production volumes |

Ores that do not require beneficiation and are used in domestic industry make up only a quarter of reserves; mining engineering and infrastructure problems |

|

Titanium |

Low quality of ores and complicated occurrence environment limit the development of placer deposits; low degree of development – 2.9 % of reserves are involved in development; 28.2 % are prepared for development and explored, 68.9% remain in the unallocated subsoil reserve fund |

Prospects for a major increment: C2cond indicator is approximately half of reserves; increasing of reserves (PMRB = 297.93 %) accompanied by growing production volumes; obtaining of titanium concentrate from ores of the Khibiny deposits [10] as well as the technological mineralogy of titanium ores offer good prospects [11] |

No possibility of using industrial technology for processing high-titanium titanomagnetite concentrates |

|

Beryllium |

Resumption of mining is associated with the Ermakovskoe deposit which was not developed since 1989; currently, OOO Ermakovskoe is working at this deposit planning to develop it by open pit mining |

A potential trend could be the development of tailings dumps containing beryllium as one of components, which reduces the volume of mining waste and complies with the principles of a circular economy [12, 13] |

The scientific community is actively discussing the need to organize full-cycle beryllium production – from ore to metal, which requires the appropriate technological solutions |

|

Bauxites |

Low quality of ores, mining engineering and infrastructural difficulties led to the situation when Russia uses only 43 % of bauxite reserves for alumina production. Average development of the raw material base: 53.1 % of reserves – unallocated subsoil reserve fund; 33.4 % involved in development and 13.5 % is being prepared for operation |

Increment prospects are low: C2cond indicator is less than 3 % of current in-place reserves; decreasing reserves (PMRB = –116.79 %) are accompanied by growing volumes |

The need to introduce into industrial production a more advanced technology for processing low-quality raw materials allowing work in modern economic conditions |

|

Zirconium |

Russian baddeleyite concentrate – a unique, high-quality zirconium raw material, is mainly exported. Low degree of the MRB development: 3.4 % reserves are involved in development; the share of deposits prepared for development and exploration is 28 %; 68.6 % remain in the unallocated subsoil reserve fund (according to 2022 data). Currently, the Tuganskii GOK largely satisfies the demands of domestic industry |

Prospects for major increment: C2cond indicator is comparable to the amount of in-place reserves. Increasing reserves (PMRB = 360.98 %) accompanied by decreasing production volumes |

Use of associated sources of zirconium raw materials: it is necessary to implement the industrial technology for beneficiation and extraction of zirconium from eudialyte ores. The use of complex, multi-stage processing technologies for ores from the Katuginskoe and Ulug-Tanzekskoe deposits is required |

|

Lithium |

Most deposits, except those where lithium is an associated component are in the unallocated subsoil reserve fund. A complex composition of ores and their low dressability hinder the development of lithium deposits |

There are no prospects for reserves increment: contingent reserves of category C2 amount to 2.3 % of in-place reserves. Reduction in reserves as a result of revaluations is accompanied by absence of production in the RF. Potential lithium resources are associated with formation brines in areas of exploration and production of hydrocarbon raw materials |

Lack of an efficient technology for beneficiation, extraction and processing is one of the reasons for non-involvement of existing sites of unallocated subsoil reserve fund into operation. Planned integrated projects based on the Kolmozerskoe (Rosatom and Norilsk Nickel) and Kovyktinskoe (Gazprom) deposits can cover the need of domestic economy for lithium |

|

Fluorspar |

Raw material base is extensive, but ore quality is low, so since 2014 the Russian consumers were dependent on imports. Low development degree of the raw material base: 38. 1% of reserves are involved in development; 7.8 % reserves are mined; 9.5 % – the share of deposits prepared for development and explored; 52.4 % of reserves remain in the unallocated subsoil reserve fund |

The prospects for reserves increment are high: 28.9 million t in terms of contingent reserves of category C2, which corresponds to the amount of in-place reserves. Reduction in reserves (РMRB = –21.79 %) is accompanied by production renewal in the RF |

To meet the needs of the Russian industry for fluorspar of chemical grades, it is necessary to improve the current technologies for beneficiation of fluorspar ores to increase fluorite content and reduce carbonate level |

|

Rhenium |

There are no active reserves, the reserves are associated with occurrence of rhenium in deposits of porphyry copper ores, molybdenum ores, tungsten-molybdenum ores, uranium ores in sandstones, fumarole gases of the Kudryavyi volcano 14] |

Rhenium reserves in the RF are scarce, their replenishment has no prospects, therefore, it is necessary to search for new sources of raw materials and re-evaluate the deposits |

It is planned to use borehole underground leaching technology with rhenium yield of 3.4 t per year by the end of 2024 |

|

Yttrium |

Scarce reserves: deposit in the Revda Village, Murmansk Region, contains 1.3 % yttrium (of all mined REM). Reserves of medium and heavy REE – yttrium group – are taken into account along with all REE |

The lack of demand from domestic producers does not allow using the associated raw materials in modern economic conditions |

Poor infrastructure and harsh climatic conditions prevent the development of the Tomtorskoe deposit with yttrium trioxide content of about 0.5 % |

Table 4

Areas of SSMR use

|

Type of SSMR |

Use |

Main consumers |

|

Uranium |

The most significant volume of uranium raw materials in the RF is used to produce nuclear fuel for domestic and foreign nuclear power plants. Part of the needs in uranium are provided by supplies from Kazakhstan facilities of the “Rosatom” state corporation |

Companies of AO TVEL (part of Rosatom) engaged in uranium conversion and enrichment: AO Angarsk Electrolyte Chemical Plant (AO AEKhK), AO PO Electrochemical Plant (AO PO EKhZ), AO Ural Electrochemical Plant (AO UEKhK), AO Siberian Chemical Plant (AO SKhK) |

|

Tungsten |

Use in heat-resistant and hard materials as an alloying additive in production of steels, special and acid-resistant alloys, in chemical industry and electronics. Main consumer industries: automotive industry, mining industry, tool industry, aerospace industry, power engineering, etc. |

OAO Gidrometallurg, AO Kirovgrad Hard Alloy Plant, OOO Moliren |

|

Graphite |

High-tech areas (for example, production of high-capacity batteries); metallurgical industry (ferrous metallurgy, aluminium production, etc.); production of dyes, lubricants, graphite electrodes |

ZAO Grafitservis, PAO Severstal, OAO NLMK, OAO MMK, OAO EVRAZ NTMK, OAO EVRAZ ZSMK, PAO Chelyabinsk Metallurgical Plant, PAO Magnezit Plant, OAO Dinur ( refractory products manufacturers) |

|

Molybdenum |

Production of ferroalloys and alloying elements, stainless steels; production of catalysts in chemical industry; use as an anti-friction lubricant, etc. |

OOO SFMZ, OOO Moliren, OOO Nizhnevolzhskii Ferroalloy Plant, AO Ural Steel, PAO Severstal, OAO Oskol Electrometallurgical Plant |

|

Tantalum |

Use in modern electronics (production of high-quality capacitors), as a component in production of hard alloys, military industry, nuclear power engineering, etc. |

Ekaterinburg Non-Ferrous Metals Processing Plant (OAO EZ OTsM), companies of Rosatom fuel division, electronics manufacturing companies |

|

Vanadium |

Battery production; ferrous metallurgy (increasing the strength of alloys, strength and wear resistance of steel); space, aviation, defense and other industries |

AO PO Northern Machine-Building Company, PAO Ufaorgsintez, AO Votkinsk Plant, AO NPK Uralvagonzavod, research organizations |

|

Niobium |

Aerospace industry; electric power engineering; railway transport; electronics |

AO NII NPO Luch, AO Research Institute of Machine Building, AO A.M.Isaev KBKhM, AO M.V.Khruchnev GKNPTs, AO Uranium ONE GROUP, PAO NPO Iskra, AO Votkinsk Plant, etc. |

|

Manganese |

Production of ferroalloys which are completely consumed by steel industry; use as an alloying metal; production of welding electrodes, water filters, fiberglass, ceramics and bricks (as a pigment); production of dry electric batteries; other areas of industry and medicine. Domestic consumption in 2021 accounted for 1.47 million t of manganese ores and concentrates. Consumption of manganese ferroalloys is for 74 % covered by domestic products, however, imported concentrates and ore are used for the production of ferroalloys |

PAO Severstal, PAO Magnitogorsk Metallurgical Plant, PAO Novolipetsk Metallurgical Plant, PAO Kosogorsk Metallurgical Plant, PAO Nizhny Tagil Metallurgical Plant, AO Che-lyabinsk Electrometallurgical Plant, Satka Iron Works, PAO Klyuchevsky Ferroalloy Plant, AO Chelyabinsk Zinc Plant |

|

Chromium |

Production of ferroalloys; production of metal chromium and chemical compounds; production of stainless steel; use as an alloying element; production of refractories, etc. Domestic consumption of chromium concentrates and commercial chromium ores is mainly provided by imports, on average in 2012-2019 domestic production covered about a third of all needs (from 24 to 45 %) |

AO Chelyabinsk Electro-Metallurgical Plant, AO Novotroitsk Chromium Compounds Plant, AO Russian Chromium 1915, NSplav, PAO Klyuchevsky Ferroalloy Plant, AO Polema, OOO Tikhvin Ferroalloy Plant, OOO UK Industrial Metallurgical Holding (PMKh) |

|

Titanium |

Engine construction, shipbuilding, construction of drilling and production platforms, offshore equipment; power engineering; non-ferrous metallurgy; machine building and chemical industry; production of titanium metal; production of welding electrodes and welding wire; use by companies of paint and varnish industry and manufacturers of rubber products, photocatalysts, self-cleaning glasses, etc. All titanium raw materials used by the Russian companies is imported |

PAO VSMPO-AVISMA Corporation, AO SMK, OOO “NPO Rusredmet, OOO Normin, OOO ZVM, etc. |

|

Beryllium |

Nuclear power engineering and renewable energy sources, defense and military industry, rocket and space industry (for example, use of beryllium oxide in production of rocket engines and as transparent protective coating on telescope mirrors); aircraft manufacturing; medical and industrial equipment; automotive industry; aircraft engineering, telecommunications equipment, etc. |

PO Mayak, Rosatom (including AO D.V.Efremov NIIEFA, AO GNTs NIIAR, AO Uranium One Group), AO NII NPO Luch, AO NPK Systems of Precision Instrumentation Engineering |

|

Bauxites |

Production of alumina for aluminium smelting used in many industries; use as a flux in ferrous and non-ferrous metallurgy companies. Construction, aircraft, automotive and shipbuilding, packaging production, electrical items production, machine building and consumer goods, aluminium industry [15]. Only 35-40 % of needs of Russian aluminium smelters are covered by domestic products |

Bogoslovskii and Ural alumina refineries |

|

Zirconium |

Production of ceramics, metal zirconium, refractories, abrasive products, non-stick coatings; aviation, rocket and space equipment and transport; foundry. Obtaining the world's only baddeleyite concentrate with a higher cost compared to zirconium concentrate. Russia's leadership in the world market in production of zirconium rolled products. Production of powders and ceramic products based on zirconium dioxide used by nuclear industry; chemical, oil and gas, medical, food industries. Apparent consumption of zirconium concentrates in Russia is 9.9-11.6 thousand t per year, more than 90 % of it is covered by imported zircon concentrates |

OAO Dinur, AO Shcherbinsky Plant of Electrofused Refractories, AO Borovichi Refractories Plant, AO Podolskogneupor, AO NPO Yuzhuralinstrument, PAO Klyuchevsky Ferroalloy Plant, AO Chepetsky Mechanical Plant, AO Angarsk Electrolysis Chemical Plant, PAO Uralkhimplast, NPP Technology, NPP Ekon |

|

lithium |

Atomic industry; aluminium industry – in the composition of alloys containing magnesium; for production of batteries, fibres, special glasses, lithium ceramics. Russian consumers of lithium are mainly processing plants. Production of lithium items in the RF has a positive dynamics – in 2017-2020 it increased 1.5-fold (from 5,310 to 8,030 tons) |

PAO Chemical Metallurgical Plant, PAO Novosibirsk Che-mical Concentrates Plant (part of Rosatom and nuclear fuel producer AO TVEL), OOO TD Halmek |

|

Fluorspar |

Ferrous metallurgy is the main consumption; chemical and cement industry; non-ferrous metallurgy; production of electrodes, ceramics; building sector. Change in consumption from 2012 due to replacement of cryolite, the raw material of which is fluorspar, with aluminium fluoride in aluminium industry. In 2012-2021, domestic consumption of fluorspar concentrates varied from 160 to 390 thousand t, on average being about 210 thousand t. The maximum value was reached in 2012 |

PAO Novolipetsk Metallurgical Plant, PAO Magnitogorsk Metallurgical Plant, AO Oskol Electrometallurgical Plant, AO HaloPolymer Perm which produces fluoropolymer pro-ducts, OOO Topkinskii Cement |

|

Rhenium |

Aviation; petrochemistry; non-ferrous metallurgy; metallurgical alloys; electrical engineering; nuclear industry (catalyst component); oil refining industry [16, 17] |

OAO Stupino Metallurgical Company, VIAM GNTs RF ZAO Industrial Catalysts |

|

Yttrium |

Defense industry – production of high-temperature superconductors as well as guidance units for aviation; nuclear medicine – treatment of oncological diseases |

OOO Bebig, manufacturers of REE products |

An efficient mechanism for encouraging private companies to develop the SSMR deposit is interaction between the state and business. Thus, in 2022, the state corporation Rosatom and PAO “GMK “Norilsknickel” concluded an agreement on the implementation of a joint project for the development of the Kolmozerskoe deposit and further deep processing of lithium raw materials. Such an agreement makes exploration more accessible to business and also satisfies the needs of nuclear industry. Sanctions pressure with limited access to innovation and software and tightening of environmental standards in connection with updating the climate agenda, etc., can be levelled out with support of the state corporations [8, 18, 19].

The current state of geological exploration for the SSMR in the RF is characterized by the following features.

Currently, geological exploration is carried out mainly at the expense of own funds of the companies. In 2022, the ratio of state and business participation in geological exploration in monetary terms was 13:10,000 for hydrocarbon raw materials and 2:25 for solid minerals (SM), while 10 years ago the ratio was 1:20 and 1:5, respectively. When assessing the financial investments in geological exploration, it is necessary to consider the long payback period and the demand for large investments [20].

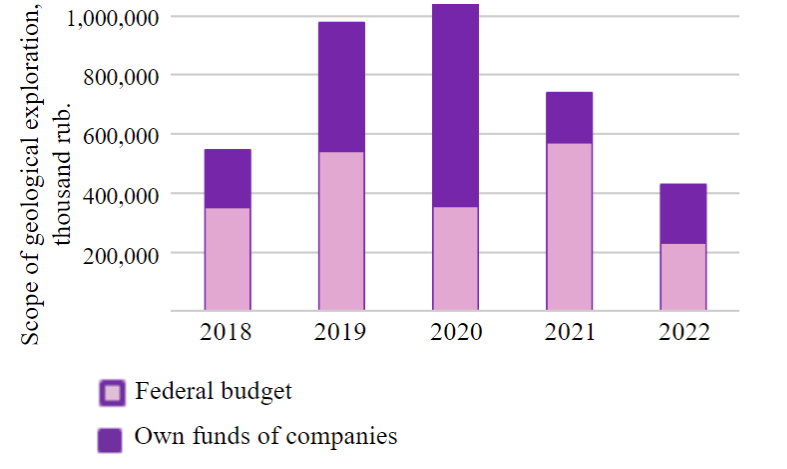

According to the data in form N 7-gr “Information on geological exploration by exploration types and groups of minerals”, there is a decrease in funding of geological exploration for the SSMR (hereinafter, the SSMR do not include bauxites and fluorspar, since the information on these types of minerals is not outlined in form N 7-gr). Over the past three years, the extent of the SSMR funding decreased from 1,053 million roubles to 429 million roubles – by 59.3 % (Fig.3) [21].

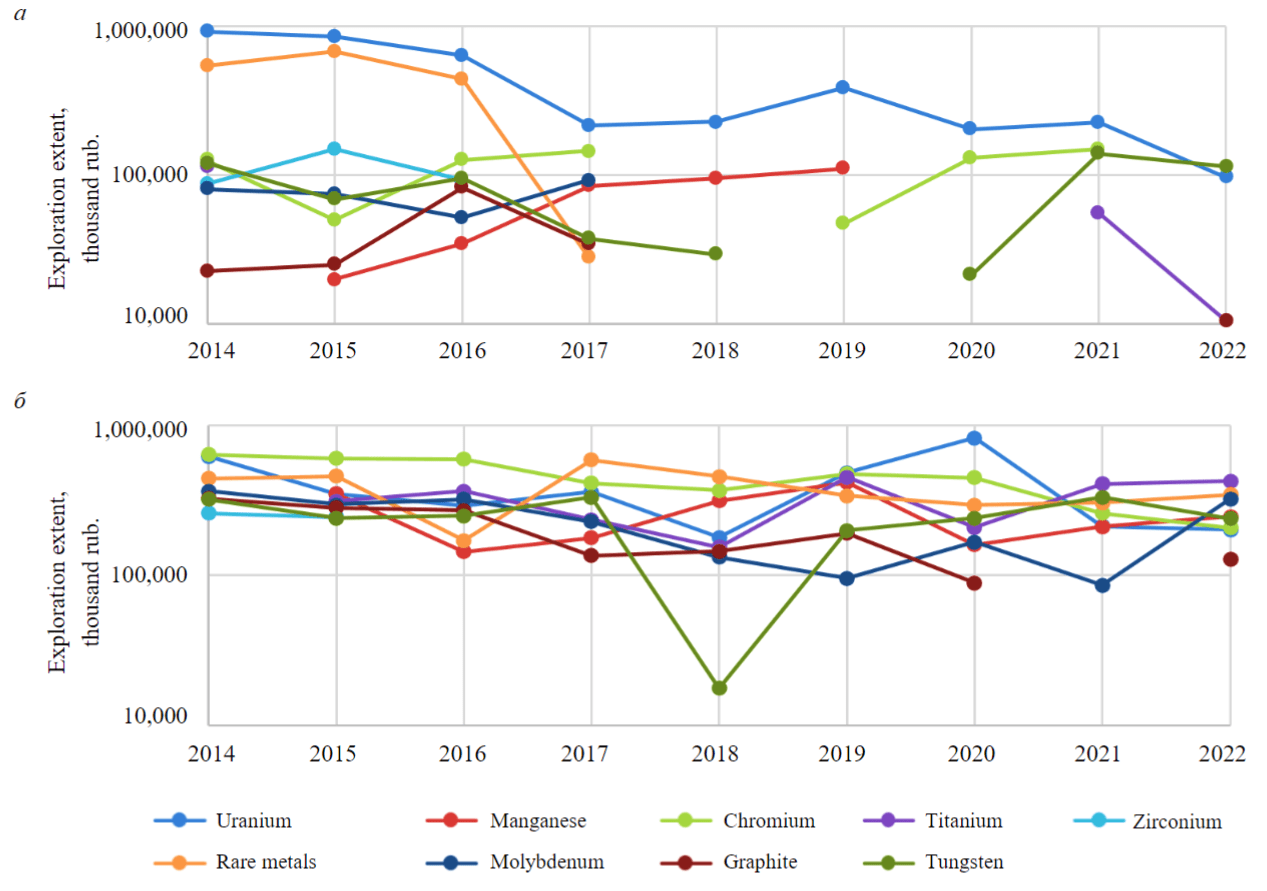

Declining interest of subsoil users to geological exploration is also confirmed by results of analysing the dynamics of the SSMR financing for each type of mineral resource (Fig.4). The largest amount of financing for geological exploration is recorded for uranium and tungsten, while for zirconium there is neither public, nor private investments.

Funding of geological exploration for manganese from the federal budget was discontinued in the last three years; for chromium, in the last year; and for rare metals, in the last five years. Private investment adequately supports the reproduction of manganese and rare metals, and the exploration for chromium should receive public funding.

Geographic exploration that ensures the reproduction of uranium and chromium is financed primarily from the budget (41.6 and 49.3 % of total SSMR funding from the federal budget, respectively). Lack of funding for geological exploration of zirconium, both from the public and private investments, was recorded since 2017. In 2016, the share of funding from the federal budget for geological exploration of zirconium was 5.9 %, and in 2015 – 2.9 % at the expense of the companies' own funds. Manganese, chromium and graphite are characterized by low investment attractiveness which either increases or decreases over time.

The MRB development strategy of the Russian Federation until 2035 represents as an internal challenge the reduction in budgetary funding for geological exploration of subsoil in the absence of a possibility of conducting regional research based on private investment. The federal budget does not finance geological exploration for manganese, chromium, and rare earth metals. Private investments adequately support the reproduction of manganese and rare earth metals, and exploration for chromium should receive public funding.

Fig.3. Dynamics of exploration financing for SSMR

Fig.4. Dynamics of financing geological exploration for SSMP from the federal budget (a) and own funds of companies (b) for eight years

Financing of geological exploration at the expense of own funds of the companies is characterized by a positive dynamics, while funding from the federal budget is insufficient. However, subsoil users are not interested in geological exploration for zirconium and chromium, which is confirmed by results of analysis. According to para. 2 art. 23 of the Law of the RF “On Subsoil” dated February 21, 1992, N 2395-1, subsoil users are obliged to ensure the completeness of geological study and reasonable integrated use of subsoil.

Currently, the problem of intensifying geological exploration is relevant. The rate of additional exploration and putting the already discovered deposits into operation is much higher than the rate of exploration aimed at discovering new deposits in relatively poorly studied areas. Budgetary funding does not cover the expenses; there is a shortage of modern geological exploration, technological and analytical equipment. Production volumes are outstripping the exploration and development of deposits, and the prospecting reserves significantly decreased [22, 23].

The presence or lack of interest of subsoil users in geological exploration for the SSMR can also be assessed by the data on the activity of obtaining licenses of various categories (of primary interest are the exploration licenses of type P). Prospecting licenses allow their owners to conduct geological exploration including prospecting and evaluation of mineral deposits. Table 5 shows the statistics on the license for the SSMR type P valid as of 01.01.2022.

Table 5

Analysis of SSMR licenses by type of use valid as of 01.01.2022

|

Licenses |

Uranium |

Manganese |

Chromium |

Titanium |

Bauxites |

Lithium |

Zirconium |

Fluorspar |

Rare earth metals |

|

Licenses for geological study for prospecting and evaluation (issued on a declarative principle) |

– |

5 |

7 |

5 |

2 |

4 |

3 |

5 |

1 |

|

Licenses for geological study for prospecting and evaluation |

1 |

5 |

9 |

7 |

2 |

4 |

5 |

6 |

3 |

|

For exploration and production (operation) |

26 |

5 |

3 |

14 |

7 |

3 |

6 |

9 |

12 |

|

For geological study, exploration and production (combined) |

2 |

5 |

9 |

7 |

11 |

– |

2 |

3 |

2 |

|

Total number of licenses (2 + 3 + 4) |

29 |

15 |

21 |

28 |

20 |

7 |

13 |

18 |

17 |

Most of valid licenses for geological study for prospecting and evaluation in the vast majority of cases (60-100 %, with the exception of uranium and rare earth metals) were obtained on a declarative principle, which points to the efficiency of the licensing mechanism introduced in 2014. Subsoil plots that could otherwise be ignored by subsoil users are now covered by prospecting and evaluation work [24, 25].

Total number of licenses in force in Russia shows that since 2020 about half of them were obtained on a declarative principle, although the funding attracted on its basis for geological exploration was much lower (for example, in 2021, 15.6 billion roubles, which is 26.9 % of total funds). This is explained by a small extent of activity of the companies receiving a license by a simplified mechanism; comparably higher risks when working in subsoil plots with no data available on the occurrence of solid minerals and/or predicted solid mineral resources of categories P1 and/or P2, if the plot is not considered to occur in the Arctic zone or for other reasons.

Thus, the declarative mechanism can encourage subsoil users to engage in reproduction of the SSMR MRB through a simplified procedure for obtaining licenses, although in practice, in the vast majority of cases, the applications are submitted for placer gold (66 %) and ore gold (19 %) – 70 and 15 % of issued licenses for types of solid minerals, respectively). Total number of valid licenses for geological studies for prospecting and evaluation issued on a declarative principle for the SSMR is 32 (Table 5), which is 0.66 % of total number of valid licenses received on a declarative principle in 2021.

These conclusions are confirmed by the Catalogue of accounting units of the State Register of Reserves, which makes it possible to analyse the activity of subsoil users on specific sites of the state in-place reserves (Table 6).

The highest activity of subsoil users in exploration of deposits, both in absolute and relative values, is recorded for the following types of the SSMR: chromium (in 16 records of deposits the exploration is conducted, which is about 57 % of all records), manganese (exploration is underway at five sites out of nine) and uranium (11 records of deposits out of 30 were explored, which is 36.7 %).

Table 6

Extent of development of deposits with SSMR licenses as of May 22, 2024

|

State |

Uranium |

Manganese |

Chromium |

Titanium |

Bauxites |

Zirconium |

Beryllium |

Lithium |

Rhenium |

Rare-earth metals |

Fluorspar |

Tungsten |

Graphite |

Vanadium |

Niobium |

Tantalum |

Molybdenum |

|

Number of records of deposits with a license |

30 |

8 |

29 |

18 |

13 |

8 |

2 |

5 |

7 |

12 |

13 |

30 |

3 |

40 |

14 |

5 |

23 |

|

Development extent: prepared for development |

5 |

3 |

2 |

7 |

8 |

3 |

– |

– |

4 |

5 |

4 |

12 |

1 |

9 |

4 |

2 |

9 |

|

explored |

11 |

5 |

16 |

4 |

1 |

4 |

1 |

1 |

2 |

– |

1 |

10 |

– |

5 |

– |

– |

4 |

|

developed |

14 |

2 |

13 |

9 |

7 |

3 |

2 |

4 |

2 |

8 |

8 |

9 |

2 |

29 |

11 |

3 |

11 |

|

Not transferred for development (sites without a license) |

31 |

21 |

11 |

19 |

43 |

15 |

– |

13 |

1 |

8 |

30 |

66 |

9 |

9 |

27 |

27 |

12 |

Sites not transferred for development (without a license) (Table 6) are potential subsoil plots, due to which the SSMR MRB can be incremented, if they are transferred for development to subsoil users. It is impossible to interest subsoil users without solving the legal, technological and financial problems.

Creating favourable investment conditions, along with development of exchange-based financing instruments, help to attract private funds from investors both in mining industry in general [26], and in geological exploration in particular. Recommended measures: tax incentives for shareholders of exploration companies, development of venture capital market, partial subsidies for exploration, insurance of investments in geological exploration for the SSMR, tax preferences for exploration companies and subsoil users, preferential lending, public-private partnerships, interindustry agreements etc. The implementation of these measures also involves state monitoring of exploration projects for the SSMR for their classification according to the level of possible risks associated with both geological environment of geological exploration, as well as infrastructural, technological, economic and other factors.

In addition, the possibility of transferring rights to use subsoil to the third parties, bypassing the phase of active development as well as subsequent production, is a necessary condition for the development of minor geological exploration companies (juniors) specializing in prospecting deposits for subsequent sale to mining companies [27]. For example, one of the strongest and most competitive Canadian uranium junior companies, Denison Mines, was running several large projects since 1985 and increased their market share. Positive prospects for the existence of juniors: about 64 % of uranium juniors continue their activities, conduct exploration for another metal, engage in another business, and are also absorbed, the rest discontinue their activities or freeze the projects [28, 29].

International experience of functioning of junior business structures also presupposes access to exchange-traded instruments for financing their activities (there are about 2,000 junior issuers in total). At the St. Petersburg Exchange, a separate segment “SPB Juniors” was set up, but currently not a single company went through the procedure of public offering of shares, though the issue of shares of PAO Almar was expected in 2023. The possibility of implementing a positive scenario for this segment is also supported by current trends in increasing number of expected IPOs of Russian companies, development of exchange financing practice in the country as a whole (according to Moscow Exchange estimates, 40 new IPOs could be held by 2025, which is a significant percentage of existing issuers in various sectors) [30, 31].

It is necessary to consider possible risks and difficulties associated with establishment of junior exploration companies. A detailed criticism of the proposed solution to the SSMR problem is discussed in [32]; paper [33] is devoted to possible risks of fraud on the part of new business structures. Since the practice of setting-up junior companies originated abroad, it is important to take global experience into account [34-36]. Key statistics demonstrating industry trends (including a major share of junior companies in discovery of new deposits around the world) are given in [37, 38]. Legal aspects of operation of such companies in other countries are presented in [39], financial issues and evaluation of such companies are discussed in [40-42]. These scientific works, along with other studies devoted to junior companies, describe the accumulated experience in studying this trend of business, which is important for assessing its possible risks and prospects.

Conclusion

In the current geopolitical conditions, the problem of scarcity of strategic mineral resources is a priority and requires relevant measures. Political events of recent years led to the breakage of many international relations, which once again showed the danger of national economy dependence on the import of key raw materials.

Analysis of the state of the SSMR MRB, demand for minerals, level of technology and equipment development showed that solving the problem of scarcity of considered minerals is associated with the following trends:

- the need for industrial implementation of new technologies for processing and beneficiation of raw materials;

- overcoming infrastructure difficulties (manganese, bauxites and yttrium);

- intensification of geological exploration for potential SSMR (manganese, uranium, chromium, fluorspar, zirconium, titanium).

Geological exploration for ensuring the development of the SSMR MRB involves resolving a set of legal and financial problems. After introduction of the declarative principle, not only the number of “prospecting” licenses for placer and ore gold increased enormously, but also this mechanism became a prerequisite for the development in the RF of junior business structures – minor geological exploration companies whose goal is to expand the MRB through the development of potential subsoil plots. International practice shows that in the last decade more than 65 % of all deposits were discovered by junior companies [37].

Economic and legal initiatives can further stimulate the development of the junior movement in Russia. For example, expanding the application of the declarative principle to a larger number of subsoil plots for individual mineral resources [43] (in particular the SSMR), considering the possibility of free trade in subsoil use rights between the Russian subsoil users, solving the problem of fines for discovering a deposit (the fine arises in the course of obtaining a license of R type by the discoverer who collected and registered the geological information at his own expense) [44].

Lack of conditions for free sale of subsoil use rights does not allow minor exploration companies to operate for a long time accumulating practical experience and consolidating a larger number of fixed assets. After receiving positive results from work on a subsoil plot, a modern Russian junior will be absorbed by a major subsoil user, which is due to a possibility of transferring the license for subsoil use within one legal entity. A way for a geological exploration company to generate income that does not lead to absorption is the sale of geological information with a trade secret regime established for it (Article 27 of the RF Law “On Subsoil”). A major subsoil user acquiring information from a junior gains an advantage over the others, since the degree of uncertainty for a specific subsoil plot is reduced, and he can take a more weighted decision about the prospects of such a plot [45]. Creating conditions for freer trading of licenses can increase income opportunities for juniors and allow them to develop in the long term without moving into the mining stage.

Introduction of additional tax and other benefits (for example, provision of loans on preferential terms) for the companies engaged in prospecting and exploration (including for investors in junior projects) can help intensifying the discovery of new deposits and specifying the reserves for existing ones. Thus, the tax system of Canada, which is successfully developing at the expense of the mining business, uses the following methods of encouraging exploration: regulation of tax rates; granting “tax holidays”; a system of discounts and transfer of the tax burden to the field operation stage; tax benefits to investors financing exploration as well as to private sector with the right to transfer these benefits. The country has a flexible taxation system for subsoil use [46]. When drawing up the draft for such benefits, it is necessary to consider the potential benefits from geological exploration determined depending on the probability of success, which is controlled by the quality of the MRB of the RF for specific SSMR and the information available on them (see Table 3).

When analysing the main consumers of the SSMR, a potential measure to reduce the scarcity of the considered minerals was recognized - development of a set of tax incentives for large consumer companies for stimulating the exploration of subsoil by users at their own expense without attracting public funding. It is also advisable to extend tax benefits to activities related to the development of infrastructure in remote areas.

Thus, an integrated approach to solving the problem of scarcity of strategic minerals in the RF will provide favourable conditions for expanded reproduction of the SSMR MRB and reduce the level of dependence on foreign sources of raw materials.

References

- Semin A.N., Tretyakov A.P., Danilova K.A. On mining and reserves of mineral resources of the largest countries in the world: ranking analysis. ETAP: Economic Theory, Analysis, and Practice. 2022. N 1, p. 7-27 (in Russian). DOI: 10.24412/2071-6435-2022-1-7-27

- Albertyan A.P. Development of the mineral resource complex as an increase in the geopolitical status of Russia. World Politics. 2022. № 1, p. 48-58 (in Russian). DOI: 10.25136/2409-8671.2022.1.37713

- Pashkevich N.V., Tarabarinova T.A., Golovina E.I. Problems of reflecting information on subsoil assets in International Financial Reporting Standards. Academy of Strategic Management Journal. 2018. Vol. 17. N 3, p. 1-9.

- Yurak V.V., Dushin A.V., Mochalova L.A. Vs sustainable development: scenarios for the future. Journal of Mining Institute. 2020. Vol. 242, p. 242-247. DOI: 10.31897/PMI.2020.2.242

- Paveleva Yu., Fofanova E., Melnikova O. et al. Assessing the uncertainty and value of information as a tool for planning the exploration program. Rossiiskaya otraslevaya energeticheskaya konferentsiya: Sbornik materialov konferentsii, 3-5 oktyabrya 2023, Moskva, Rossiya. Moscow: Geomodel, 2023, p. 720-746 (in Russian).

- Orlov V.P. On some achievements and challenges of national geological surveys over the past 50 years. Mineral Resources of Russia. Economics & Management. 2016. N 1-2, p. 11-17 (in Russian).

- Ponomarenko T., Nevskaya M., Marinina O. An Assessment of the Applicability of Sustainability Measurement Tools to Resource-Based Economies of the Commonwealth of Independent States. Sustainability. 2020. Vol. 12. Iss. 14. N 5582. DOI: 10.3390/su12145582

- Nevolin A.E., Cherepovitsyn A.E., Solovyova V.M. Methods for developing strategic alternatives for the mining and metals sector: A case study of Nornickel. The North and the Market: Forming the Economic Order. 2023. N 3, р. 44-60 (in Russian). DOI: 10.37614/2220-802X.3.2023.81.003

- Tcvetkov P. Small-scale LNG projects: Theoretical framework for interaction between stakeholders. Energy Reports. 2022. Vol. 8. S. 1, p. 928-933. DOI: 10.1016/j.egyr.2021.11.195

- Mitrofanova G.V., Marchevskaya V.V., Taran A.E. Flotation separation of titanite concentrate from apatite-nepheline-titanite ores of anomalous zones of the Khibiny deposits. Journal of Mining Institute. 2022. Vol. 256, p. 560-566. DOI: 10.31897/PMI.2022.81

- Kotova O.B., Ozhogina E.G., Ponaryadov A.V. Technological mineralogy: development of a comprehensive assessment of titanium ores (exemplified by the Pizhemskoye deposit). Journal of Mining Institute. 2022. Vol. 256, p. 632-641. DOI: 10.31897/PMI.2022.78

- Ignatyeva M.N., Yurak V.V., Dushin A.V., Strovsky V.E. Technogenic mineral accumulations: problems of transition to circular economy. Technogenic mineral accumulations: problems of transition to circular economy. 2021. Vol. 6. N 2, p. 73-89 (in Russian). DOI: 10.17073/2500-0632-2021-2-73-89

- Calvo G., Valero A. Strategic mineral resources: Availability and future estimations for the renewable energy sector. Envi-ronmental Development. 2022. Vol. 41. N 100640. DOI: 10.1016/j.envdev.2021.100640

- Marinina O., Kirsanova N., Nevskaya M. Circular Economy Models in Industry: Developing a Conceptual Framework. Energies. 2022. Vol. 15. Iss. 24. N 9376. DOI: 10.3390/en15249376

- Ilyushin Y.V., Kapostey E.I. Developing a Comprehensive Mathematical Model for Aluminium Production in a Soderberg Electrolyser. Energies. 2023. Vol. 16. Iss. 17. N 6313. DOI: 10.3390/en16176313

- Chanturiya V.A. Scientific substantiation and development of innovative processes for the extraction of zirconium and rare earth elements in the deep and comprehensive treatment of eudialyte concentrate. Journal of Mining Institute. 2022. Vol. 256, p. 505-516. DOI: 10.31897/PMI.2022.31

- Lutskiy D.S., Ignatovich A.S. Study on hydrometallurgical recovery of copper and rhenium in processing of substandard copper concentrates. Journal of Mining Institute. 2021. Vol. 251, p. 723-729. DOI: 10.31897/PMI.2021.5.11

- Golovina E., Shchelkonogova O. Possibilities of Using the Unitization Model in the Development of Transboundary Groundwater Deposits. Water. 2023. Vol. 15. Iss. 2. N 298. DOI: 10.3390/w15020298

- Blinova E., Ponomarenko T., Knysh V. Analyzing the Concept of Corporate Sustainability in the Context of Sustainable Business Development in the Mining Sector with Elements of Circular Economy. Sustainability. 2022. Vol. 14. Iss. 13. N 8163. DOI: 10.3390/su14138163

- Litvinenko V.S., Petrov E.I., Vasilevskaya D.V. et al. Assessment of the role of the state in the management of mineral re-sources. Journal of Mining Institute. 2023. Vol. 259, p. 95-111. DOI: 10.31897/PMI.2022.100

- Sarkarov R.A., Belan S.I., Huseynov N.M. Assessment of the current state and prospects mining of lithium and its com-pounds in Russia. Industrial Economics. 2022. N 2-1, p. 57-68 (in Russian). DOI: 10.47576/2712-7559_2022_2_1_57

- Burdin D.B. Problematic issues of stimulating geological exploration. Prospects for a solution. Nedropolzovanie XXI vek. 2022. N 1 (93), p. 22-25 (in Russian).

- Kuzina E.S. The problems of financing geological exploration in subsoil use. Mineral Resources of Russia. Economics & Management. 2020. N 6, p. 70-72 (in Russian).

- Tretyakova E. Legal status of a subsoil user as a special participant in business activities. Energy Policy. 2023. N 3 (181), p. 76-88 (in Russian). DOI: 10.46920/2409-5516_2023_3181_76

- Melgounov V.D., Kostareva A.N. On some problematic issues of legal regulation of relations involving the circulation of geological information and export of information about the subsoil. Mineral Resources of Russia. Economics & Management. 2023. N 3, p. 66-71 (in Russian).

- Litvinenko V.S., Tsvetkov P.S., Molodtsov K.V. The social and market mechanism of sustainable development of public companies in the mineral resource sector. Eurasian Mining. 2020. N 1, p. 36-41. DOI: 10.17580/em.2020.01.07

- Shcheglov E.V., Sotnikov M.S., Nugumanov E.K. Selecting a market value approach for greenfield projects. Journal of Economics, Entrepreneurship and Law. 2022. Vol. 12. N 12, p. 3345-3360 (in Russian). DOI: 10.18334/epp.12.12.116894

- Dorokhova I. Uranium juniors – a rare species from the “Red Book”. Atomnyi ekspert. 2021. Vol. 1-2, p. 216. URL: https://atomicexpert.com/uranium_juniors/ (accessed 15.10.2023) (in Russian).

- Hodge R.A., Ericsson M., Löf O. et al. The global mining industry: corporate profile, complexity, and change. Mineral Economics. 2022. Vol. 35. Iss. 3-4, p. 587-606. DOI: 10.1007/s13563-022-00343-1

- Pogudin S. Is it possible to make money from an IPO? Finansovyi zhurnal. 2024. URL: https://www.finam.ru/publications/item/ mozhno-li-zarabotat-na-ipo-20231026-1427/ (accessed 08.04.2024).

- Bobylov Yu.A., Makiev S.S. Junior Exploration Companies for the Russian geological prospecting. Bulletin of the Far East-ern Federal University. Economics and Management. 2017. N 3 (83), p. 102-114 (in Russian). DOI: 10.24866/2311-2271/2017-3/102-114

- Oganesian L.V. The state of exploration and the mineral resource base of Russia in the light of the formation of junior business structures. Mineral Resources of Russia. Economics & Management. 2023. N 2 (181), p. 4-18 (in Russian).

- Shaklein S.V., Rogova T.B., Pisarenko M.V. Junior exploration companies at risk of criminalization. Mineral Resources of Russia. Economics & Management. 2023. N 3 (182), p. 42-52 (in Russian).

- Nunez-Picado A., Martinus K., Sigler T. Globalisation strategies and roles among Australian junior mining firms in Latin America. Geographical Research. 2022. Vol. 60. Iss. 1, p. 179-195. DOI: 10.1111/1745-5871.12505

- Nunez-Picado A., Martinus K., Sigler R. Junior Miner internationalisation in the globalising mining industry. Resources Policy. 2022. Vol. 79. N 103084. DOI: 10.1016/j.resourpol.2022.103084

- Mulaba-Bafubiandi A.F., Singh N. Junior mining as innovation entrepreneurship in minerals industry in South Africa. Pro-ceedings of the International Conference on Industrial Engineering and Operations Management Pretoria, 29 October – 1 November 2018, Johannesburg, South Africa. IEOM Society International, 2018, p. 1892-1898.

- Kustra A., Kowal B., Ranosz R. Financing Sources of Exploration Works in the Light of Risk Related to their Activity. Inłynieria Mineralna. 2021. Vol. 1. N 1, p. 89-87. DOI: 10.29227/IM-2021-01-12

- Kneas D. Placing resources: Junior mining companies and the locus of mineral potential. Geoforum. 2020. Vol. 117, p. 268-278. DOI: 10.1016/j.geoforum.2020.05.007

- Luning S. Liberalisation of the Gold Mining Sector in Burkina Faso. Review of African Political Economy. 2008. Vol. 35. Iss. 117, p. 387-401. DOI: 10.1080/03056240802411016

- Leśniak T., Kustra A.J., Wilczyński G., Tobiasz R. Factors affecting the market value of junior mining companies listed on the Alternative Investment Market (AIM) London. Gospodarka Surowcami Mineralnymi. 2022. Vol. 38. Iss. 3, p. 151-172. DOI: 10.24425/gsm.2022.142786

- Iddon C., Hettihewa S., Wright C.S. Value Relevance of Accounting and Other Variables in the Junior-Mining Sector. Aus-tralasian Accounting, Business and Finance Journal. Vol. 2015. Vol. 9. Iss. 1, p. 25-42. DOI: 10.14453/aabfj.v9i1.3

- Klossek P., Klossek A. The Specific Value of Junior Mining Companies: Are Common Valuation Methods Appropriate? Journal of Business Valuation and Economic Loss Analysis. 2014. Vol. 9. Iss. 1, p. 105-144. DOI: 10.1515/jbvela-2013-0014

- Shchirova E.O., Golovina E.I. The role of junior companies in the gold mining of the Russian Federation. Digital Trans-formation of Economic Systems: Problems and Prospects (ECOPROM-2022): Collection of works of the All-Russian scientific and practical conference with foreign participation, 11-12 November 2022, Saint Petersburg, Russia. Saint Petersburg: POLITEKh-PRESS, 2022, p. 436-439 (in Russian). DOI: 10.18720/IEP/2021.4/132

- Burdin D.B. Analysis of the application and issues of improving the representation of the right to use the subsoil for the geological study of the subsoil according to the declarative principle in the Russian Federation. Nedropolzovanie XXI vek. 2022. N 3 (95), p. 24-29 (in Russian).

- Litvinenko V.S. Digital Economy as a Factor in the Technological Development of the Mineral Sector. Natural Resources Research. 2020. Vol. 29. Iss. 3, p. 1521-1541. DOI: 10.1007/s11053-019-09568-4

- Baimishev R.N. Effective International Approaches to Subsoil Public Administration. Mining Science and Technology (Russia). 2020. Vol. 5. N 2, p. 162-184 (in Russian). DOI: 10.17073/2500-0632-2020-2-162-184